Practice owners hire indebted associates, more seasoned associates work alongside indebted associates. Given the magnitude of this issue — many call it a crisis — and the fact that the gap between veterinary educational debt and income continues to widen, most colleagues are coming to recognize that saying “It’s not my problem” is no longer an option for any of us.

It’s not surprising that most borrowers, their parents, other advisers and even the leadership at veterinary schools and organizations struggle to understand the topic and various options for managing the debt.

Seeking a lower interest rate or paying more towards loan payments almost always makes sense when managing traditional debt, such as a mortgage or business loan. However, it often results in higher monthly payments, reduced flexibility, or a higher total repayment cost when managing veterinary student debt.

Tony Bartels and I have made helping colleagues understand and manage their student debt a focus (some call it an obsession) over the past six years since Tony graduated with and married into Federal educational loans exceeding $400,000. In recent years the VIN Foundation has taken this on as part of its mission to help colleagues in all stages of their careers from pre-veterinary candidate through retirement.

Educational cost and student debt repayment is not unique to veterinary medicine. However, the magnitude of veterinary student debt and the high debt-to-income ratios carried by most recent veterinary graduates make repayment particularly challenging.

Despite several meetings focused on the veterinary student debt crisis, no one has found a workable solution. Recently, at the July 2018 AVMA House of Delegates meeting, possible solutions to the veterinary student debt crisis were discussed. This is wonderful to see.

Given that veterinary students graduating in 2017 had a collective debt of over $400 million, it is difficult to see how we would fund this magnitude of debt from within the profession.

The topic of lower interest rate student loans was raised as a fix. This is not a new idea. Several companies offer private student loans and refinancing, advertising lower interest rates; and some veterinary schools offer or are considering offering lower interest rate loans directly or in partnership with a bank.

We applaud the intent of these organizations and celebrate that the conversation has moved beyond how many coffees veterinary students are buying during school. Lower interest rate private student loans may benefit some. However, even if we could immediately swap out all of the Federal student loans used by most veterinarians with lower interest rate private student loans, it would not benefit colleagues with average or higher than average student debt. In fact, doing so would be detrimental to their financial well-being and likely cost them more to repay. Read on and we’ll explain why.

This cycle produces graduates with higher student debt payments than their veterinary incomes can support using traditional repayment plans.

Since 2012, Federal Direct Loans for graduate/professional school loans have been unsubsidized, meaning interest accumulates from the date the loan is received. This can add significantly to a student’s total educational debt.

Direct loans have fixed interest rates for the duration of repayment. The rates are updated each summer and applied to the loans disbursed for the upcoming academic year. The current Direct Unsubsidized interest rates for the 2018-2019 graduate/professional academic year are 6.59% and 7.59% for Direct and Direct PLUS loans, respectively.

Some may consider, 6.59% and 7.59% to be high interest rates in today’s market. If students could borrow at lower interest rates, or our graduates could refinance their debt at lower interest rates that would surely be a good thing, right?

Unfortunately, unless they could get the lower rates through the Federal student loan program (which can’t happen without the help of Congress) the answer is almost always, no.

No, not for veterinarians with a student debt balance greater than their income. In fact, besides giving up the invaluable safety nets of the Federal student loan program, the lower interest rate, less flexible loan will also be more expensive than their higher interest rate, more flexible, Federal student loan for most veterinary graduates with student debt.

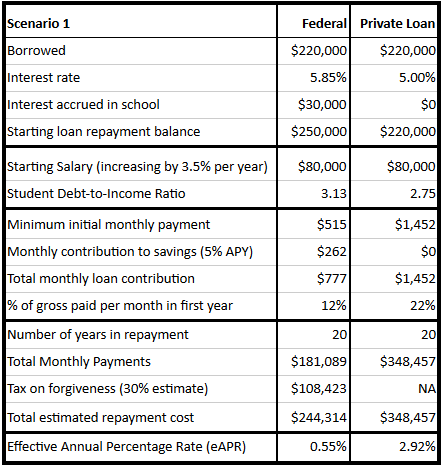

For example, let’s say a veterinarian graduated in 2018 and borrowed $220,000 for veterinary school. If they utilized all Direct Loans to finance their education, they would accrue about $30,000 of interest before entering repayment. The starting loan repayment balance would be $250,000 at 6.1% (5.85% with autopay discount). If that graduate earns $80,000 per year post-graduation and has no family, their minimum monthly payment using an income-driven repayment plan like Pay as You Earn (PAYE) would be $515/month.

Alternatively, let’s imagine a world where a private lender will offer the same 24 year old veterinary student with little or no credit history $220,000 with a 0% interest rate during school. After graduation, their interest rate is fixed at 5% for a repayment period of 20 years. They earn the same $80,000 per year income after graduation. However, their minimum monthly payment is now $1,452/mo with a total repayment cost of $348,457. The monthly student loan impact to their budget during the first year post-graduation is 21.8% of their gross monthly income.

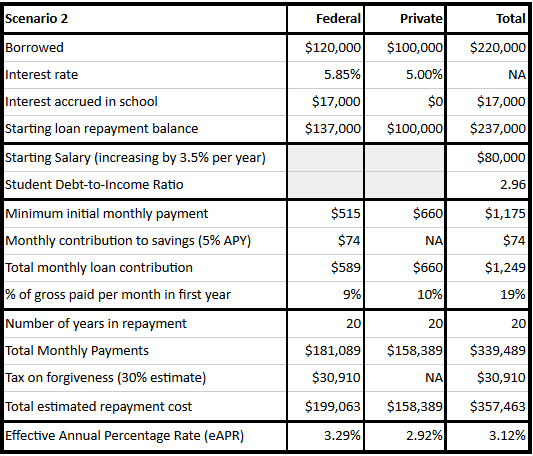

Let’s indulge in one more scenario (one playing out at a couple of schools and states and proposed by others), where a private lender finances $100,000 of the veterinary educational debt at 0% interest during school and 5% after school with a 20-year repayment term. The other $120,000 is coming from a Federal Direct Unsubsidized loan that accrues about $17,000 of interest during school. The graduate now has two loans to satisfy with their $80,000 income. The private $100,000 loan at 5% requires a monthly payment of $660/mo. The $120,000 at 5.84% (5.59% with autopay discount) Federal student loan balance paid using PAYE will have a minimum monthly payment of $515/mo. The monthly payment under PAYE is the same regardless of the student loan balance, however, additional private student loan balances are not accounted for in the monthly payment determination.

In a traditional loan repayment scenario, seeking a lower interest rate will almost always save you money. After running thousands of scenarios for thousands of veterinary students and graduates, Tony and I have learned that rule of thumb does not apply to the typical veterinary graduate scenario eligible for income-driven repayment

There are three solutions to “fixing” the veterinary student debt crisis:

2 thoughts on “Student Loan Interest Rates and Repayment — Don’t Listen to Your Parents!”

Hi VIN,

My daughter is considering majoring in veterinary internal medicine. I understand the costs of education and her options for federal aid. I see from your web site that the starting pay rate is between $70,000 and $80,000. Can point me to a site that will show the national statistics for veterinarians with 5 or more years of experience.

Regards,

Irving

Hi Irving,

Thanks for leaving a comment! Couple of points of clarification — There are some undergraduate programs in animal science or veterinary science that some folks major in prior to attending veterinary school, but there is no major in veterinary internal medicine that I am aware of. Folks who attend veterinary school (at least in the U.S.) receive a doctorate in veterinary medicine. Those graduates are usually considered to be general veterinary practitioners. Some veterinarians go on to specialize after veterinary school. One of those specialties is veterinary internal medicine. I am married to a veterinary internal medicine specialist, aka “veterinary internist.” I mention that because the salary profiles for a veterinary specialist and general practitioner are very different both post-program completion and five years out.

For more salary resources, I would point you to the American Veterinary Medical Association (AVMA). They have a couple of different salary calculators based on their frequent surveys of veterinarians: https://www.avma.org/ProfessionalDevelopment/Pages/salary-calculator.aspx and https://myvetlife.avma.org/new-veterinarian/your-financial-health/veterinary-salary-estimator. If you live near a college of veterinary medicine, their libraries usually have copies of the AVMA salary reports that you can review. You can also refer to the BLS data on veterinarians: https://www.bls.gov/ooh/healthcare/veterinarians.htm.

For veterinary specialist income, there’s unfortunately very little public data available on salaries. There was one recent study from the OVMA published in 2016 that sheds a bit of light on that information: 2016 Report on Compensation and Benefits for Specialist Veterinarians. I just can’t find a direct link to the report 🙂

I hope that helps!