New features extend utility for colleagues in any stage of the veterinary student loan and repayment cycle.

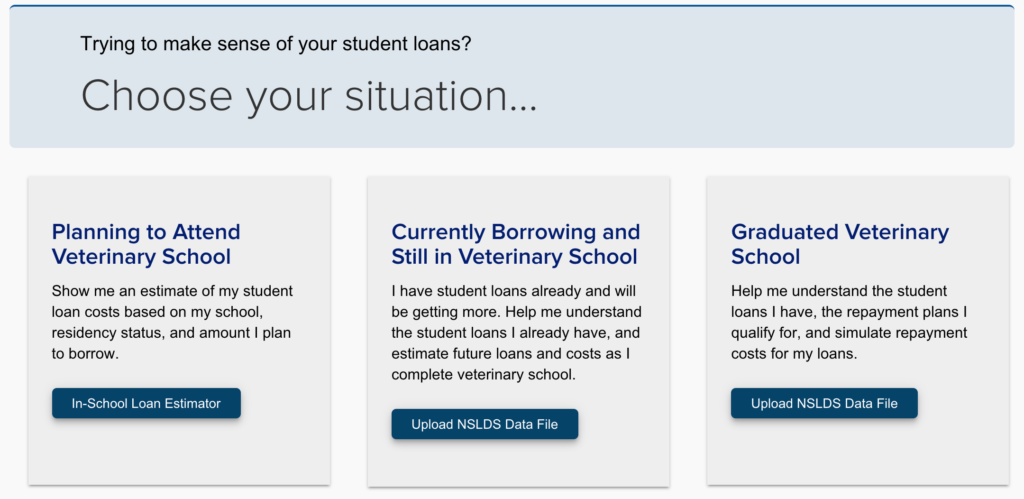

The VIN Foundation is excited to announce the addition of the In-School Loan Estimator and additional features to the Student Debt Center.

Helping current and future veterinarians understand their borrowing and loan repayment options is key to surviving this student debt crisis. It starts with informing them before veterinary school and continues for the duration of their loan repayment. This is why the VIN Foundation’s Student Debt Center is so helpful and the Student Loan Repayment Simulator is a critical resource for those with debt and those advising them.

In the latest update, the VIN Foundation My Student Loans connects all the “dots”, completing the path of full student debt support throughout a veterinary career. This support starts with the Vet School Bound website and Cost of Education Map to help pre-veterinary students and veterinary school applicants Apply Smarter.

The In-School Loan Estimator helps students before and after borrowing. Many veterinary students are unfamiliar with the Federal student loan process. The In-School Loan Estimator allows pre-veterinary students to project their anticipated borrowing for the veterinary school they plan to attend.

If they have begun borrowing, they can import current Federal student loan balances and estimate total loan costs, enabling them to be more informed and proactive borrowers while in school.

These estimates and what-if scenarios can then be automatically fed to the VIN Foundation Student Loan Repayment Simulator to help explore their loan repayment options after graduation.

Connecting the “dots” provides veterinary students and veterinarians an information hub and integrated toolset to help them compile, organize and assess their critical Federal student debt information through the life of the borrowing and repayment process.

A majority of veterinarians are leaving school with a student debt load exceeding two times their salary, far surpassing the “healthy” debt-to-income ratio recommended by most financial professionals. This veterinary student debt-related stress is taking a toll on individuals and the profession – a toll measured in physical, emotional and financial stress. Providing education to help pre-vets, veterinary students, and veterinarians is vital for setting them up for success in their career.

Learn more about My Student Loans, the In-School Loan Estimator, and the Student Loan Repayment Simulator in the VIN Foundation Student Debt Center, or explore more VIN Foundation resources.

VIN Foundation

The VIN Foundation was founded by members of the Veterinary Information Network (VIN) in 2005. VIN is an online community of veterinarians and veterinary students with over 100,000 members worldwide. The VIN Foundation’s charitable efforts are centered around the belief that a healthy veterinary profession is essential for healthy animal and human communities.