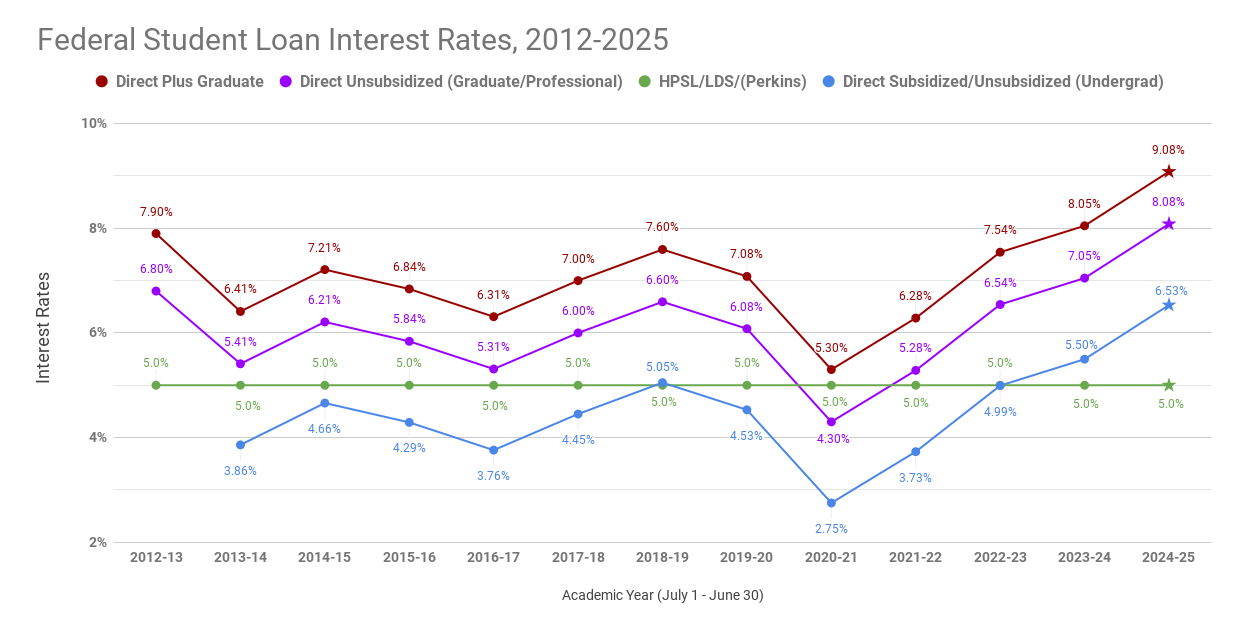

Student Debt

With veterinarians leaving school having a student debt load routinely exceeding two times their salary, and far surpassing the “healthy” debt-to-income ratio recommended by most financial professionals, this is a critical issue impacting the veterinary profession. Topics cover student loan repayment strategies along with the latest news and information.

See all Student Debt posts >>

Mental Health

Supporting veterinary colleagues covering topics from mental health to finding work/life balance, and best practice tips from colleagues.

See all Mental Health posts >>

Latest Podcast Episode

Listen in as student debt experts and Board Member Drs. Tony Bartels and Rebecca Mears in this next installment of our Student Debt Series. In...

Read more