Federal Direct Loan interest rates for graduate school break their upward trend

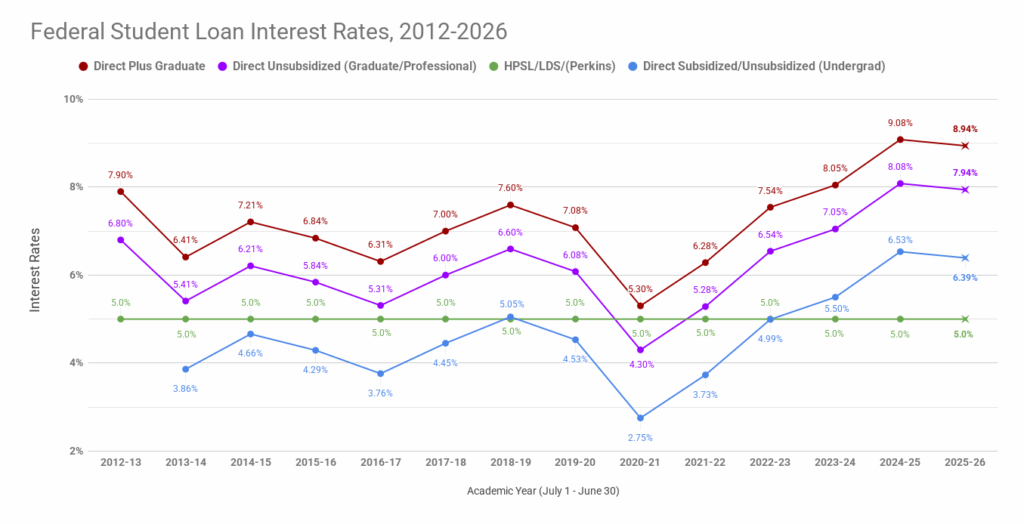

Federal student loan interest rates have a fixed rate for the life of the loan. That fixed interest rate depends on when you receive the loans.

Each spring, we closely monitor the federal treasury yields. With all of the economic uncertainty this year, treasury yields have been volatile. Student loan interest rates for the next academic year are adjusted using the high yield of the last U.S. 10-year Treasury note auction before June 1st.

The high yield, plus an add-on factor per Direct loan type, sets the fixed rate you are charged for the life of those loans. For veterinary students, the graduate/professional school Direct Unsubsidized loan interest rate for loans received after July 1, 2025, will be 7.94%, down slightly from 8.08% last year. The Direct Graduate Plus loan rate will be 8.94%, down from 9.05% last year.

With the cost of veterinary school higher than ever, plus interest rates near historical highs, it’s never been more important to carefully consider how much student loan debt you need to pay for your veterinary education. The more you borrow, the more interest you will accrue. Since interest accrues from the moment you receive your student loans, student loan interest can add tens of thousands of dollars to your veterinary school costs.

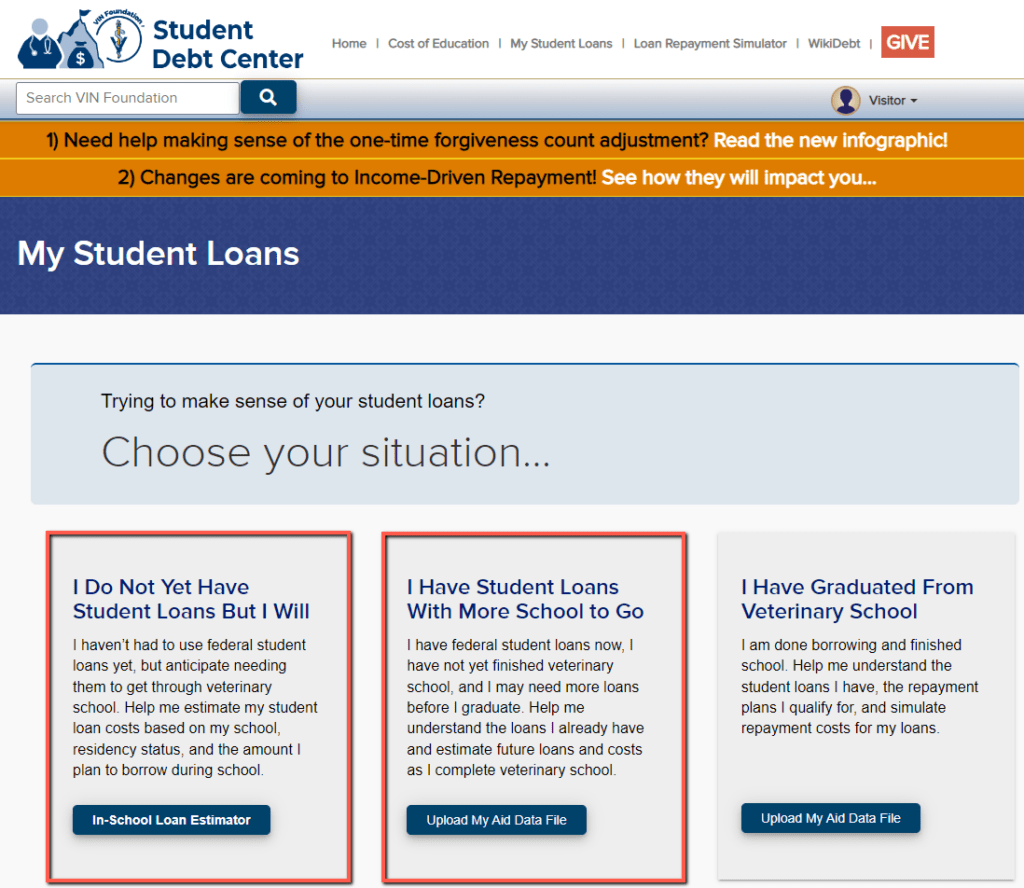

For example, $40,500 of Direct Unsubsidized Loan received this August 2025 to start a four-year veterinary program will add $11,375 of interest for that balance at graduation. If you need an additional $25,000 of Direct PLUS Graduate loans in that first year, you’ll add another $7,906 of interest to your total for that loan by graduation. That’s $19,281 of interest for just your first year of loans. Use the VIN Foundation My Student Loans tool and In-School Loan Estimator to see how much your loans will cost you.

Your School's Cost Of Attendance

Future and current veterinary students – It’s more important than ever to Apply Smarter to veterinary school and Borrow Better while you’re in school. The less you borrow, the less interest accrues, and the less you’ll have to manage in repayment. It’s ALWAYS easier to manage less than more when it comes to student loan repayment. Review your school’s published cost of attendance (COA) and look for ways to reduce the loans offered to you in your financial aid awards. If your school offers Health Professions Student Loans or Loans for Disadvantaged Students, apply for and accept them when possible. These are two of the only subsidized loans available for veterinary school (loans that do not accrue interest while in school).

As graduate/professional school students, you’re frequently offered student loans to cover the full COA. Use your budget to determine if you actually need to accept all the loans you are offered. The COA sets the maximum amount you can borrow. Your mission, if you choose to accept it, will be to accept only budgeted needs, and ideally, less than the maximum COA.

Reducing Loan Awards and Returning Loans Vs. Paying During School

Too many veterinary students are making payments on student loans while they are in school and are still borrowing.

First, if you can afford to make payments on your student loans as a student, ask yourself where that payment money comes from.

Second, if you can afford to make payments on your student loans as a student, then you borrowed too much.

If you’re using federal Direct student loans to pay down other federal Direct student loans, you’re not gaining any ground. A better plan would be to borrow less.

If the funds you’re using to make payments to your loans during school are coming from your veterinary school job or outside help, then borrow less.

Reduce your future loan awards or return loans that you received above your budgeted need to make the biggest impact. You have up to 120 days to return the loan amounts you received that you might not need. When you return student loans, the principal, interest, and fees are also returned. The loans you don’t borrow or the principal you return within the 120-day window will go much farther than paying the interest while in school. To learn more, visit the VIN Foundation Borrow Better resource page.

If you are starting veterinary school this fall or returning next fall, use the VIN Foundation My Student Loans tool and In-School Loan Estimator to help you review your current student loans, interest rates, and project your graduation balance using this new interest rate information.

Here is a video tutorial on how to locate and download your student aid data file. These free tools help you account for loans you already have and help you estimate your total debt balance at graduation. You can even use the In-School Estimator to calculate how much you might save by returning unused student loans or reducing your future financial aid awards.

Less Expensive Borrowing Options

Health Professions Student Loans (HPSL) and Loans for Disadvantaged Students (LDS) are potential federal alternatives to Direct loans for veterinary school if they are available for your education program and if you are eligible to receive them.

HPSL and LDS have an interest rate of 5%, and they do not accumulate interest during school (subsidized loans). They can also be consolidated into a Direct Consolidation Loan after you finish veterinary school, making them eligible for income-driven repayment plans or Public Service Loan Forgiveness.

Ask your financial aid office if they offer HPSL or LDS and how to apply for them. Oftentimes, they require your parents’ financial information to determine your eligibility.

Avoid Private Student Loans for Veterinary School

Steer clear of private student loans to fund your veterinary education. As long as you are attending an accredited veterinary college and are eligible for U.S. federal student loans, you will be able to borrow U.S. student loans up to your school’s cost of attendance. Federal student loans are the most flexible and least risky debt you will ever have.

Private student loans do not have the benefits, protections, and repayment options that come with your federal student loans. Even if you find private loans with a lower interest rate, the repayment options and hardship provisions will not be as beneficial compared to federal loans. Private student loans can even limit your career opportunities depending on the balance and deferment provisions. Make sure you have maximized all federal student loan options before you consider any kind of private student loan for veterinary school.

We’re here to help!

Happy budgeting this spring, summer, and fall. An ounce of planning is worth a pound of interest saved in repayment. Please feel free to reach out with any questions: [email protected].

VIN Foundation is here to help with understanding your veterinary school borrowing and repayment options now or in the future!

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.