Attention 2020, 2021, and 2022 veterinary graduates with student loans!

You have some special homework to maximize all of the recently announced benefits.

If you have federal student loans and you graduated into the pandemic forbearance period, here are the things your graduating classes need to know and perhaps DO soon to ensure you take advantage of all the recent benefits.

Normally, your student loans from veterinary school enter their grace period after graduation. For most student loans, that grace period is 6 months. Usually, if you do nothing before the end of that grace period, your unpaid interest from veterinary school capitalizes (gets added to your principal) and you are automatically entered into the standard 10-year repayment plan (STD 10).

UPDATE: The Department of Education is now asking your loan servicers to undo interest capitalization IF your grace period ends between March 13, 2020 and June 30, 2023. This means there is now an incentive to not consolidate your loans during your grace period. Instead, let your grace period expire normally so any unpaid interest you have does not capitalize.

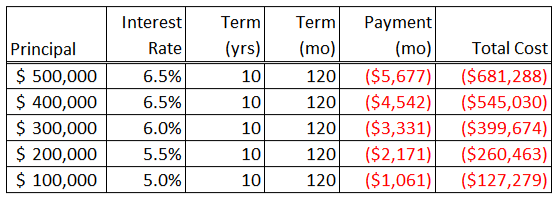

If you have not yet chosen a repayment plan when your grace period expires, then your loans will be in a STD 10. The STD 10 uses your principal and interest rate to calculate the monthly payment needed to pay your balance to zero in 10 years (120 monthly payments).

As a result of the pandemic forbearance on federally held student loans, no interest has accrued on your loans since March 13, 2020, and no payments have been due.

The STD 10 monthly payment can be quite high, depending on your student loan balance as shown in the table below. Most veterinarians will want to choose a different repayment plan before interest and payments resume, sometime in 2023. Compare your income-driven repayment plan options to a STD 10 payment, particularly if your student debt to income ratio is greater than one.

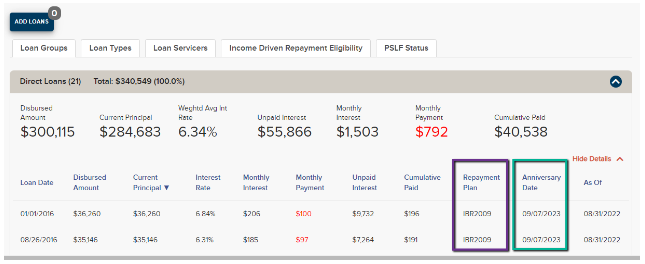

I have already graduated, consolidated, and applied for an income-driven plan

Congratulations! The time you’ve spent in repayment during the forbearance using an income-driven repayment plan counts towards the time required to reach loan forgiveness. Make sure to check your income-driven renewal date, aka anniversary date. You’ll see that date if you upload a recent student aid data file into the VIN Foundation My Student Loans tool. As part of the pandemic forbearance benefits, no one will be required to renew before July 2023. If you see an anniversary date in your loan details that is earlier than July 2023, you can add one year to it. For many recent graduates, that will result in very low or no payments well into 2024. Enjoy 🙂

I have not done anything with my student loans since graduation or during the pandemic forbearance

Thanks to the special April 19th announcements, you have a rare second chance through May 1, 2023 to simplify your repayment strategy, preserve your forgiveness qualifying time, and maybe even earn more forgiveness time. Any post-grace period Direct Loans will receive forgiveness credit. But you may want to use the special one-time forgiveness count adjustment to consolidate older loans or other non-Direct Loans (like older Federal Family Education Loans, Perkins Loans, or Health Professions Student Loans) into a Direct Consolidation Loan. This will allow you to have them included in your income-driven repayment strategy or maybe even earn some additional forgiveness qualifying time by including older loans from before veterinary school.

UPDATE: You will need to consolidate soon to benefit from the one-time forgiveness count adjustment. That count is expected to be completed “no sooner than Jan. 1, 2023.” in 2023 for those elgible for forgiveness and “All other borrowers will see their accounts update in 2024.“

Graduate, consolidate, and apply for an income-driven repayment plan, as covered in the most recent VIN Foundation New Grad Student Loan Repayment Playbook remains the best pathway forward for recent graduate veterinarians. Even if you think you missed your chance to follow this recommended repayment path after graduation, do it now.

With the recent change to unpaid interest capitalization coming out of a grace period, consolidation recommendations are changing and can now be used only in specific situations, such as when you have non-Direct Loans that could benefit from income-driven repayment or Public Service Loan Forgiveness.

Additionally, new and recent veterinary school graduates are likely to be the biggest beneficiary of the proposed one-time cancellation of up to $20,000 in “federally held” student loans.

UPDATE: The proposed debt relief is blocked while legal challenges make their way through the courts.

Individuals with an adjusted gross income (AGI) from either a 2020 or 2021 tax return that is less than $125,000 ($250,000 for married couples or heads of households) are eligible for up to $10,000 of student loan cancellation. Many of you may not yet have a tax return that shows an income above those limits (yet), making you eligible for this particular benefit. The student debt relief application has recently been released. Submit your application as soon as you can.

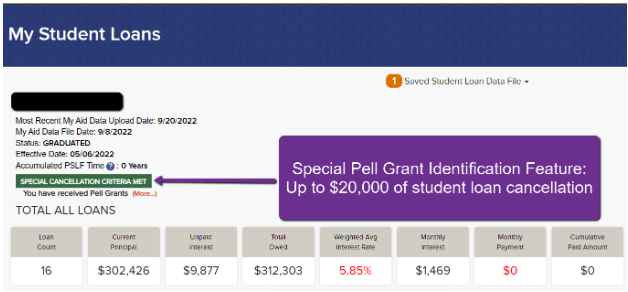

If you received a Pell grant at any time in your collegiate past and met the AGI thresholds, you are eligible for an additional $10,000 of student loan cancellation, for a total of $20,000 of student loan cancellation. If you’re not sure if you received a Pell Grant in the past, upload your student aid data file into the VIN Foundation My Student Loans tool, and we’ll tell you!

What if I’m still not sure what I should be doing with my student loans?

If you don’t know which repayment plan you’re in, find out! We see many recent graduates using repayment plans that are not the most beneficial for them. Download your student aid data file from studentaid.gov, upload it into the VIN Foundation My Student Loans tool, and check your repayment plan. If your repayment plan shows “forbearance” or something other than an income-driven plan, then reach out to your loan servicer to request your repayment details. If possible, request some kind of confirmation of the repayment plan you’re in and when that repayment period started for each loan.

If you have already selected an income-driven repayment plan, be sure to review your anniversary date. This is when you’ll be due to recertify your income information next to satisfy the income-driven repayment requirements. UPDATE: The pandemic forbearance benefits have pushed ALL income-driven renewal dates, aka) “Anniversary Date”, to no sooner than six months after the pandemic forbearance benefits end. You may even see a date that is further out than that – which is great if your payment is low or zero. If your renewal date shows a date before about February 2024 , then you can keep adding a year to it until it is greater than February 2024, per the language on the extension. If your income has decreased since you last applied for an income-driven repayment plan, then you can (and should) submit new documentation to have your payment decreased prior to the end of the pandemic forbearance benefits.

If you have not yet picked a repayment plan since graduation, then apply for an income-driven repayment plan. Use a Direct Consolidation Loan to take advantage of the special April 19th announcement details as part of your income-driven application; you may even earn additional forgiveness time if you have older loans that were in repayment before veterinary school.

You want to make sure you’re earning forgiveness qualifying time after the special forbearance benefits end. If available, you can use your 2020 or 2021 tax return as your income documentation to apply for an income-driven plan. The tax return from your last year of veterinary school likely shows a very low AGI if you started your veterinary career late in the 2020 or 2021 tax year. A low AGI on a recent tax return will assure that your payment for the next 12 months will also have a relatively low monthly payment and qualify for forgiveness. Even if you may not reach forgiveness, it’s better to log that qualifying time just in case forgiveness becomes a possibility for you in the future.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.