What is the one-time forgiveness count adjustment?

The one-time forgiveness count adjustment for federally-held student loans is a lesser-known, more confusing, yet more widely available special benefit announced in April 2022. Anyone with federally-held student loans is eligible to receive the adjustment. Essentially, the adjustment will count any repayment time, and certain deferment or forbearance time as forgiveness eligible, regardless of payments made, loan type, or repayment plan used.

***MAY 2024 UPDATE: CONSOLIDATION DEADLINE EXTENDED TO JUNE 30, 2024***

Think about that for a moment. Those of you who have been in repayment for 10, 15, 20, or more years — regardless of the repayment plan you’ve used or the life events that have interrupted your well-intentioned repayment strategy — can have most (if not all) of that time credited as forgiveness-eligible.

For most veterinarians who graduated before 2012, forgiveness requires 25 years of qualifying payments. This is a special opportunity to clean up all of the unfavorable mess that has been student loans for the last 30 years and be done with repayment sooner rather than later. In fact, many of our colleagues who have been in repayment for 25 years or more are seeing their loans forgiven right now under this special count adjustment! More than 800,000 borrowers have received forgiveness notices and had their balances canceled so far. Each month going forward, more borrowers who meet the repayment threshold will see their balances forgiven as well.

Student loan forgiveness time is very valuable. Even adding one more year of time towards forgiveness can save you tens of thousands of dollars of monthly payments. The more you reduce the required number of years you need to pay, the less you’ll pay in total and the sooner you’ll be done with repayment.

Special Forgiveness Note

Many need to apply for a new Direct Consolidation Loan in order to receive the maximum count adjustment benefit. Should you consolidate? Let’s dive in to this a bit.

Since the recent Climbing Mt. Debt webinar on how to make sense of student loan changes and prepare for interest and payments, we’ve had hundreds of questions regarding the count adjustment. The most common are:

- How do I know if I’m eligible for the one-time forgiveness count adjustment?

- How do I know if I need to consolidate to receive the one-time count adjustment?

- How do I know how much time I will receive if/when I consolidate?

- Won’t consolidation reset my forgiveness progress?

- Which repayment plan should I choose if I do consolidate my loans?

Having coached thousands of our colleagues through these dilemmas over the last two years, let’s talk about how the VIN Foundation Student Debt Team approaches each of those commonly asked questions:

How do I know if I’m eligible for the one-time forgiveness count adjustment?

Anyone with federally-held student loans is eligible to receive the adjustment. Essentially, the adjustment will count any repayment time, and certain deferment or forbearance time as forgiveness eligible, regardless of payments made, loan type, or repayment plan used.

If your count adjustment puts you over the finish line (25 years of eligible time for most veterinarians) you will receive a cancellation notice. These notices have started going out already.

If you have not yet reached the required number of qualifying payments to receive a cancellation notice, you can expect to see your count adjustment by September 1, 2024.

How do I know if I need to consolidate to receive the one-time count adjustment?

First, let’s review those who do not need to consolidate. If you have loans only from veterinary school and they are all Direct loans, then there is no additional count for you to gain via consolidation UNLESS you are a new graduate and your loans are still in their grace period.

Now let’s explore who should consolidate.

In-school loan time is not forgiveness eligible. If you graduated in 2024 and your loans are still in their grace period, then you may want to consolidate in order to get your forgiveness clock started. Grace period time is not forgiveness-eligible time, even under the count adjustment. The only way to end a grace period early is to consolidate and select the “do not delay processing” option.

If you have a portfolio of federal loans that includes Direct Loans and other loans: Federal Family Education Loans (FFELs), Health Professions Student Loans, Loans for Disadvantaged Students, or Perkins Loans; this is an excellent opportunity to consolidate those non-Direct Loans. Not only will this keep the forgiveness credit you have for your Direct Loans, but you could also add to your forgiveness count, particularly if you have older Direct or FFELs that have additional qualifying repayment time. Start your Direct Consolidation Loan before the end of this year April June 30th, 2024 to receive the maximum forgiveness count adjustment.

At this point, whenever we see a portfolio of loans that contains FFELs, we recommend consolidating ASAP. Some of you with older FFELs may even see your remaining balance forgiven after you consolidate.

Special Consolidation Recommendation Note

If you paid older loans to zero during the pandemic forbearance period, you can request a refund of those COVID payments which will re-instate those loans, then consolidate all of your loans to receive a higher amount of forgiveness credit (if those older loans have been in repayment longer than your veterinary school loans). Crazy, right? (Please note: the pandemic payment refund window has closed if you have not already requested or received a refund.)

Unfortunately, if you have older loans that you have already paid off before the pandemic forbearance period, they will not be counted in the forgiveness count adjustment.

The most beneficial (or sometimes necessary) way to receive the maximum one-time forgiveness count adjustment is to consolidate all of your remaining loans into a Direct Consolidation loan. Why? If you have loans with different amounts of repayment time included in a consolidation loan, your consolidated loan will receive the maximum number of repayment years when the count is applied in 2024. However, you must consolidate before Dec 31, 2023 April June 30, 2024, in order to receive the maximum possible count adjustment.

If your only remaining loans are already Direct Consolidated Loans, you don’t need to do anything more to receive the count adjustment. If you’re not sure, log in to studentaid.gov, grab a federal student aid data file, and upload it into the VIN Foundation My Student Loans tool.

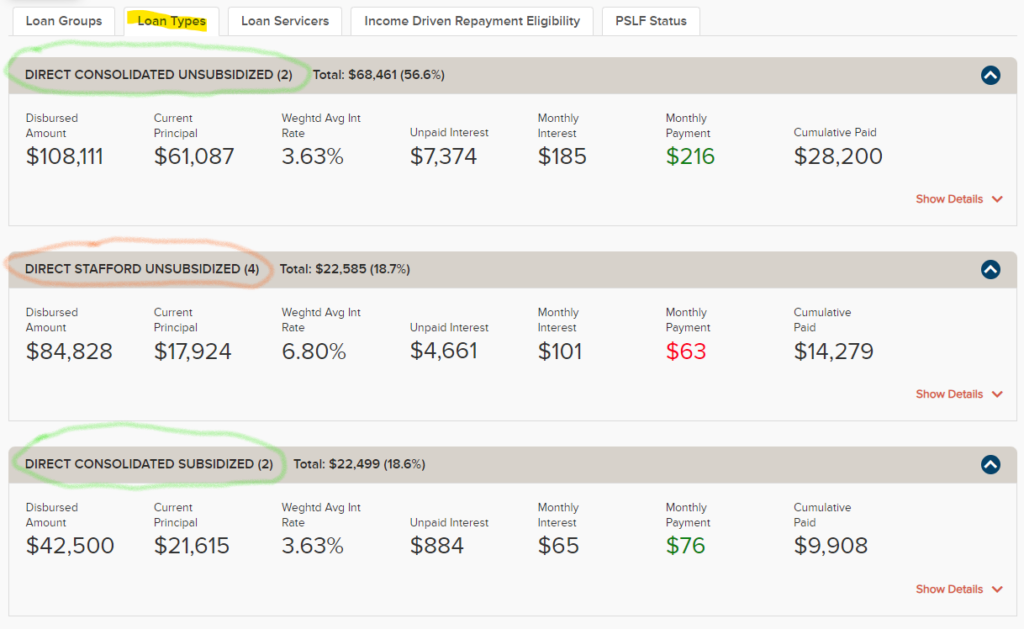

In the My Student Loans summary, look at the Loan Types tab. You’ll see names for your various remaining loan types. In the My Student Loans example below, we see two different types of Direct Consolidated loans and one type that is not consolidated (Direct Stafford Unsubsidized).

The already consolidated loans will receive the maximum count adjustment based on the loans included in that consolidation. But there is also a potential opportunity to consolidate the remaining Direct Stafford Unsubsidized loan with the existing consolidated loans into a new Direct Consolidation Loan if it would increase the overall repayment time for the new consolidation loan.

If all of your loans are from veterinary school only and are all Direct Loans already, or if your remaining loans are only Direct Consolidated loans, you don’t need to do anything. You’ll receive the maximum count adjustment corresponding to when you started repayment after graduation. However, if you have multiple different loan types with potentially different amounts of repayment time, then you could benefit from a new Direct Consolidation Loan before the end of this year.

How do I know how much time I will receive when I consolidate?

This question is best answered with an example:

Let’s take a 2017 DVM who graduated with a mixture of Direct Loans, Health Professions Student Loans, and Perkins Loans. They completed their undergraduate degree in 2012, entered repayment on those loans, and then were admitted to veterinary school in 2013. They didn’t consolidate after graduating from veterinary school. They’ve had their Direct Loans in an income-driven plan for the last 6 years, and their HPSLs and Perkins have been in a fixed 10-year plan. If they consolidate ALL of their federal student loans into a Direct Consolidation loan before the end of this year, they will have one remaining Direct Consolidation Loan that has 7 years of qualifying repayment time: Six years for the years in repayment since graduating from veterinary school plus one year of credit for the year in repayment before entering veterinary school. They will also have a lower monthly student loan payment because all of their remaining consolidated balance will be covered by a single repayment plan.

Take that same example and increase the time between undergraduate and veterinary school. Maybe they experienced a career change and completed undergrad in 2005 and had FFELs in repayment for 8 years before starting veterinary school in 2013. Even if you’re consolidating a rather small amount that has an additional 8 years of repayment time, your entire new consolidation loan will receive that extra time as forgiveness time. In this case, you should have 14 years of qualifying forgiveness time when the count is applied in 2024: Six years for the years in repayment since graduating veterinary school plus eight years of credit for the years in repayment before entering veterinary school.

The closer you get to forgiveness without having to make payments, the less you’re going to pay for your student loans and the sooner you will be done with student loan repayment.

The same is true for those with differing amounts of Public Service Loan Forgiveness (PSLF) time. Let’s say you have some loans with 90 months of qualifying PSLF time and others with 40. In this case, the 40 qualifying PSLF months overlap with some of the 90 months as the borrower took additional loans for a master’s degree later. If you consolidate all of these loans together before the end of the year and submit a new PSLF employment certification form (or forms) covering the 90 months of time you have, your entire new consolidation loan will receive the maximum PSLF credit of 90 months and on track to receive tax-free PSLF at 120 months.

Won’t consolidation reset my forgiveness progress?

It used to. And the consolidation application will still tell you that will happen. However, that is not the case during the forgiveness count adjustment period. This is why it’s so important to stay informed on changes to student loan repayment. There are two major changes that have significantly changed how consolidation treats your loans: the limited one-time forgiveness count adjustment and the more permanent weighted average forgiveness change that will take effect on July 1, 2024.

The limited-time forgiveness count adjustment will give you the maximum forgiveness count credit for the loan with the highest amount of forgiveness qualifying time included in the consolidation loan as long as you consolidate before the end of this year April June 2024.

After July 1, 2024, consolidating loans with differing amounts of forgiveness qualifying time will result in a weighted average forgiveness count for the new consolidation loan. It’s much more beneficial to receive the maximum count adjustment. However, the weighted average calculation will be helpful for those who are not able to consolidate under the limited time count adjustment — like veterinary students who are in school during the limited one-time forgiveness count adjustment period. Everyone else should be quickly assessing whether or not they can benefit from a Direct Consolidation Loan before the end of this year.

Which repayment plan should I choose if I do consolidate my loans?

For now, choose the plan that results in the lowest monthly payment. If that is an income-driven plan, great! If it’s maybe the standard plan, that’s fine for now. The key is to get your loans in a position to receive the maximum one-time count adjustment.

Until the count is applied, any repayment time is considered forgiveness-eligible. However, once your count is applied, the normal forgiveness rules will apply, meaning you will need to use a forgiveness-eligible plan from that point forward if you have repayment time remaining until you reach forgiveness. Knowing your exact forgiveness count will help you determine which repayment plan type you should use going forward. It also gives you an opportunity to scrutinize your income, comparing the difference between your gross income and Adjusted Gross Income (AGI) from your recent tax return. Not only may you be eligible for a lower payment using the new SAVE plan, but if you’re married, filing taxes separately, that could be the difference between reaching forgiveness sooner and paying more for longer.

Use the VIN Foundation My Student Loans tool to check your income-driven repayment eligibility and the Student Loan Repayment Simulator to see what your range of monthly payments will be. The Simulator can also help you check your likelihood of reaching forgiveness depending on your years in repayment and forgiveness count adjustment. One of the major advantages of the VIN Foundation Student Loan Repayment Simulator is the ability to account for your current forgiveness time in your remaining repayment projection. The Department of Education simulator does not count your current forgiveness time.

If your repayment projections suggest that it is likely you will reach forgiveness after your count is applied, then choose an income-driven plan like SAVE, the recently updated version of REPAYE. This applies even if your income is high and would result in payments that are equal to a fixed 10-year plan. If, by making minimum required payments, you’re likely to pay your loans to zero and not reach forgiveness, then you can choose a strategy that makes sense for you.

If you are already using an income-driven repayment plan because it results in the lowest monthly student loan payment for you, then apply for income-driven repayment again during consolidation. With recent changes to repayment, including SAVE, there are now more flexible and beneficial options for you to receive a lower monthly student loan payment. For income-driven plans, your payments depend on your taxable income, marital status, recent tax filing status, spouse’s income, spouse’s federal student debt, family size, and state of residence.

The one-time forgiveness count adjustment is covered in more detail in the recent Climbing Mt. Debt webinar. Review the recording if you were not able to attend the live session.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

25 thoughts on “Student Loan FAQs: The one-time forgiveness count adjustment”

It would be nice to know how to figure out if any of my forbearances or deferments were forgiveness eligible. I don’t know if any of these periods were forced on me. I was also on unemployment for 2 years and wonder if I am missing any benefits from that time.

Hi Marjorie,

Thank you for your comment! Many deferment or forbearance periods are eligble for forgiveness credit under the one-time forgiveness count adjustment whether they were forced on you or not. If you have older loans or various loans with different repayment histories, then I would seriously consider a Direct Consolidation Loan of all your remaining loan types before the end of this year. If your loans are not already fully consolidated into only Direct Consolidation Loans remaining, then submit a Direct Cosnolidaiton Loan before 12/31/2023 to get the maximum count adjustment for your remaining balance when the count is applied in 2024. We’re going to be reviewing how to evaluate your loans and decide if consolidation is right for you at a free webinar tonight (Thursday) December 14th, 2023 at 8pm ET. Register and join if you can!

I am TOTALLY CONFUSED…!!! I graduated in 2017 on a HECS loan and i owe MORE now than i did when io graduated , even though i have been paying the max amount each and every pay cheque to the Aussie government.. as the interest rates increase, so does my HECS repayment total.. this is ridiculous, barely making ends meet here. I germnay Vet school is FREE! go figure ??

please advise what i should do, regards

Lyddy

Hi Lyddy,

Thanks for your comment! The content covered in this blog post is specific to folks with U.S. federal student loans from veterinary school. It sounds like you may have a different loan type through the Austrailia government. Loans from different governments can and probably do have very different repayment options and benefits compared to U.S. federal student loans. I would review the contract you signed for your Aussie loan types to see what benefits and repayment options you have.

Is this for veterinarians only?

Hi Dan,

Thanks for your comment! All of the content on the VIN Foundation website is focues specifically to pre-veterinarians, veterinary students, and veterinarians. That said, the student loan content is applicable to anyone with graduate school U.S. federal student loan debt.

This was helpful, thanks for the info!

I recently applied to consolidate before the June 30 deadline.

One thing I’m not clear on… Above you say “for now, choose the plan that results in the lowest monthly payment”, but if I chose the standard plan, am I disqualified from receiving the one-time count adjustment? If the idea to just get it consolidated before the deadline, how will it work if you need to be on IDR for the adjustment or forgiveness, but you choose standard payment when applying? Am I screwed?

Hi Jay,

Thanks for your comment. And you’re very welcome!

There’s nothing that I know of that will disqualify you from receiving the count adjustment as long as you have the right loans to receive it. If you need to be on an IDR after your count adjustmnet is applied, then apply for an IDR. Right now and until your count is applied any repayment plan and time is forgiveness eligible. But once the count adjustment is applied, you’ll need to use an IDR in order to continue receiving forgiveness time to get you over the forgiveness threshold in the future. Be aware that PAYE and ICR are both scheduled to be phased out on July 1. So if either of those would be your best IDR, you’ll want to apply for them before the phase out date. Good luck!

I have been in repayment since I graduated in 2007 before I consolidated then. I have been on income hardship (because paying upon graduation immediately is difficult), then ICR, then IBR, now save.

Does this one time adjustment have any benefit to someone like me, other than I have been in repayment since June 2007? 16yr and 7 months?

Hi Janell,

Thanks for posting a comment! Have you tried the VIN Foundation My Student Loans tool? I would upload your student aid file there, review your loan types, your income-driven repayment plan eligiblity, Anniversary Date, and minimum monthly payment information. It sounds like you have all remaining Direct Loans (which is great), but it’s hard to know just from your comment. If you have all Direct Loans, particularly if you have only a Direct Consolidated Loan remaining, then you are all set to receive the maximum one-time forgiveness count adjustment. If all of that is true and you graduated in 2007, then you should receive at least 17 years of forgiveness time when the count is applied by July 1, 2024, leaving you 8 years from reaching forgiveness if you’re using a plan like SAVE. What that looks like will depend on your remaining student loan balance, income, marital status, family size, tax filing status, and state of residence. The VIN Foundation Student Loan Repayment Simulator can help you to project your remaining costs. Don’t forget to add that 17 years of repayment time you have when you’re using the simulator! If you need additional help, review the VIN Foundation Student Debt Help page 🙂

Yes all of them are Direct Consolidated. Thank you for your help! I went on ICR in 2009, since I graduated in 2007 I basically get 2 years shaved off my 25yrs?

That’s awesome.

Is it true that those of us who had federally consolidated student loans for decades, but have already paid them off don’t qualify for any loan forgiveness?

Hi Anonymous,

Thanks for commenting! Yes, if you have no student loans remaining, then there is no forgiveness for you to receive under the one-time forgiveness count adustment.

I have both undergraduate and veterinary school loans that I consolidated after I graduated vet school in 2005: one consolidated subsidized loan and one consolidated unsubsidized loan. Both are serviced through EdFinancial. I’m currently on a 30 year repayment plan and have been making monthly payments since graduation including during the interest pause period. Since it’s not directly through Federal Student Aid, am I still eligible for the forgiveness count adjustment? If not, can I switch to Fed Student Aid to become eligible? Thanks!

And I guess I should mention that it states both loans are direct loans with the current owner as U.S. Department of Education.

Hi Deb, Thanks for your comment! If all of your remaining loans are Direct Consolidated loans that you consolidated at the same time, then there is nothing more for you to do in order to receive the forgiveness count adjustment. You should see your count some time before July 1, 2024. Let’s say you receive 19 years of forgiveness time. That would leave you about 6 years from reaching forgiveness using a plan like ICR or SAVE. You’d want to choose a forgiveness-eligible plan with the lowest monthly payment after your count adjustment is applied. I would encourage to post on the VIN and VIN Foundation Student Debt Message boards for more detailed assistance.

I also a bit confused. I graduated in 2010. I only have direct loans (direct stafford subsidized and direct stafford unsubsidized), so I don’t have to consolidate? I was on REPAYE, but was bumped to SAVE after payments restarted last year. I tried to use the VIN debt center student loan repayment simulator to determine which plan I should be on. That indicates that my payments would be around $1000 or less and maybe should consider switching to IBR for less time to forgiveness? Mohela has my loans currently and if I input the same information into their repayment calculator to compare plans, it gives me 3 options for income based repayment, SAVE, ICR, and IBR, but indicates that payments would be $1850 and $1450 for ICR and IBR (which seems really high for what I make right now). I’m not sure why the information is different or what to do at this point.

Hi Kari,

Thanks for your comment! From what I can see, your loans look to be in REPAYE (now SAVE) with a relatively low monthly payment. That payment will remain the same until you’re next due to renew later this summer. The Dept of ED recently extended the pause on IDR recertifications: https://studentaid.gov/announcements-events/idr-recertification-extended. When you’re next due to renew, your payment will depend on the income information you have available, your family size, tax filing status, and state of residence. Based on your graduation year, you would not be eligible for then new version of IBR with a shorter time to fogiveness. I would encourage to post on the VIN and VIN Foundation Student Debt Message boards for more detailed assistance.

I will go ahead and rase my hand as one of those who is also confused… My older FFELP loan and any Perkins loans have all been paid off. When I look through my loan portfolio I have 2 Direct Grad Plus loans, one that began repayment in 2012 (side trip through grad school), and one in 2014; the remainder are all 2016 (vet school). If I consolidate the loans, the new forgiveness date will be based off of the 2012 loan?

Hi Brook,

Thank you for your comment. My apologies for the delayed reply.

Without seeing your loan details, it’s tough to say for sure, but conceptually, the answer to your question is yes. If you have older loans from before veterinary school that entered repayment in 2012 and then started borrowing again for vet school in 2016, if you consolidate all of those loans together, your forgiveness credit starts with the oldest loan in repayment. However, in-school time does not count as forgiveness-eligible. If you’re not sure, it’s probably best to consolidate before the end of the June 30 deadline and you’ll find out when your count adjustment is applied. Good luck!

I have undergraduate loans going back to 1995 that I have been paying off intermittently through the years and reconsolidated with my vet school loans about 9 yrs ago. My vet school loans were discharged recently through sweet ba Cardona and am left with all of the undergrad loans. Am I eligible for this program? From what I’ve read, I don’t need to consolidate again.

Hi Troye,

Thanks for your comment! And congrats on receiving a discharge via the Sweet v. Cardona settlement. As long as your remaining loans are Direct Consolidation loans, then you should be eligible to receive the count adjustment and should likely receive forgiveness of your remaining balance if those remaining loans are from 1995. If your remaining loans are not Direct Consolidation Loans, then submit a new Direct Consolidation Loan application before June 30th, 2024. Good luck!

Hi,

I have been told that I should consolidate my loans to take advantage of the one time account adjustment. But, when I went to do that before they extended the deadline, the FAFSA website showed that my forgiveness date would be reset to 25 years out. I have loans for a second undergraduate from 2005-2008, and then graduate school loans from 2008 – 2010 and 2014-2018. I don’t want to prolong my repayment period and it is freaking me out that it shows that the payment period would be reset. All my loans are direct loans and I feel that there would be an advantage to consolidating but again, it shows that the payment period is being reset. Are we sure that the payment period isn’t being reset for the earlier loans? Thank you.

Hi Heather, thanks for posting your comment/question. Yes, the consolidation applicatition will tell you that your forgiveness time will be reset. That is not correct. YOu’re welcome to review the published guidance from the Dept of ED on the topic: https://studentaid.gov/announcements-events/idr-account-adjustment#questions-answers. Look for the “If I consolidate, will that reset my payment count for IDR and PSLF?” section in the FAQs. You’re not going to prolong your repayment time by consolidating. If anything, you’ll shorten it. It sounds like you may have had a break of 3-4 years where your older loans could have been in repayment before you started borrowing again in 2014. The count adjustment would add that time to your overall balance as long as you submit a conoslidation application by the June 30 deadline.

Hi Tony, Thank you for all your work trying to help us get this straight. I wanted to know if you would recommend for me to consolidate.

I have a set of already consolitaded loans from vet school in 2020 (no undergrad loans), but went back to school last year to get a master degree and just graduated this May. Now I have 1 consolidated loan + 3 unconsolidated loans from my masters. Do you recommend that I consolidate all of my loans (consolidated vet school loans + new masters loans)? I am considered a new student and am in that grace period. I know technically I would want to end the grace period so I can get my clock restarted, but unfortunately I don’t currently have a qualifying job yet. At the very least can all my loans be consolidated and be stamped with the max time while still being in the grace period until I find that job? And would this mean I SHOULDN’T select the “do not delay processing” option? Thank you in advance!