On February 5th, 2025, VIN and VIN Foundation provided a Climbing Mt. Debt webinar: What’s Next for Your Student Loans?

There was excellent engagement with over 1,000 registered, 600 attendees, and 250 great questions about student loan repayment.

This post summarizes some of the questions asked during the webinar, including additional details and links to help you better understand and navigate your federal student loans during this period of uncertainty.

Any thoughts or ideas on what to do if StudentAid.gov is shut down?

Tony, if the Dept of Education disappeared tomorrow (our reality) what documents and records do we need to be downloading/screenshotting and saving?

Keep up-to-date records of your existing student loan data. This includes:

- Your student aid data file available via studentaid.gov

- Statements from your loan servicers

- Your IDR forgiveness or PSLF progress details:

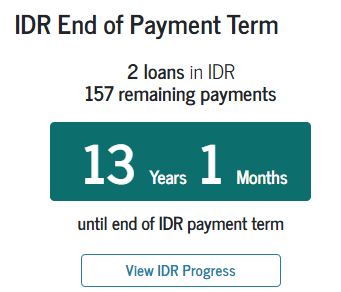

- If you are using an income-driven repayment plan you should see the “IDR End of Payment Term” module on your studentaid.gov dashboard

- If you are working towards PSLF, you should see a “PSLF/TEPSLF Payment Progress” module on your student aid.gov dashboard

- Take screenshots of that information

- Detailed forgiveness payment count information

- Via StudentAid.gov > IDR End of Payment Term > “View IDR Progress”

- Save your IDR qualifying payment history via the *NEW* VIN Foundation Download My IDR Progress Chrome browser extension

- Via the API link after you’re logged into StudentAid.gov

I’ve used the link to the forgiveness payment counter API to read my payment count information, but how do I read this?

The API data is not formatted well for reading. The fewer loans you have, the easier it is to read. Each individual loan can be identified by a section starting with “awardID:”

Identify the income-driven repayment plan you are using to repay your student loans: ICR, IBR, PAYE, IBR 2014, SAVE.

- Qualifying Payment Count = the number of monthly payments you have made that count toward IDR student loan forgiveness

- Forgiveness Required Payments = the number of monthly payments required to reach IDR student loan forgiveness for that plan

- Forgiveness Remaining Payments = the number of monthly payments required to reach IDR student loan forgiveness

Example:

A borrower using IBR 2009 may see:

{“type”:”IBR”,”borrowerEligibleIndicator”:”Y”,”loanEligibleIndicator”:”Y”, “qualifyingPaymentCount”:81,”eligiblePaymentCount”:null, “forgivenessRequiredPayments”:300,”forgivenessRemainingPayments”:219}

The text says that the borrower has 81 qualifying forgiveness payments with 219 monthly payments required to reach forgiveness at the maximum repayment period of 300 months for IBR for this particular loan. In this case, IBR refers to “old IBR” or IBR 2009.

Am I supposed to move out of SAVE and into another plan?

It depends on what other plans you’re eligible for (IDR Profile) and what your financial circumstances are. The SAVE forbearance, where no payments are due and no interest is accruing, is not a bad place to be right now. Although you’re not earning forgiveness credit during this forbearance, your student loans are not costing you anything at this time. Once we have more certainty about what income-driven repayment plans may help you going forward, then readjust your repayment strategy. In the meantime, enjoy the forbearance and focus on other areas of your financial wellness.

Indications for those that may want to get out of the SAVE forbearance sooner rather than later are borrowers that are very close to reaching forgiveness either through PSLF or income-driven repayment.

You can use the VIN Foundation My Student Loans tool to review which income-driven repayment plans your student loans are eligible for (Income Driven Repayment Eligibility tab) and review your IDR Profile. The Student Loan Repayment Simulator can help you understand what your monthly payment might be based on your current income, family size, and another eligible plan you may switch to.

Why has my IDR application been “pending” for 6 months?

When can I realistically expect it to be approved so I can get out of forbearance?

Most likely, your student loans are in a processing forbearance or maybe even a general forbearance. We often see this with colleagues who consolidated their loans and requested SAVE as their repayment plan as part of that consolidation around the time when the court blocked SAVE. In most cases, the consolidation was completed, but the application for SAVE was not.

Check with your loan servicer to see what status your student loans are actually in. You should also check a student aid data file in the VIN Foundation My Student Loans tool. Review your repayment plan details as well as your unpaid interest balance.

A processing forbearance can last for 60 days. During that time, interest accrues and you receive forgiveness credit. After the processing forbearance, you’re eligible for a general forbearance. Interest does not accrue during the general forbearance but you do not receive forgiveness credit. It’s the same as the SAVE general forbearance, but your repayment plan may not show SAVE as your repayment plan.

If you have about 2 months of interest accrued in your unpaid interest balance since your consolidation was completed, you’re likely in the general forbearance now. If you see something different, then keep asking questions.

If I move to Canada or Europe, will my student loan debt follow me?

Yes, you will still need to manage your student loans even if you live outside of the US.

Your US federal tax return would likely show a low or even $0 Adjusted Gross Income (AGI) if you live and work outside of the US. That income documentation could be used to secure a $0/mo minimum payment using an income-driven repayment plan. However, beware that your unpaid interest amount will grow during that time. With a very low or zero monthly payment you will see a higher student loan balance when you reach forgiveness. That forgiven amount is viewed as taxable income even if you live outside of the US. You would be projected to owe a tax on your forgiven amount at that time unless there is a specific tax exemption that will reduce or eliminate your liability.

If you’re going to use an IDR while living and working outside of the US, build a dedicated forgiveness tax fund to help cover the anticipated tax due when you reach forgiveness.

Could the whole idea of forgiveness actually go away?

I have been hoping for forgiveness and saving for it, but do not want my efforts to be in vain...

It could, but it also depends on which type of forgiveness we’re talking about. Forgiveness provided by the Department of Education-created plans (ICR, PAYE, SAVE/REPAYE) is more at risk than Income-Based Repayment forgiveness or Public Service Loan Forgiveness (PSLF). The ongoing SAVE litigation could result in the end of forgiveness for ICR, PAYE, and SAVE/REPAYE depending on the ruling. However, to eliminate IBR or PSLF, Congress would need to pass legislation to eliminate forgiveness for current borrowers.

In general, the proposals to do away with student loan forgiveness are directed toward future borrowers, and would likely not impact those that already have federal student loans and progress towards forgiveness. While we may see some changes to IDR availability and which plans earn forgiveness credit vs. provide forgiveness, it’s too soon to say what the future of student loan repayment looks like or which types of forgiveness could be affected.

In the meantime, review your repayment plan details. Are you using an IDR plan that still provides forgiveness credit? (ICR, IBR, or PAYE). What is your IDR Anniversary Date? What is your IDR plan eligibility and profile in case you do switch to another plan? What would your minimum monthly payment be using a different repayment plan? What is your forgiveness payment count? If you were to switch, when would be the best time for you to do so? If you need help answering any of those questions, complete a Student Debt & Income Signalment Form.

Can you clarify what it means to receive "forgiveness credit" but not be able to receive "forgiveness"?

Forgiveness credit is what you earn as you make qualifying payments. Forgiveness is what you receive when you have made the required number of qualifying payments using a forgiveness-eligible repayment plan.

Forgiveness as a feature (seeing your remaining balance canceled after making the required number of payments) for any of the Department of Education-created plans (ICR, PAYE, SAVE/REPAYE) is paused by the ongoing SAVE litigation. Forgiveness is still available for IBR.

You can still receive “forgiveness credit” by making your minimum monthly payment each month for any income-driven plan other than SAVE.

If you do reach the required number of qualifying to receive forgiveness under the Department of Education-created plans, you can request a forbearance while you await a forgiveness determination by the court. You can also try switching to IBR (if eligible) to have your forgiveness processed. This is a developing situation and we will be updating borrowers as we learn more.

Key takeaway: payments made using ICR or PAYE will still provide student loan forgiveness credit. You can monitor your forgiveness credit using the “IDR End of Payment term” module on your studentaid.gov dashboard. You should see that countdown decrease with each month’s payment as you continue earning forgiveness credit.

My loans were placed in a general forbearance due to the litigation…

Should I continue to make payments during the general forbearance?

For those in the SAVE forbearance, no payments are owed at this time and no interest is accruing. In other words, your loans are not costing you anything right now. And if you do continue to make payments, you will not receive forgiveness credit.

This is a good time to redirect what would be your monthly student loan payment to other parts of your overall financial wellness. You could put that amount in something like a high-yield savings account, later you could use that amount toward your monthly payments or other financial goals.

You may also use this as an opportunity to review your student loan details carefully. What is your IDR plan eligibility and profile in case you do switch to another plan? What would your minimum monthly payment be using a different repayment plan? What is your forgiveness payment count? If you were to switch, when would be the best time for you to do so? If you need help answering any of those questions, complete a Student Debt & Income Signalment Form.

Are you projected to reach student loan forgiveness? If so, then making payments toward your loans during this forbearance is not beneficial.

If you are very close to reaching student loan forgiveness either through PSLF or income-driven repayment, then you might consider switching to another forgiveness-eligible plan to get your loans across the forgiveness finish line.

Do you have to recertify if you are currently in forbearance?

If your loans are in the SAVE forbearance you do not need to recertify. The most recent guidance says that the earliest recertification deadline for those in SAVE is Feb 1, 2026.

If you receive info from your loan servicer that you need to recertify earlier, please reach out to us to double-check what you’re hearing.

If I make payments while in SAVE, will those months count towards forgiveness?

Any payments you made in SAVE before the court injunction do count towards forgiveness. However, since the injunction (July 2024), all borrowers using SAVE have been placed in a general forbearance. Voluntary payments made toward your student loans during this forbearance do not count towards forgiveness.

Read more here: https://studentaid.gov/announcements-events/save-court-actions

I’m in SAVE forbearance. Why is my balance increasing?

If your loans are in the SAVE general forbearance, then your balance should not be increasing. A few things could be happening, maybe simultaneously:

- You’re not in the SAVE forbearance,

- You have some loans in the forbearance and others that are not, or

- Your loan servicer is making a mistake.

Check with your loan servicer and check a student aid data file in the VIN Foundation My Student Loans tool to see what status your student loans are actually in. Loans in the SAVE general forbearance should not accrue interest, thus the balance should not increase. If you recently applied for SAVE, it will take 60 days to reach the general forbearance. Loans do accrue interest during a 60-day processing forbearance, so ask your loan servicer to explain your current forbearance status for each of your remaining loans.

Lost? Confused? We're Here to Help!

No matter where you fall during this period of extreme uncertainty in student loan repayment, make sure to keep excellent records of any applications/recertifications you submit, communications you have with loan servicers or Dept of ED representatives, and data available for your student loans.

Follow your application(s) closely and look for anything unexpected. Expect long wait times. If you have payments that are due, you may need to request a forbearance pending completion of a recently submitted application.

Document all calls and communications with your loan servicers or other studentl oan officials with names, dates, and the topics covered. Request a full history of your loan repayment and account history from your loan servicer, especially if you have questions about your account(s) or loan balance. Never assume that what you are told is what actually happens with your loans. You can verify by checking studentaid.gov and frequently reviewing student aid data files in the VIN Foundation My Student Loans tool.

Right now, student loan repayment is quite chaotic. It will get better, hopefully, sooner rather than later. There are ways to navigate the chaos, but it will take a bit longer and could be a bit more frustrating than usual for a little while longer.

For many of you, working through these IDR issues will serve you best in the short and long term. For those who say “Why not just use a different repayment plan?” You certainly can, but the monthly payments will most likely be much higher and they may not be forgiveness-eligible. That can prolong your repayment and have you paying more than you otherwise have to.

If you’re confused (it’s hard not to be right now), ask questions. Ignoring your student loans is never a good strategy.

You can ask questions on the student debt message board or submit a Student Debt & Income “Signalment” form and we’ll create a new anonymous post to review your loans with you.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.