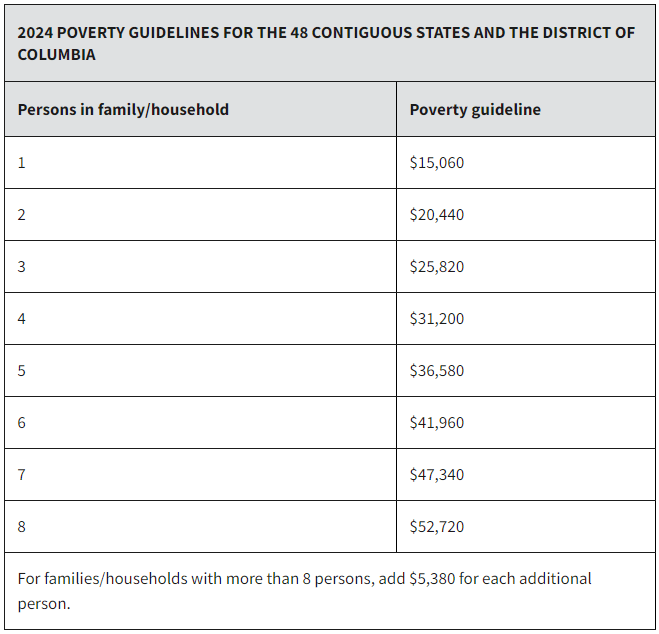

Federal Poverty Guidelines

Each year in January, the U.S. Department of Health and Human Services (HHS) updates the federal poverty guidelines used to determine financial eligibility for certain programs. Your federal student loan monthly payments are impacted by these updates when you use an income-driven repayment (IDR) plan. The VIN Foundation Student Loan Repayment Simulator is now using the recently updated 2024 poverty guidelines for IDR calculations.

The 2024 poverty guidelines have increased between 3.29-4.27% from their levels in 2023. The higher the poverty guidelines, the lower the monthly student loan payment will be using an income-driven repayment plan.

Generally speaking, the higher your family size, the higher the poverty guideline, and the lower your monthly student loan payment will be using an income-driven repayment plan.

Income-driven repayment (ICR, IBR, PAYE, and SAVE) can be extremely beneficial for veterinarians, who routinely start their careers with a student debt balance exceeding their income. With the one-time forgiveness count adjusment, many mid and late career veterinarians can also benefit.

Poverty Guidelines, Discretionary Income, and Income-Driven Repayment

When choosing an income-driven repayment plan, your minimum monthly payment is calculated as a percentage of your Discretionary Income. The Discretionary Income formula protects a portion of your taxable income from your student loan payment. Different income-driven plans protect different amounts of your taxable income by poverty guideline multipliers. The higher the multiplier, the more of your income is protected and the lower your monthly student loan payment.

Discretionary Income Multipliers for Income-Driven Repayment Plans:

Income-Contingent Repayment (ICR) | Income-Based Repayment (IBR) | Pay As You Earn (PAYE) | Saving on A Valuable Education (SAVE) |

1.0 | 1.5 | 1.5 | 2.25 |

The Discretionary Income formula used by the Department of Education (ED) for income-driven repayment plans is:

Taxable Income – Multiplier * HHS poverty guideline

Let’s say you are a single veterinarian living and working in the lower 48 states and your Adjusted Gross Income (AGI) from your recent tax return is $103,260. Your Discretionary Income for the various income-driven plans would be:

Repayment Plan | Discretionary Income Forumula | Discretionary Income |

ICR | $103,260 – 1.0*$15,060 | $88,200 |

IBR | $103,260 – 1.5*$15,060 | $80,670 |

PAYE | $103,260 – 1.5*$15,060 | $80,670 |

SAVE | $103,260 – 2.25*$15,060 | $69,375 |

A percentage of your Discretionary Income determines your minimum monthly student loan payment. The percentage differs among income-driven repayment options:

Repayment Plan | Plan Percentage | Discretionary Income | Monthly Payment |

ICR | 20% | $88,200 | $1,470/month* |

IBR | 15% or 10% | $80,670 | $1,008 or $672/month** |

PAYE | 10% | $80,670 | $672/month |

SAVE | 5-10% | $69,375 | $289-$578/month*** |

*ICR payment is the lesser of (1) what you would pay on a repayment plan with a fixed monthly payment over 12 years, adjusted based on your income or (2) 20% of your discretionary income, divided by 12.

**IBR has 2 mutually exclusive versions, (1) for new borrowers as of July 1, 2014 = 10% of Discretionary Income, or (2) anyone who is a not a new borrower as of 2014 = 15% of Discretionary Income.

***Currently 10% for everyone. Starting July 1, 2024, borrowers on the SAVE Plan will have their payments on undergraduate loans cut in half (reduced from 10% to 5% of income above 225% of the poverty line). Borrowers who have undergraduate and graduate loans will pay a weighted average of between 5% and 10% of their income based on the original principal balances of their loans taken to attend school.

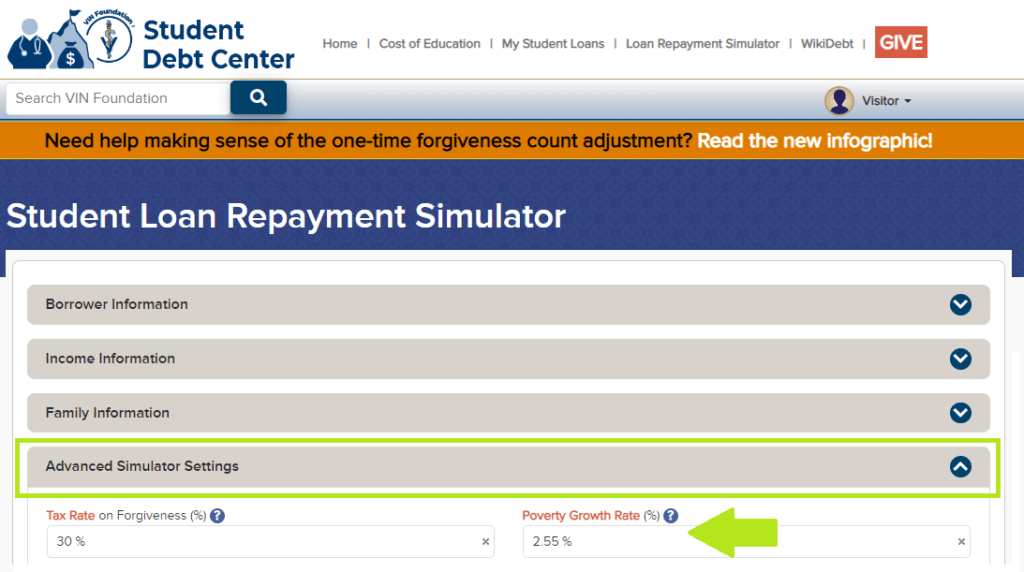

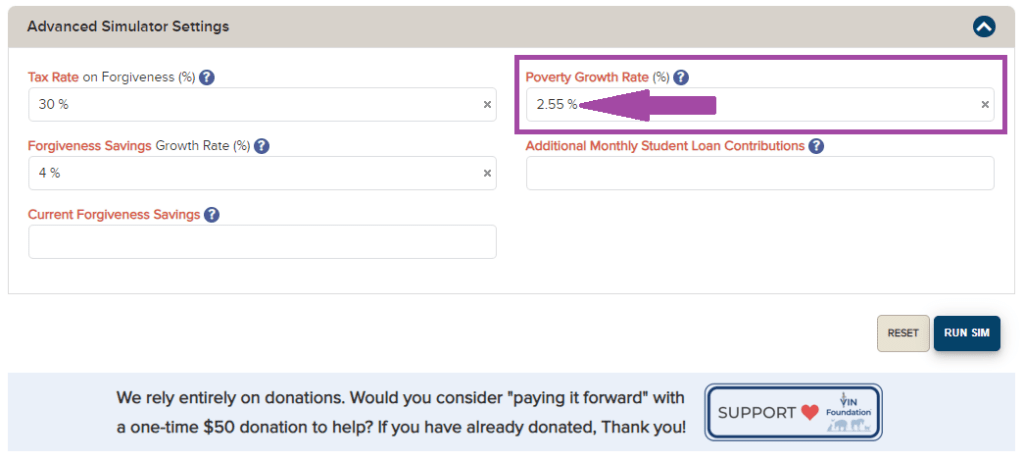

Poverty Guidelines in the VIN Foundation Loan Repayment Simulator

Projecting future payments for income-driven plans requires annual adjustments to the poverty guidelines. The VIN Foundation Student Loan Repayment Simulator is now using the recently updated 2024 poverty guidelines for IDR calculations. You can change how the Simulator increases the poverty guidelines beyond 2024 in the Advanced Simulation Settings section of the Simulator. The Poverty Growth Rate field has a default value of 2.55%, but you are welcome to change it to any growth rate you see fit. You might be asking, “why is the rate so low when inflation has been running much higher for the last couple of years?”

While inflation has been higher than average lately, history tells us that it should eventually settle between 2-3%. For example, over the last 10 years poverty guideline increases have been averaging about 2.75%. However, in the last few years, that average rise has been around 5.6%. That means the short-term projections of the Simulator may show you paying more than you actually do until inflation settles to historical averages. Over the long run, your simulations will be a good approximation of your total projected repayment costs, including any amount of tax forgiveness.

VIN Foundation receives a lot of questions from veterinarians and veterinary students about how income, tax filing status, and family size plays into a student loan repayment strategy. If you’re a veterinarian or veterinary student, you have access to the special student debt message board area where we provide student debt help to our colleagues.

During this tax-filing season, do a good “physical exam” of your student loans.

We’re here to help!

If you need help understanding your options, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected]. We’re here to help!