What to do if you're in The Pickle - or not

Congratulations on your upcoming graduation from veterinary school, Doctors!

Whether you’re in The Pickle or not, you have two critical homework assignments to complete before you graduate:

- File a 2023 tax return; and

- Review your student loan repayment options, particularly your income-driven repayment plan eligibility.

And you thought you were done with student deadlines 🙂

This year, unlike previous years, you have some unique deadlines to consider for your student loan repayment strategy.

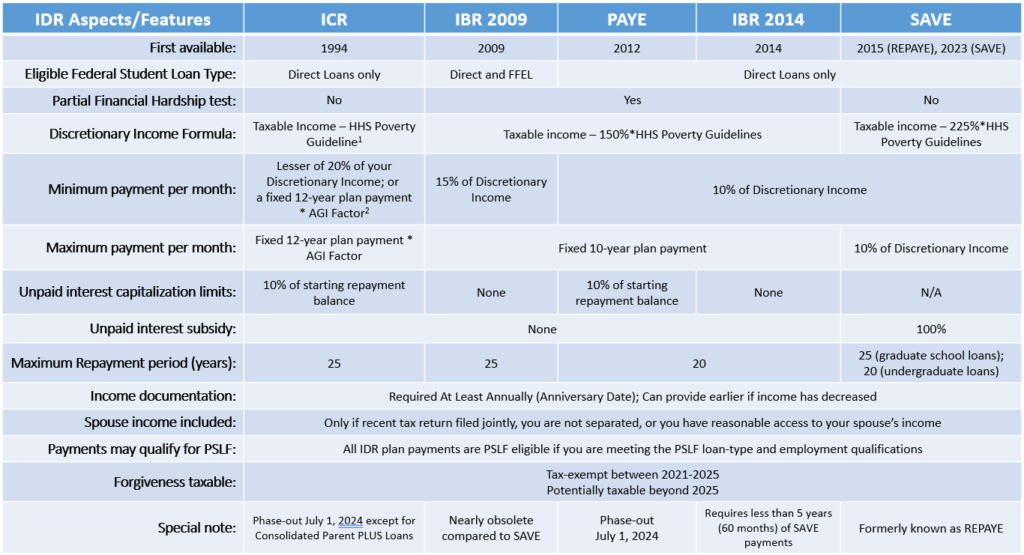

Income-driven repayment plans are very beneficial for any veterinarian starting their career with a federal student debt balance. The most helpful income-driven repayment plans are Pay-As-You-Earn (PAYE), Saving On A Valuable Education (SAVE, formerly known as Revised PAYE (REPAYE), and the new version of Income-Based Repayment (IBR 2014). However, not all new graduates are eligible for the same plans. If they were, there would be no need for your student loan homework assignment or this post.

What’s different about the 2024 graduation year?

Pay-As-You-Earn (PAYE), one of the most beneficial of the income-driven repayment plans, will be phased out on July 1, 2024. You have to either be using PAYE before that date or potentially apply for it before the phase-out date. For certain graduates, PAYE can be your best repayment option but you’ll have to act quickly if you want to use it.

Class of 2024 New Grad Student Loan Playbook

Who does the PAYE phase-out impact most?

Anyone with graduate school student loans who is eligible for PAYE but not eligible for IBR 2014 will be impacted by the phase-out.

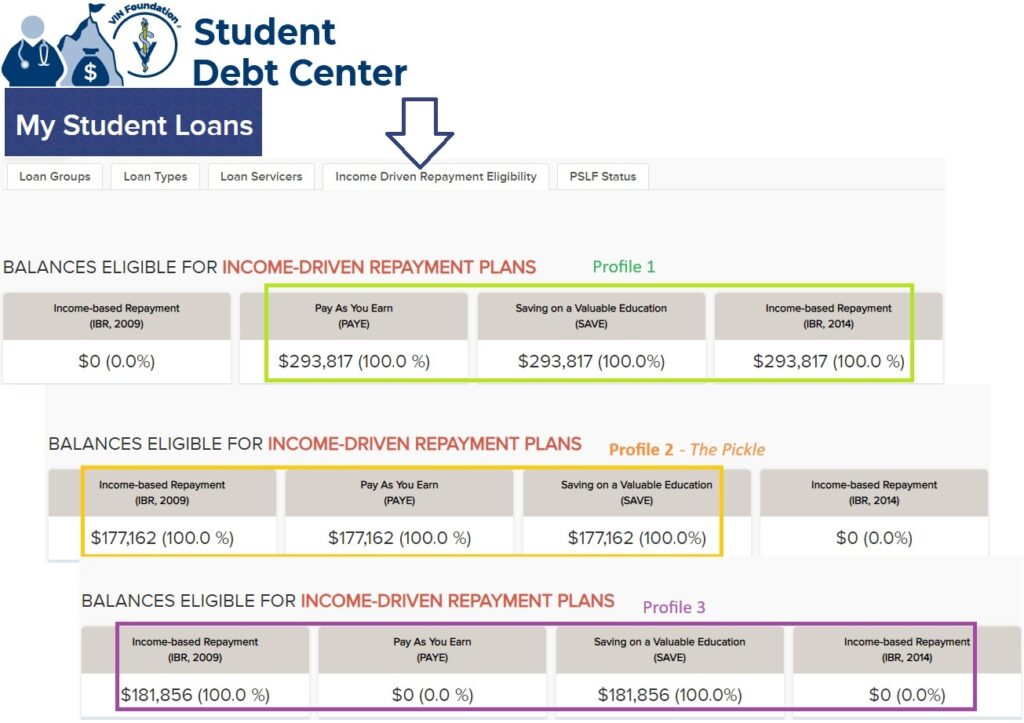

There are three different income-driven repayment eligibility profiles you can fall into:

- Eligible for PAYE, SAVE, and IBR 2014. This is the most favorable profile and lessens your urgency to act before July 1, 2024. Most 2024 graduating veterinarians should fall into this profile.

- Eligible for IBR 2009 (the older version of IBR), PAYE, and SAVE. This profile includes the folks who must act quickly if they want a chance to use PAYE before it is phased out.

- Eligible for IBR 2009 and SAVE. This is the most restrictive profile. Since there is no PAYE eligibility here; there is no urgency to act before July 1, 2024.

The easiest way to find out which income-driven plan profile you’re in is to upload your federal student aid file into the VIN Foundation My Student Loans tool and review the Income-Driven Repayment Eligibility tab. You can watch a video tutorial on how to find your student aid file on My Student Loans.

Note: Everyone with Direct Loans is also eligible for the original Income-Contingent Repayment (ICR) plan. However, there is nearly ever a scenario where a new graduate would choose the ICR plan over any of the newer repayment options. ICR will also be phased out on July 1, 2024, for everyone except those with consolidated Parent PLUS loans.

Which student loan repayment plan should I choose?

For anyone in profile 1 or 3, choose SAVE. No matter what your student debt to income ratio is after graduation, SAVE is very helpful in at least the first couple of years after graduation.

This new SAVE plan has simplified repayment for most new graduates. Best of all, if you have a recent tax return on file, you can nearly guarantee a zero-dollar minimum payment for the first 12 months of repayment while the Department of Education covers your interest with the 100% unpaid interest subsidy which is a unique feature of SAVE.

For those in profile 1, you have the option of using SAVE until you pay your balance to zero or reach forgiveness after 25 years of qualifying payments. You also have the option to use SAVE for no more than 5 years, then switch to IBR 2014 to reach forgiveness at 20 years if you don’t pay your balance to zero before then. We’ll do another post on switching from SAVE to IBR 2014, but that is homework for a much later date. Focus first on filing your tax return and knowing your income-driven plan profile. Whether it makes sense for you to switch 5 years later or not, starting your repayment with SAVE will be most beneficial.

For anyone in profile 3, SAVE is your best available repayment option, particularly in the early years after graduation. SAVE has largely made IBR 2009 obsolete. There is no sensible reason for a new graduate to choose IBR 2009 over SAVE.

Expert Tip

SAVE is also the best repayment plan choice for anyone who is planning to reach Public Service Loan Forgiveness (PSLF). Even when you’re in profile 2, if you’re planning to work for a PSLF-qualifying employer, then forgo PAYE and choose SAVE.

1 FFEL = Federal Family Education Loan

2 HHS Poverty Guidelines: https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

3 AGI = Adjusted Gross Income, a specific measure from your tax return

Profile 2 is the trickiest. We call profile 2 The Pickle. When you’re in The Pickle, you’re only available 20-year income-driven forgiveness option is PAYE, the plan being phased out on July 1, 2024. The good news: the number of 2024 graduates who are in The Pickle is low. But we know you’re out there because we’ve seen your student aid files. Check your income-driven repayment eligibility.

To use PAYE as a 2024 graduate, you need to graduate before July 1, 2024 (most new veterinarians from U.S. schools graduate before then) and submit a Direct Consolidation Loan application soon after graduating, end your post-veterinary school student loan grace period early (select “do not delay processing” in your consolidation application), and select PAYE as your repayment option, ideally using your recently filed tax return as your income documentation – so you start with a zero, or near-zero dollar minimum payment.

The earlier you graduate in 2024, the easier it will be for those in The Pickle to get into PAYE. Many veterinary schools graduate students in May or June. It often takes time for your loans to officially enter their grace period status, especially if you have Health Professions Student Loans (HPSL) or Loans for Disadvantaged Students (LDS). Time is of the essence.

It shouldn’t take more than 30-60 days for your loans to officially enter their grace period after you graduate. Often, the status changes within days of graduation. Your Direct Unsubsidized, HPSL, and LDS loan types are the loans that must be in a grace period status to be eligible for consolidation. So, if you want a chance at using PAYE after graduation, you’ll have to start your consolidation application before July 1, 2024. Ideally, you’ll try to get your consolidation processed before July 1, 2024. A Direct Loan Consolidation application can take 30-60 days to process. Do the best you can given your graduation date.

If you can’t get your loans into PAYE before the July 1, 2024 phase-out, you still have access to SAVE. SAVE is a great repayment option, particularly in those early years when your tax return income will be relatively low, resulting in a lower monthly student loan payment. The lower your student loan payment, the more you’ll benefit from the SAVE unpaid interest subsidy. PAYE does not provide any unpaid interest subsidy. But SAVE requires you to be in repayment for five years longer if you’re on a path to reach forgiveness. Hence, The Pickle.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “2024 Graduating Veterinarians: Special Student Loan Timing Considerations”

Hi Tony,

Have you heard of issues consolidating the HPSL loans /adding them manually on the Direct Consolidation Application? Do you by any chance know the answer or how to work around this issue? Thank you!! Your posts and webinars have been incredibly helpful.

Hi Faye,

Thanks for your comment! We have heard of the issues with the electronic Direct Consolidation application for folks who are adding in HPSLs. The current work around is to either submit a paper consolidation application and include ALL of your loans in it, including your HPSLs. OR you can submit the electronic application for all of your loans other than the HPSL, then use the “Add Loans” paper application to add your HPSLs separately. Neither are great options, but they will get the job done until the Dept of ED can address that HPSL glitch in the electronic application. Good luck!