On the VIN and VIN Foundation Student Debt Message Boards and during recent Climbing Mt. Debt webinars, hundreds of questions have been asked and answered. One of the most frequent questions is, “Should I switch to the new Saving on a Valuable Education (SAVE) income-driven repayment plan?”

In most cases, the answer is yes, you should switch to SAVE. But there is a small group where the answer is not so straightforward. These are borrowers who are in The Pickle.

Are you in The Pickle?

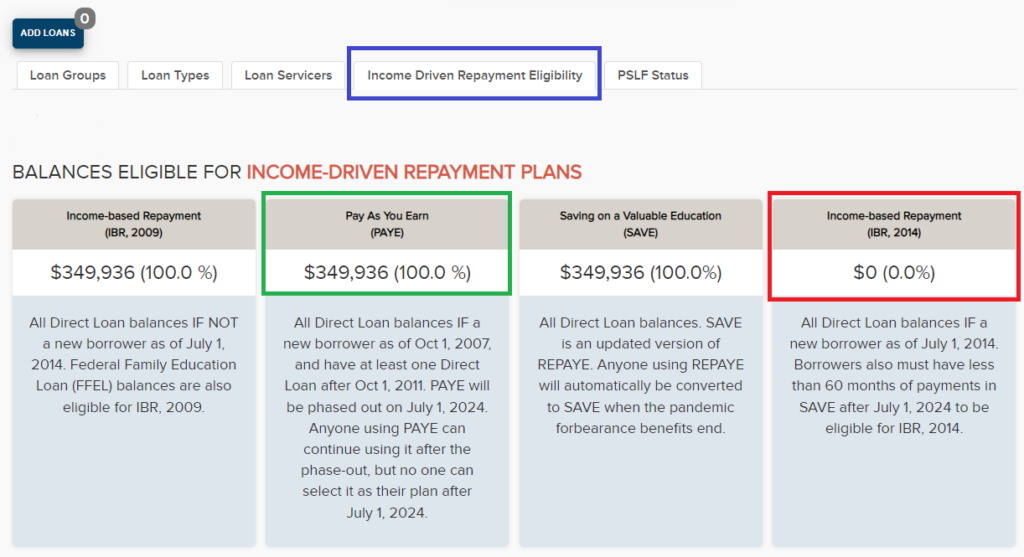

You are in The Pickle if you are eligible for PAYE but ineligible for the newest version of IBR (IBR 2014). All Direct Loans are eligible for SAVE.

Expert Tip

You might be in The Pickle if you graduated veterinary school after 2012 (when PAYE was introduced). Check your Income-Driven Repayment Plan eligibility in the VIN Foundation My Student Loans tool.

What makes you eligible for PAYE?

- The right loans: only federal Direct Loan balances are eligible for PAYE.

- The right timing: A) you were a new borrower as of October 1, 2007, and B) you received at least one Direct Loan after October 1, 2011.

For years, we have recommended PAYE as one of the best repayment options for eligible veterinarians. We still find veterinarians who are eligible for PAYE using a less beneficial repayment plan. And very soon, PAYE will be phased out on July 1, 2024. Anyone using PAYE can continue using it after the phase-out, but no one can select it as their plan after July 1, 2024. If you are eligible for PAYE and want to use it, make sure you’re in PAYE before July 1, 2024

If you’re not eligible for PAYE or IBR 2014, you are not in The Pickle, and you should be using SAVE or switching to SAVE the next time you are due to recertify your income and family information. SAVE has made the older version of IBR (IBR 2009) largely obsolete.

What is The Pickle?

Reaching forgiveness sooner is usually more beneficial than being in repayment longer. Both PAYE and IBR 2014 have 20-year forgiveness timelines. IBR 2009 and SAVE require 25 years of repayment to reach forgiveness for graduate school borrowers (i.e. veterinarians.) If you’re eligible for PAYE and not IBR 2014, then PAYE provides your only 20-year forgiveness option. But SAVE provides many new features that PAYE does not.

SAVE has the most beneficial Discretionary Income formula and will nearly always have the lowest monthly payment of any of the available income-driven repayment options. SAVE also has a very beneficial 100% unpaid interest subsidy; if the minimum monthly payment is less than your monthly interest, the Department of Education covers the unpaid portion of interest for you. When you use SAVE, you will no longer see your loan balance increase. Additionally, SAVE (unlike its predecessor REPAYE) allows you to exclude your spouse’s income from the payment calculation as long as you file your taxes separately from your spouse. The big drawback with SAVE is that 25 years of repayment time is required to reach forgiveness for anyone with graduate school federal student loans. Federal student loans used for veterinary school loans are graduate school loans.

PAYE does not have an unpaid interest subsidy; your loan balance can still grow while using PAYE. The minimum monthly payment using PAYE will nearly always be higher compared to your SAVE payment because of the different Discretionary Income formulas between PAYE and SAVE. But PAYE allows you to reach forgiveness sooner than you can using SAVE. Analyzing the cost profiles between the two does not always yield a clear winner. Hence, The Pickle.

Getting out of The Pickle

Generally speaking, if you anticipate any income decrease for any length of time for any reason, SAVE will work better for you.

If you have a student debt-to-income ratio that is 3 or higher, SAVE is probably your best repayment plan regardless of your other available options.

If you are working your way through internships, residencies, Ph.D. programs, or other advanced training pathways where your income is lower until you complete your training, SAVE will be your best repayment option.

And if you are working towards or anticipating Public Service Loan Forgiveness (PSLF), SAVE is also your best repayment option.

But if you have some repayment time logged (you’ll see your forgiveness count by July 1, 2024, as part of the ongoing account adjustment) and do not fall into one of the previously mentioned categories, PAYE might be your best repayment option.

From the cases we see on the student debt message boards, the best candidates to remain in or switch into PAYE before the July 1, 2024 phase-out are those with at least a few years in repayment AND those who have a dedicated forgiveness savings plan for the potential tax on student loan forgiveness already started.

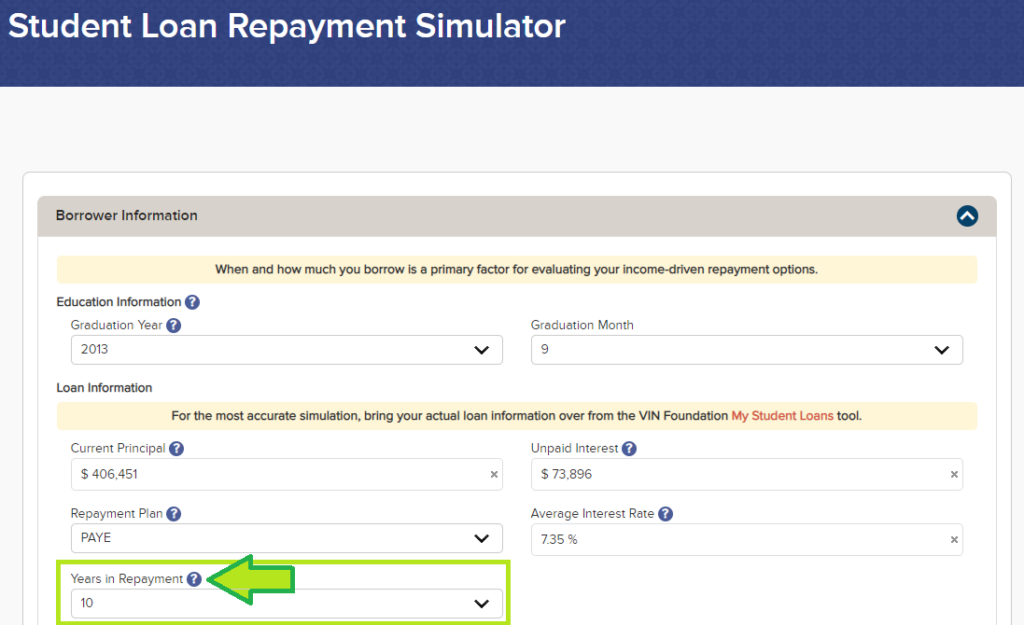

The devil is really in the details. Run your details (student debt, income, tax filing status, and family information) in the VIN Foundation Student Loan Repayment Simulator.

Expert Tip

Make sure you’re entering your repayment time in the Simulator. If you’re not sure what your repayment time is, subtract your veterinary school graduation year from the current year. Forgiveness time is extremely valuable. Not including it will give you nonsensical simulation results. During the special one-time forgiveness count adjustment, any repayment time (and certain deferment and forbearance time) is considered forgiveness-eligible. Even if you haven’t been using a forgiveness-eligible repayment plan, you might significantly benefit after receiving your forgiveness count. Learn more about the one-time forgiveness count adjustment.

What’s Most Important To You?

The PAYE phase-out is the worst part of the recent student loan changes. When discussing options with you on the Student Debt Message Board, we use the VIN Foundation Student Loan Repayment Simulator to numerically compare PAYE to SAVE and weigh what is most important to you to help you find your way out of The Pickle. Here are some guidelines:

- Prefer the lowest monthly payment possible? SAVE.

- Prefer to be done with repayment as soon as possible? PAYE.

- Prefer to see your loan balance stop growing? SAVE.

- Career or financial uncertainty? SAVE.

- Prefer to pay the least possible? Toss up. The outcome depends on many current and future variables.

Expert Tip

SAVE can look more costly long-term than PAYE in simulations because the additional 5 years in repayment are often at the highest projected income levels. Refine your income assumptions in the Income Information section of the Simulator to improve the accuracy of your results.

When in doubt, choose PAYE. You can always switch to SAVE later if you can benefit from SAVE more than PAYE. But after July 1, 2024, you can no longer get back into PAYE.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to studentdebt@vinfoundation.org.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.