Income-driven repayment renewal dates

One of the most common questions recently asked by veterinarians in student loan repayment using any of the income-driven repayment plans (IBR, PAYE, REPAYE – now SAVE, ICR) is “When do I need to provide my income information again? How do I know?”

As with many questions on federal student loans, the answer is “It depends…” Thankfully, there is guidance from the Department of Education (ED) on how to determine the answer for your student loans.

During the special pandemic forbearance period no one had to renew their income information for an income-driven repayment plan. During the early post-pandemic restart, there was a lot of confusion (mostly created by loan servicers) around recertification. As a result, ED extended recertification deadlines again. From ED, “The earliest you might have to update your income and family size for your IDR plan is September 2024.”

It’s time to perform a thorough student loan physical exam

We can help you refine your renewal date even further by looking at your federal student loan information more closely. VIN and VIN Foundation have done thousands of student loan physical exams for veterinarians and veterinary students.

A student loan physical exam entails analyzing the information contained in your federal student aid data file. The easiest way to make sense of the data in this file is to upload it into the VIN Foundation My Student Loans tool. If you’re not sure what any of that means, head over to the My Student Loans page and review the instructions (including video) on how to find and upload your federal student aid data file.

You can also look for this information on your loan servicer website. However, I would highly recommend double-checking whatever you find there with your results in the My Student Loans tool. To put it bluntly, I don’t trust anything federal loan servicers say on income-driven repayment without verifying it. They have earned a less-than-stellar reputation by screwing up any and all things income-driven repayment related.

It is amazing how many times we find inconsistencies between student aid data files and loan servicer information during the student loan physical exam. Like many of the conditions we deal with in veterinary medicine, more things are missed by not looking rather than not knowing. The good news is that you have a way to look! If you haven’t yet, it’s time for you to do a good student loan physical exam.

Income-Driven Repayment Renewal, aka Anniversary Date

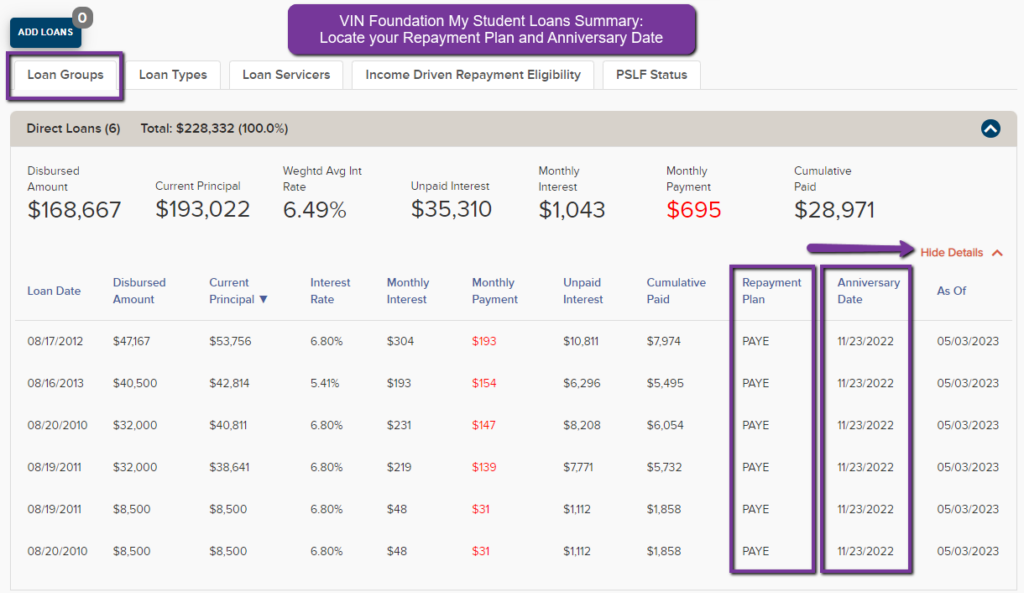

After you upload your student aid file to the My Student Loans tool, choose any of the “Loan” tabs, and click the “Show Details” text to expand the view of your loans. This will reveal an “Anniversary Date” column. Your income-driven repayment renewal/recertification window opens about 90 days before your Anniversary Date. You can expect to receive some notifications from your loan servicer within this 90 day window.

If your loans have been using an income-driven repayment plan, you will see a date listed. If your loans have not been using an income-driven repayment plan, you will not see a date listed in the Anniversary Date column.

Think of your Anniversary Date as your expiration date — the last day of your previous income-driven plan payment schedule. You need to provide income information before your Anniversary Date to prevent your payment from increasing to an amount resembling a fixed 10-year plan payment. The updated guidance requires you to provide income information at least 35 days before your Anniversary Date. Don’t flirt with that 35 day deadline. Since the loan servicers have been taking too long to do just about everything with federal student loans, plan to submit your information at least 60 days before your Anniversary Date. Even if you provide your recertification 60 or even 90 days before your Anniversary Date, your payment will not update until after your Anniversary Date.

What if I want to switch my repayment plan during my renewal?

Think of switching plans and recertifying your income as two separate events. In fact, there are different options for you to select if you are recertifying your income vs. switching repayment plans on StudentAid.gov/idr as show in the image below.

It might make sense for you to switch plans and you might be waiting to switch until you’re due to renew. Let’s consider a case where a recent graduate has a very low payment using PAYE but has decided SAVE will be a better plan for them. They want to keep the favorable PAYE payment for as long as possible, then switch to SAVE as their favorable PAYE payment expires. Switching repayment plans during your renewal period is a great time to switch plans. However, leave yourself enough time for your switch to process. If your application to switch is not processed before your Anniversary Date, then you could end up in forbearance with interest accruing or seeing one of those fixed 10-year plan payment statements issued.

Unlike renewing or recertifying your existing income-driven plan, your new payment schedule will start as soon as your application to switch is processed. Unfortunately, it’s impossible to say how long your application to switch will take given poor loan servicer performance as repayment has restarted.

You can try to make the most out of your time with a previously lower payment but don’t wait too long. Oftentimes, borrowers think they don’t need to renew until their Anniversary Date. Unfortunately, your Anniversary Date is your expiration date. You must provide income information before your Anniversary Date to continue having a payment that is calculated from your income.

What if my Anniversary Date shows a day in the past?

Add one year to that date. For example, if your Anniversary Date shows 5/12/2023, your new renewal date will be 5/12/2024. Since that falls into the recent extension window, you can assume your new Anniversary Date is at least November 1, 2024 if not May 2025. That means the minimum monthly payment currently listed in your student aid file.

The only exception to this would be if your current income would generate a payment that is less than what your income-driven repayment plan shows now. Or maybe you discovered you should be using a different income-driven plan (like SAVE) that would give you a lower monthly payment; in that case, you can apply now to have your minimum monthly payment adjusted downwards.

What if my Anniversary Date shows a date in 2021 or 2022?

Keep adding one year to that date until you get beyond six months after the pause ends. This date should be your next income-driven renewal date. For example, in the graphic above, we see an Anniversary Date of 11/23/2022. We add one year to get to 11/23/2023. Since this date falls in the six month period after the pause will end, we add another year bringing the updated renewal date to 11/23/2024.

Repayment began in October 2023. For those of you who add a year(s) to your Anniversary Date and land on a day in January or February 2024, add another year to it.

For example, let’s say you’ve added a year(s) to your Anniversary Date and it lands on February 10th, 2024. Your renewal date would get pushed out another year, to February 10th, 2025.

Why does your Anniversary Date matter?

In the hundreds of posts made in the student debt message board area during the pandemic forbearance period by veterinarians in repayment, most had very low minimum monthly payments when the pause started. Some recent graduates have had zero minimum payments since they have graduated. The longer your payments are low or zero, the higher the chance you will reach forgiveness, particularly under a 20 year forgiveness plan like PAYE or IBR 2014.

Also be aware of new regulations taking effect July 1, 2023, and the soon-to-expire one-time forgiveness count adjustment (last chance to benefit is 12/31/2023 4/30/2024 6/30/2024), and recent changes to the income-driven plans. These updates may significantly impact most borrowers. Get familiar with the changes and review their impacts on your loan repayment using the My Student Loans and Loan Repayment Simulator.

Even if your income has significantly increased since you obtained a low or zero payment, you should review your student loan details, run student loan simulations, and see if you’re still on track to reach forgiveness. If you are, great! Make sure you’re also planning for the potential tax on the forgiven balance. If you’re not projected to reach forgiveness, great! You can continue using your income-driven plan to set the minimum payment, and use your budget and other financial plans to see if it makes sense to accelerate your student loan payoff. All of that will depend on your current and anticipated family and financial circumstances.

The student debt-to-income ratio (DIR) is still a great guide. While changes to income-driven repayment will adjust some of the thresholds we’ve seen hold true for a while, a good indicator is still a DIR of one. If your taxable income does not exceed your income within a few years of graduation or after your advanced training, then you’re likely to benefit from student loan forgiveness.

More is missed by not looking than not knowing. It’s time to take a look.

And remember, we’re here to help:

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to studentdebt@vinfoundation.org.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

1 thought on “I have federal student loans. When do I need to recertify my income?”

My anniversary date is October 24,2023. So my new date would be October 24, 2024?