Interest rates for the student loans you might borrow for the 2018-19 veterinary school academic year have been set. As you may have anticipated, the rates are increasing.

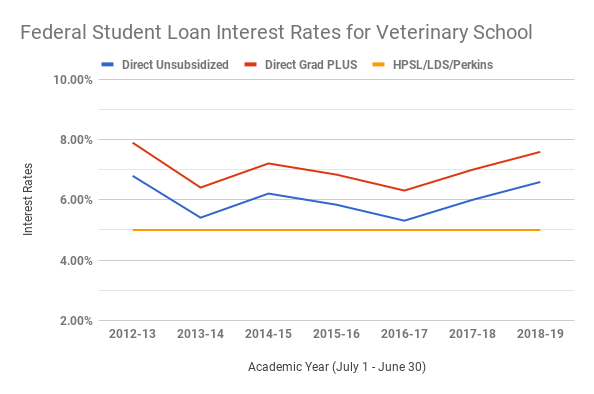

As a veterinary student, the federal student loans you borrow utilize the graduate/professional school interest rates. The Direct Unsubsidized loan interest rate will be 6.59%, up from 6% this past year. The Direct Graduate Plus loan rate will be 7.59%, up from 7% this past year. While the interest rates are updated each year based on the high yield of the May U.S. 10-year treasury note, your rate is fixed for the life of your loan.

The importance of COA

Increasing student loan interest rates make budgeting even more imperative, especially if you’re starting or continuing veterinary school this fall. Review your school’s published cost of attendance (COA) and look for areas you might be able to reduce your financial aid awards.

As a graduate student, you’re most likely eligible to borrow the full COA. You’ll need your budget to help you determine if you actually need to borrow the full COA. The COA is the maximum amount you can borrow. Your mission, if you choose to accept it, will be to accept less than the maximum COA.

The VIN Foundation Cost of Education Map uses COA to estimate a total estimated cost for each veterinary school.

Returning loans vs. paying interest

Regularly I hear from too many veterinary students who are paying the interest on their student loans while they are in school. I can’t help but ask where the money comes from to pay that interest? If you’re using this year’s financial aid award to pay interest on the amounts you borrowed last year at a lower interest rate, you’re losing ground. A better, less expensive plan would be to refuse or return loans that you received in excess of your budgeted need rather than accumulate and pay the interest on extra borrowed amounts. You have up to 120 days to reduce or return your financial aid awards. When you reduce or return student loans, the interest and fees are also returned. Your money goes much farther by not taking awarded amounts vs. paying the interest later.

Less expensive options

You can also look for ways to borrow less expensive loans. Health Professions Student Loans (HPSL) and Loans for Disadvantaged Students (LDS) are potential alternatives to Direct loans for veterinary school if they are available for your education program and if you are eligible to receive them. HPSL and LDS have an interest rate of 5% and they do not accumulate interest during school. They do, however, require you to provide your parents’ financial information in order to determine your eligibility. Check with your school financial aid office for more details on availability and the application process.

We’re here to help!

Happy budgeting this fall. An ounce of planning is worth a pound of interest saved in repayment. Please feel free to reach out with any questions. VIN Foundation is here to help with understanding your veterinary school borrowing and repayment options now or in the future!

Tony Bartels, DVM, MBA

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.