You’re running out of time to consolidate your loans

If you have federal student loans, you owe it to yourself to read this.

***NEW UPDATE: CONSOLIDATION DEADLINE EXTENDED TO APRIL JUNE 30, 2024***

Why? Because there are time sensitive options you might need to pursue to save yourself lots of time and money.

For over a decade it has been my (and a few colleagues’) honor and pleasure to inform and help colleagues navigate the student loan landscape through VIN and the VIN Foundation. Through the pandemic, while interest and payments were turned off, few seemed interested in their loans and the VIN and VIN Foundation student debt message board folder was relatively quiet.

But over the last year or two with all the recent changes impacting student loan repayment, the student debt message board folder has been extremely busy. Busy to the point our small team is not able to keep up with all the questions from veterinarian and veterinary student colleagues seeking personalized help with their student loan questions. We are working our way through the questions as efficiently as possible. But the good news is you don’t need to ask a question or wait for the response to your situation before benefiting from the Student Debt Message Board Folder.

The beauty of the Student Debt Message Board discussions, usually anonymously, is that the poster gets the answers they need, and their colleagues get to learn from the experience as well. There are thousands of student loan repayment “cases” you can learn from, and any veterinarian can have access.

Another benefit is with so many seeking help, we can see patterns in the problems and solutions.

With time running short on a few deadlines, specifically for the one-time forgiveness count adjustment, it feels imperative to alert all colleagues with federal student loans to be aware of a few common themes and challenges veterinarians are having in this complicated repayment landscape.

Three major trends we’re seeing you should be aware of:

- Consolidation procrastination – time is running out!

- Using the wrong repayment plan

- Incorrect minimum monthly payments (higher than necessary)

Consolidation procrastination - time is running out!

I am a card-carrying member of the procrastination club. However, recently, I find myself repeating the following phrase, “If it were my dog, I would be running to consolidate those loans…” Why run? Because 12/31/2023 4/30/2024 6/30/2024 is the last day you can submit a Direct Consolidation Loan application to benefit from the one-time forgiveness account adjustment. We have published a number of resources covering the adjustment:

- Infographic: Do you need help making sense of the forgiveness count adjustment?

- Blog: Got Federal Student Debt? You’re Now Closer to Forgiveness Than You Think

- Student Loan FAQs: The one-time forgiveness count adjustment

This is a complex topic that brings together federal student loan history and recent repayment benefits and changes, so I understand the hesitation and overall analysis paralysis around this issue.

Here are some guidelines to help you decide if a Direct Consolidation Loan before the end of this year is right for you:

- You upload your student aid data file into the VIN Foundation My Student Loans tool and you see an alert that reads, “You May Be Closer to Forgiveness Than you Think.” That alert is meant to inform you that you have Federal Family Education Loans (FFELs) in your portfolio. FFELs are an older loan type you could have if you used student loans anytime before July 1, 2010. If your FFELs make up at least 10% of your total portfolio, then you can benefit from a consolidation before the end of this year.

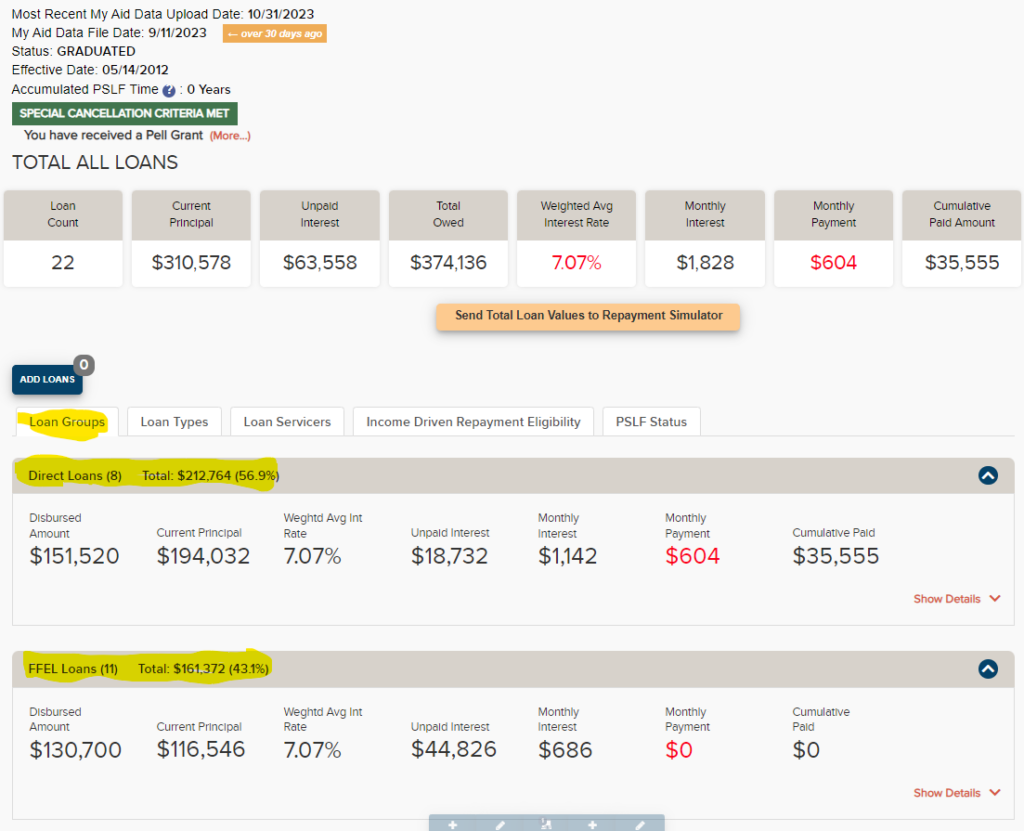

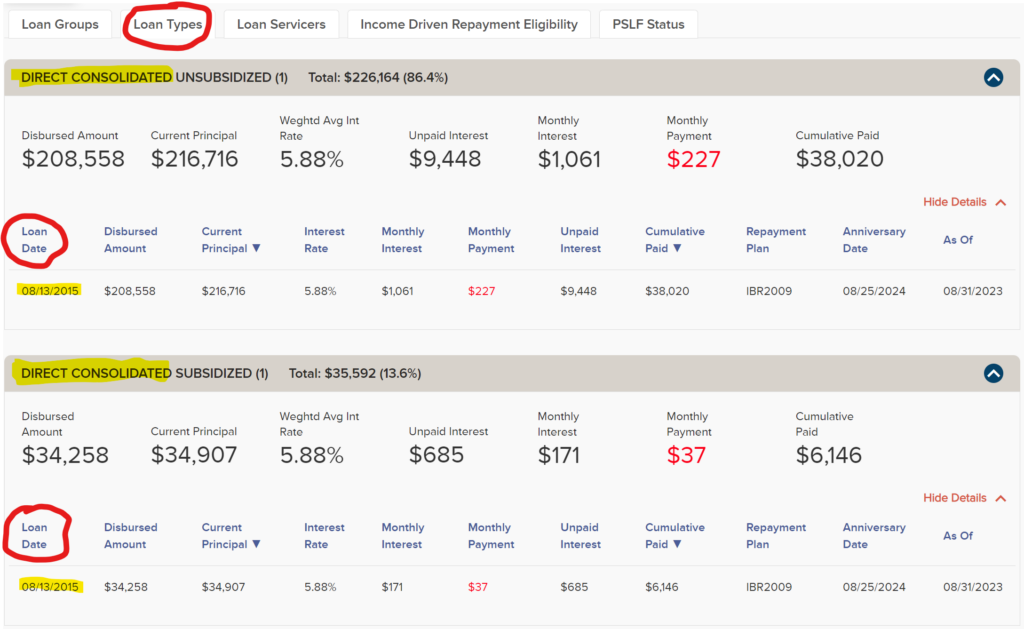

- You have FFELs and you are using Income-Based Repayment (IBR) across your loans. IBR is a really confusing repayment plan. Not only are there two different versions depending on when you started borrowing, but it’s also the only income-driven plan available for FFELs. When you leave IBR, any unpaid interest you have will capitalize. When you consolidate your loans, your unpaid interest will also capitalize. Anyone who is on the fence about consolidating and using IBR, consolidate. Since consolidation will happen no matter how you leave IBR (and you’ll all want to get out of IBR anyhow – see below), it’s better to consolidate and receive the count adjustment. Below is an example of a portfolio with 43% FFELs. This veterinarian should run to consolidate all their remaining loans:

- You have loans with a balance from before veterinary school that were in repayment before you started borrowing for veterinary school. Consolidating can help to increase your total forgiveness qualifying time. The loans with the greatest amount of repayment time in your Direct Consolidation Loan will set the forgiveness count for your consolidation loan — as long as you consolidate before the end of

2023AprilJune 2024. It can be hard to know exactly how much repayment time you have on your loans. In-school time does not count as repayment time. If you had a break of more than 12 months between degree programs, you probably have repayment time. In your My Student Loans summary, sort your loans by date and look for significant breaks in your loan dates. This will usually indicate repayment time. If you can gain a year or more of forgiveness time by consolidating, then do it. Added forgiveness time is extremely valuable. Below we see a loan portfolio with two separate breaks between borrowing, each with about 2 years between them. This could add up to four years of repayment time under the count adjustment as long as all loans are consolidated before the end of

2023AprilJune 2024.

- You have all Direct Loans and you’re using IBR. If you’re not sure if you will receive extra forgiveness time or not, and you’re likely to reach student loan forgiveness, then consolidate all of your remaining loans before the end of the year. Switching from IBR will capitalize your unpaid interest. So will consolidation. However, consolidating could add to your forgiveness time. If you can get extra forgiveness time, go for it.

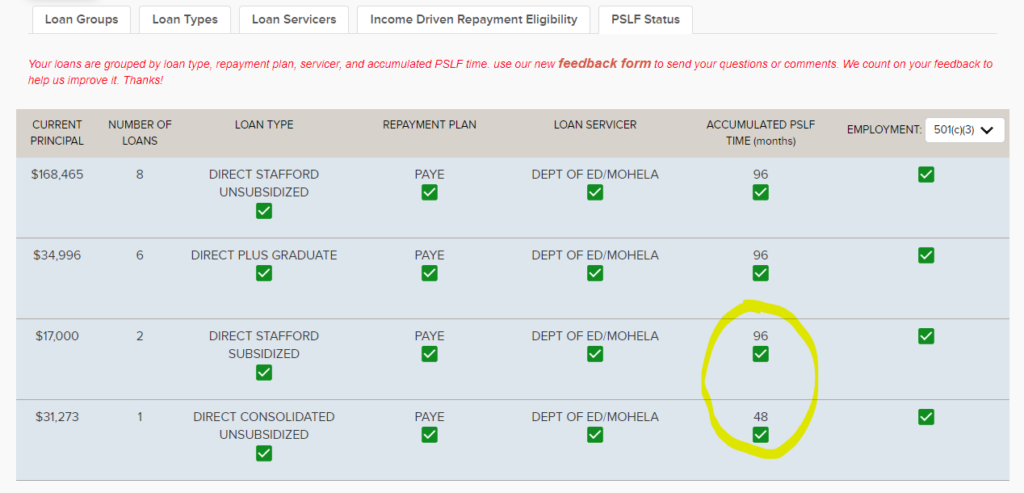

- You have Direct Loans with different amounts of PSLF time. This happens most frequently when veterinarians return to school after vet school, add more student loans, and have loans with different PSLF (or income-driven repayment forgiveness) clocks. Consolidating before the end of this year and resubmitting your PSLF employment certification for your oldest loans will give you the maximum PSLF qualifying time on your new consolidation loan. You can identify this in the VIN Foundation My Student Loans tool using the PSLF Status tab. The following veterinarian has some loans with less PSLF time than the rest. Consolidating before the end of the year can increase the PSLF count for the new consolidation loan to the maximum accumulated PSLF time:

- You have a significant amount of non-Direct Loans, like Health Professions Student Loans, Loans for Disadvantaged Students, or Perkins Loans and you’re likely to reach student loan forgiveness. You should consolidate before the end of this year.

Expert Tip

When you consolidate, the Department of Education will provide an estimated payoff date that doesn’t make sense. This is because the forgiveness count adjustment has not yet been applied. It will be adjusted by July September 1, 2024. And while your immediate income-driven payment should be correct, do not pay any attention to the future monthly payments and estimated total costs presented by the Dept of Education.

They do not allow you to change many of the variables that you can change in the VIN Foundation Student Loan Repayment Simulator, particularly your years in repayment. If you want a more accurate long-term projection, use the VIN Foundation Student Loan Repayment Simulator.

You do NOT need to consolidate if:

- All your loans are already fully consolidated into a Direct Consolidation Loan(s) with the same loan date. When your loans are fully consolidated, you’ll see only one or two loans remaining with the same loan dates that say “Direct Consolidation” in the name of the loan. This 2015 veterinarian has a fully consolidated Direct Loan portfolio:

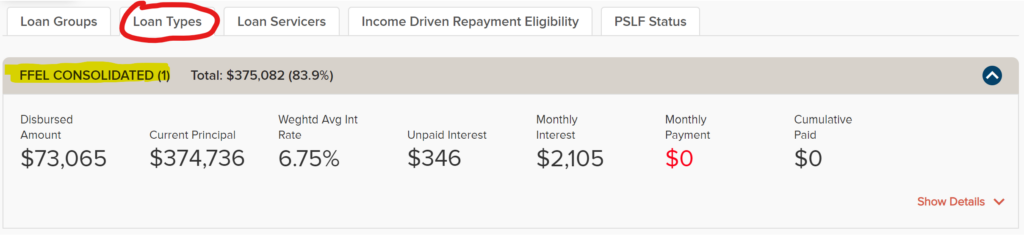

Make sure to differentiate FFEL consolidation loans from Direct Consolidation loans. The veterinarian below has FFEL Consolidated loans that can and should be consolidated again into a new Direct Consolidation Loan before the end of this year:

- You have all Direct Loans that have the same amount of repayment time using PAYE, SAVE (formerly REPAYE), or your loans have little or no unpaid interest. Check your repayment plan, monthly payment, renewal date, and look for your forgiveness count adjustment by

JulySeptember 1, 2024.

Using the wrong repayment plan

You can use any repayment plan or strategy you prefer. However, there are certain financial realities that come with your repayment plan selection. Ideally, you would choose the most financially beneficial repayment plan for your circumstances. With recent repayment plan changes, the most beneficial repayment recommendations have shifted:

- IBR 2009 is obsolete if the courts allow SAVE to continue. If so, you’ll want to switch away from IBR 2009 at some point. If you can get a lower payment using PAYE (if eligible) or SAVE right now, switch now. If you need to consolidate before you switch (see above), consolidate now and apply for PAYE or SAVE. If you have a very low (or zero) payment using IBR and you don’t need to consolidate, you can switch the next time you’re due to renew.

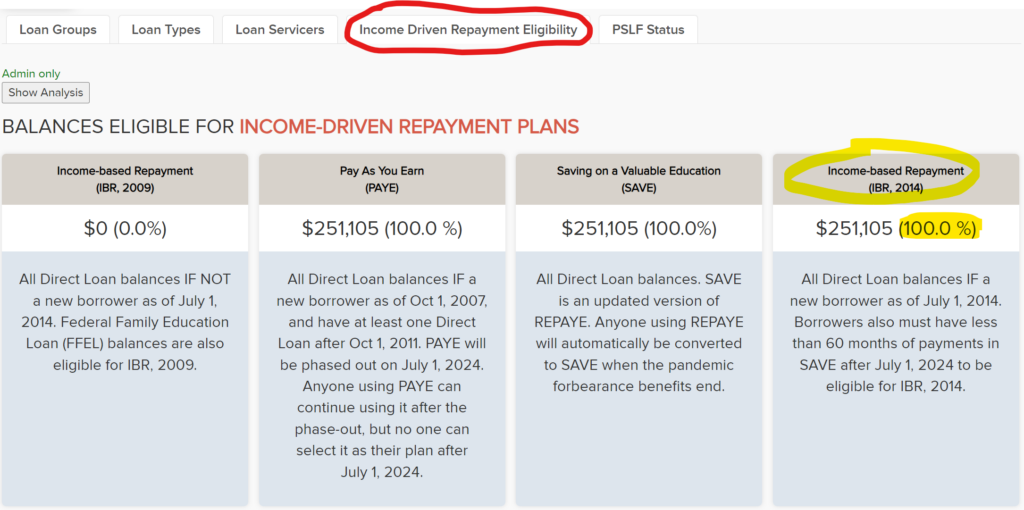

For many not-so-recent grads, IBR 2009 was the best option, particularly if married. The SAVE plan would allow you to separate your income from your spouse (just like IBR 2009) and it will calculate a much lower payment compared to IBR 2009. SAVE also provides a 100% unpaid interest subsidy. If you hated watching your loan balance grow with IBR, SAVE will stop that. - Using PAYE when you’re eligible for IBR 2014. These plans are nearly identical. However, it would be more financially beneficial to use SAVE for up to 5 years and switch to IBR 2014 to receive forgiveness at 20 years of repayment if it makes financial sense for you to do so. Check the Income-driven repayment eligibility tab in the My Student Loans tool to see if you’re eligible for IBR 2014. The following 2019 veterinarian is eligible for IBR 2014:

- Using IBR 2014 too soon. Many recent graduates are eligible for the new version of IBR (IBR 2014). Anyone who is eligible for IBR 2014 should get their loans into SAVE. Recent changes that created SAVE also put restrictions on switching to IBR 2014. You are allowed to use SAVE for up to 5 years (60 months) before you are no longer eligible to use IBR 2014. Why does that matter? SAVE provides a lower payment and a 100% unpaid interest subsidy but it requires 25 years to reach forgiveness vs. 20 years for IBR 2014. This gives you 5 years to benefit from SAVE then switch to IBR 2014 if you’d like to reach forgiveness sooner rather than later.

- Assuming PAYE is better than SAVE when you are not eligible for IBR 2014. This is the toughest analysis in this group. Many fall into what I’ve been calling The Pickle. While you would benefit from SAVE, switching away from PAYE means that you’re likely to lose your 20-year pathway to forgiveness.

As part of the changes that created SAVE, PAYE will be phased out. Anyone who is using PAYE on July 1, 2024 can continue to use it. However, anyone not using PAYE on July 1, 2024, will no longer have access to it, even if you were eligible before. This forces many veterinarians to reconcile paying less per month and sometimes less in total for 25 years vs. 20 years.Most veterinarians would prefer to be done with student loan repayment sooner rather than later. But it can be more financially advantageous to use SAVE for longer than PAYE for shorter. A mind bender, right? A good “physical exam” and student loan repayment simulations are needed to work your way through The Pickle. The VIN Foundation Student Debt Center can help. Look at your loan types, history, repayment plan(s), minimum monthly payments, and repayment plan eligibility. Compare the monthly payment amounts over time, the projected forgiveness tax, and projected total costs.

SAVE will generally reduce the projected tax on forgiveness. PAYE will have you reaching forgiveness sooner with a higher projected tax. If you already have a robust forgiveness savings plan, then sticking with PAYE can make sense. Sometimes the choice is obvious. Other times, not. If you need assistance, please reach out.

Expert Tip

For those using or eligible for PAYE and not eligible for IBR 2014, compare PAYE to SAVE closely. For years we have suggested that PAYE was the best repayment plan for most veterinarians who are eligible to use it. SAVE is a game changer. The lower monthly payment and 100% unpaid interest subsidy for SAVE is very helpful.

The biggest downside of SAVE is the 25-year forgiveness timeline for those with graduate school loans (i.e. veterinary school) compared to 20 years for PAYE. PAYE is going to be phased out on July 1, 2024. While you can always change to SAVE later if it makes sense for you to do so, after July 1, 2024, you will no longer be able to get back into PAYE if you leave it. The VIN Foundation Student Loan Repayment Simulator can help you decide which plan is best for you long-term.

Incorrect minimum monthly payments (higher than necessary)

The restart of student loan repayment has not been smooth. Loan servicers are making mistakes and the wait times to talk to someone are prohibitively long. Unfortunately, many of these mistakes are not in your favor. You must be an active participant in your loan repayment process. If you assume your loan servicer is doing things correctly for you, you’re going to get burned, and these mistakes can be expensive. Most of the mistakes we’re seeing are higher than required minimum monthly payments.

Anyone who was previously using REPAYE was automatically converted to SAVE prior to repayment resuming this October. Your SAVE payment should be lower than your payment was using REPAYE — the updated discretionary income equation for SAVE says so. SAVE will generate the lowest monthly payment of all the income-driven repayment plans (which is why it is worth a look).

Due to the pandemic forbearance benefits that paused interest and payments for more than three years, no one has been required to provide annual income renewal information. No one will be required to recertify their income information before March 2024. Some of you may even have a renewal date in 2025. However, a lot can happen in 3+ years. If you have income and/or family information that would result in a lower monthly payment than your loan servicer is showing now, then you can have your payment recalculated. You can always have your payment lowered using an income-driven plan, even if you’re not due to renew. However, if your income has increased, you can wait until you’re next due to renew for your payment to increase.

Expert Tip

Many of you worry your payments are too low since they were set during a time when your incomes were lower. Some of you then assume you will no longer reach forgiveness. However, please know many of you now have years of credit towards forgiveness as well. The pandemic forbearance benefits count towards forgiveness. Forgiveness time is extremely valuable.

The more forgiveness time you have, the more likely you are to reach forgiveness, particularly with plans like SAVE and PAYE. When you run simulations, make sure you’re accounting for the forgiveness time you have by entering the years you have been in repayment. That is the single biggest mistake I see people making when running VIN Foundation Student Loans Repayment Simulations. Don’t pay more than you have to for your student loans. There are much better things you can be doing with your money.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.