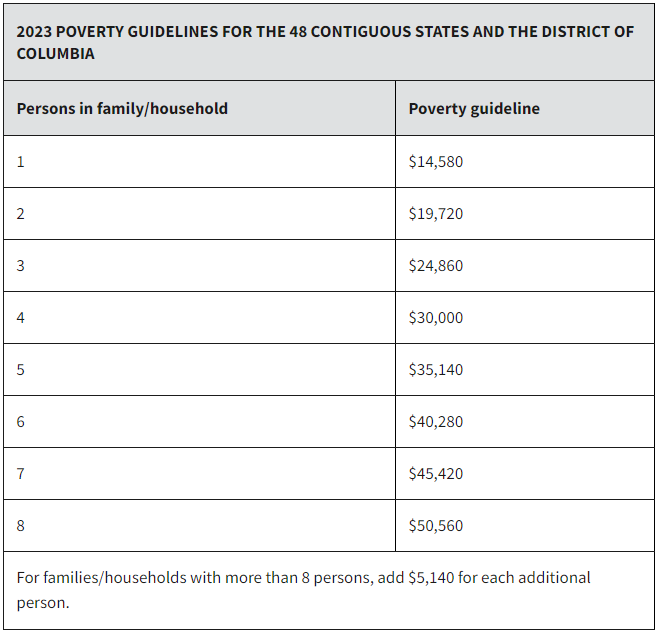

Each year in January, the U.S. Department of Health and Human Services (HHS) updates the federal poverty guidelines used to determine financial eligibility for certain programs. Your federal student loan monthly payments are impacted by these updates when you use an income-driven repayment plan. The VIN Foundation Student Loan Repayment Simulator is now using the recently updated 2023 poverty guidelines.

Income-driven repayment can be extremely beneficial for veterinarians, who routinely start their careers with a student debt balance exceeding their income. When choosing an income-driven repayment plan, your minimum monthly payment is calculated as a percentage of your discretionary income. The discretionary income formula protects a portion of your taxable income from your student loan payment. Different income-driven plans protect different amounts of your taxable income. For example, the discretionary income formula used by the Department of Education (ED) for Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised PAYE (REPAYE) repayment plans is:

Taxable income – 150% * HHS poverty guideline for your family size and state of residence

Let’s say you are a single veterinarian living and working in the lower 48 states and your Adjusted Gross Income (AGI) from your recent tax return is $100,370 for 2021. Your discretionary income would be $100,370 – 1.5*$14,580 = $78,500.

A percentage of your discretionary income will cover your minimum monthly student loan payment. For example, PAYE and REPAYE calculate your payment at 10% of your discretionary income. Our single veterinarian with a discretionary income of $78,500 would be required to pay 0.10*$78,500 = $7,850/year or $654/month for their student loans.

The poverty guidelines have increased between 7-8% from their levels in 2022 due to inflation. The higher the poverty guidelines, the lower the monthly student loan payment will be using an income-driven repayment plan (for the same level of income and family size).

Generally speaking, the higher your family size, the higher the poverty guideline, and the lower your monthly student loan payment will be using an income-driven repayment plan.

Coming soon:

Poverty guidelines in the VIN Foundation Student Loan Repayment Simulator are currently for the 48 contiguous states and the District of Columbia. We plan to include the higher poverty guidelines for Alaska and Hawaii residents later this year. Stay updated with Student Debt Center news to know when changes to the Student Debt Center tools go live!

In the meantime, residents of these Alaska and Hawaii can assume that their simulation results overestimate their total repayment costs for income-driven repayment plans.

Poverty Rates & Loan Repayment Simulations

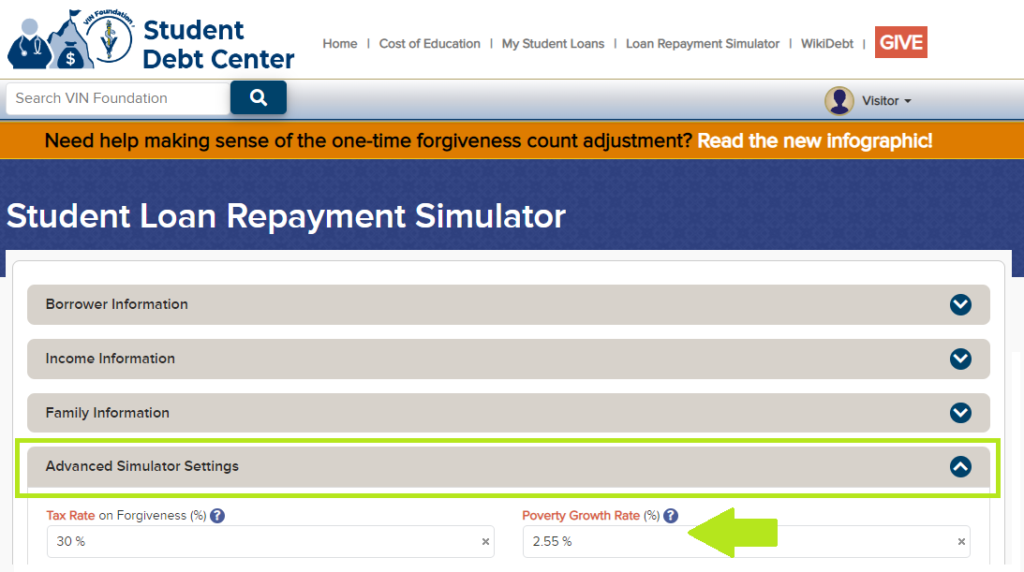

The poverty guidelines are updated in the VIN Foundation Student Loan Repayment Simulator shortly after they are released each year. The 2023 updates are now live in the simulator. Projecting future payments for income-driven plans requires annual adjustments to the poverty guidelines. You can change how the simulator increases the poverty guidelines going forward in the Advanced Simulation Settings section. The Poverty Growth Rate field has a default value of 2.55%, but you are welcome to change it to any growth rate you see fit. You might be asking, “why is the rate so low when inflation has been running much higher for the last couple of years?”

VIN Foundation Loan Repayment Simulator, Advanced Settings

While inflation has been higher than average lately, history tells us that it should eventually settle between 2-3%. For example, over the last 10 years poverty guideline increases have been averaging about 2.5%. However, in the last few years, that average rise has been around 4.6%. That means the short-term projections of the simulator may have you paying more than you actually do until inflation reaches historical averages. But over the long run, your simulations will be a good approximation of your total projected repayment costs, including any amount of tax forgiveness.

Changes to Income-Driven Repayment on the Horizon:

Newly proposed changes to REPAYE would allow for even more of your income to be protected from your monthly student loan payment. The 150% of HHS poverty guidelines calculation would increase to 225% of HHS poverty guidelines for the new REPAYE. Using the same taxable income as before this new discretionary income calculation would be:

$100,370 - 2.25*$14,580 = $67,565

If all of your student loans are from graduate school (e.g. veterinary school), your new REPAYE monthly payment would be 10% of the new discretionary income:

0.10*$67,565 = $6,757/year or $563/month, a roughly 14% decrease from current REPAYE, PAYE, or IBR 2014 monthly payments.

The VIN Foundation Student Loan Repayment Simulator will add the new version of REPAYE to the simulation outputs soon. Stay updated with Student Debt Center news to know when changes to the Student Debt Center tools go live!

In the meantime, use the VIN Foundation My Student Loans tool to determine if all your student loans are eligible for REPAYE.

What should you do now?

Start with a good “physical exam” of your student loans. Login to studentaid.gov. Make sure your contact information (name, address, email, phone number) is up to date. On your Dashboard, click the “View Details” button to get to the Aid Summary page. Look for the “Download My Aid Data” link in the upper right of the screen. Click that to retrieve a TXT file of your student loan borrowing history. Take that file over to the VIN Foundation My Student Loans tool and upload it.

Review your loan types, interest rates, amounts, and loan servicer information as well as your repayment plan and anniversary date if you are using an income-driven plan. You’ll be able to see your currently listed monthly student loan payment and whether or not you have made any payments during the special pandemic forbearance period. Also, check the Income-Driven Repayment Eligibility tab to compare your current plan to the plans you are eligible to use.

Did you know that you can request a refund of payments made during the pandemic forbearance period?

Time is running out to request a refund of any/all student loan payments you have made since the pandemic forbearance benefits began on March 13, 2020. If you’re not sure if you have made a payment during that time, check a recent student aid data file in the VIN Foundation My Student Loans tool.

If you have made any payments since 3/13/2020, request a refund from your loan servicer(s) before the forbearance benefits end.

Tax Filing Status, IDR Renwal Dates, & Monthly Payments

VIN Foundation receives a lot of questions from veterinarians and veterinary students about how income, tax filing status, and family size plays into a student loan repayment strategy. If you’re a veterinarian or veterinary student, you have access to the special student debt message board area where we provide student debt help to our colleagues.

During this tax-filing season and before the federal student loan pandemic forbearance benefit ends later this year, do a good “physical exam” of your student loans. The pandemic forbearance benefits began March 13, 2020 and will end either 60 days after a decision on the special one-time cancellation benefits is made or no later than 60 days after June 30, 2023, whichever comes first. The simulator is currently set to end the benefits on August 30, 2023.

How does your current monthly payment compare to what your payment would be with the updated poverty guidelines? If your taxable income has decreased or stayed the same over this past year, or if your family size has increased, then your discretionary income will be lower and your payment using an income-driven plan will also be lower. Depending on when you are due to recertify your income and family size, you may benefit from having your payment recalculated before the forbearance benefits expire. Run a student loan repayment simulation to see if you should update your repayment plan or have your payment lowered before interest and payments resume.

We’re here to help!

Please visit the Student Debt Help page or feel free to reach out with any questions: [email protected]. VIN Foundation is here to help with understanding your veterinary student loan borrowing and repayment questions now or in the future!