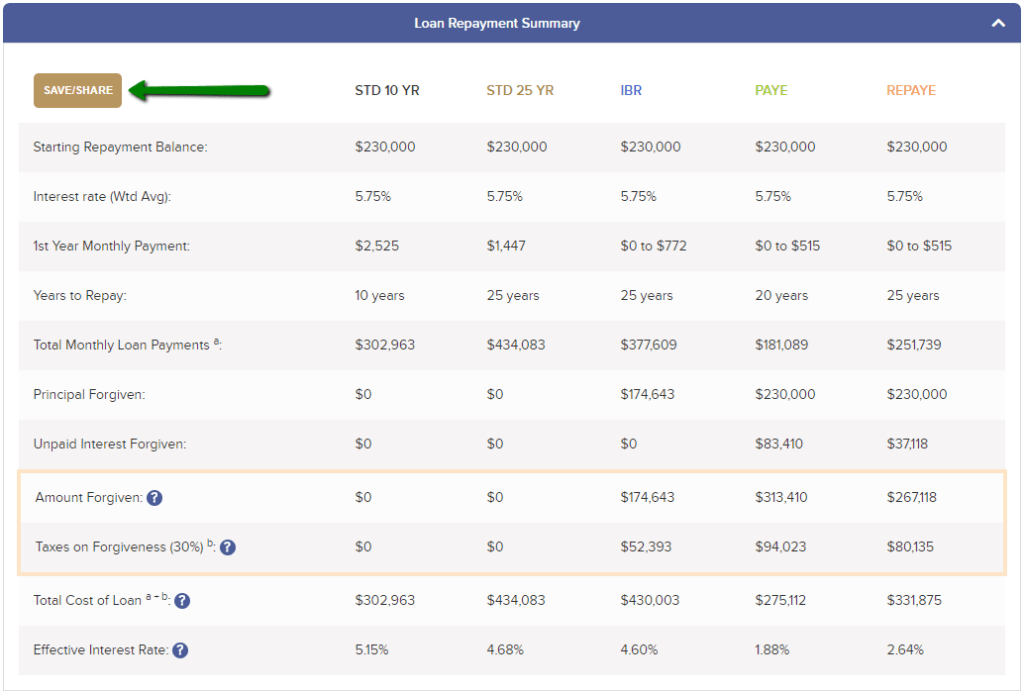

Student loan repayment is complicated. With the availability of income-driven repayment options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), confusion can set in quickly. The VIN Foundation Student Debt Center is here to help! The My Student Loans function and guides you through which repayment plans you can use and the Student Loan Repayment Simulator helps you figure out which plan you should use.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “Sharing Saves Time, Income-Driven Repayment Saves Money”

I’m still trying to figure out what I need to do before the end of the year. I have $84k in IBR (FFEL Consolidated), should I apply for consolidation?

Hi Megan,

Thanks for your comment! If you have only FFELs remaining in IBR, then you should consolidate into a Direct Consolidation Loan before the one-time forgiveness count period expires. Good news — the end of the year (2023) deadline has just been extended to April 30, 2024. As long as you consolidate before then, you can receive the maximum benefit under the one-time forgiveness account adjustment. I wouldn’t wait until the last minute. If you know you can benefit by consolidating, get that application submitted as soon as you can: https://studentaid.gov/loan-consolidation