Veterinary educational debt is a complex and continually evolving topic impacting all colleagues, not just current students and new graduates. A recent Merck Animal Health study named student debt as the biggest stressor reported by colleagues. That study also indicated that fewer veterinarians are recommending the profession as a career choice.

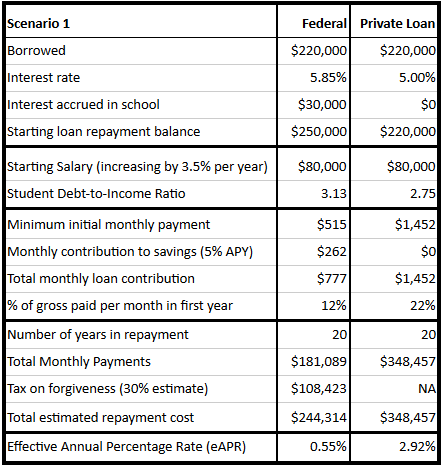

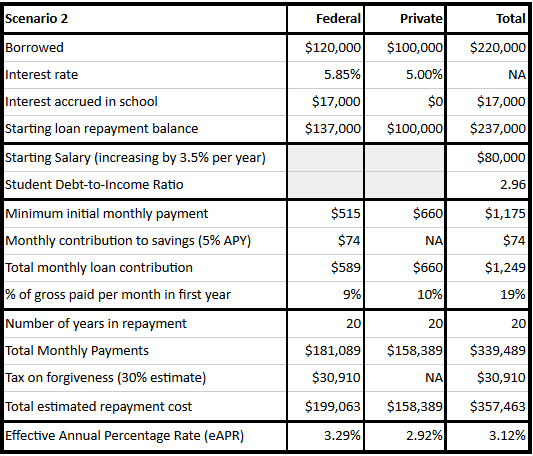

THE GOOD NEWS AND MAIN TAKEAWAY FOR VETERINARY BORROWERS IS STUDENT LOANS ARE ABOUT MORE THAN INTEREST RATES. FOR MOST, DESPITE HIGHER INTEREST RATES, STAYING IN THE FEDERAL STUDENT LOAN PROGRAM AND USING INCOME-DRIVEN REPAYMENT PLANS TO THEIR FULL BENEFIT WILL RESULT IN INCREASED FINANCIAL FLEXIBILITY AND A MUCH LOWER TOTAL REPAYMENT COST THAN THEY WOULD EXPERIENCE AT LOWER INTEREST RATES OUTSIDE THE FEDERAL STUDENT LOAN PROGRAM.

Lower interest rate private student loans will not “Fix the Debt” for veterinary medicine.

Is a lower interest rate worth a less flexible, higher risk, student loan?

FIRST, DO NO HARM.

Trading a low or no interest rate loan for less flexibility and higher costs after graduation is not helpful in the current veterinary economic landscape.

Yes, interest accumulation on Federal student loans during school is not helping this crisis. We should do all we can nationally to advocate that Congress return to an era where graduate/professional school loans are at least partially subsidized. In the meantime, as attractive as it might appear at first glance, leaving the Federal Student Loan system for less flexible loans at lower rates with fewer safeguards is not a financially sound solution for most. We need to get more creative to make a dent in the veterinary student loan crisis.

- Reducing the cost of becoming a veterinarian

- Increasing subsidies to educate veterinarians

- Increase the short and long-term earning profiles for veterinarians

LOWERING INTEREST RATES IN THE ERA OF INCOME-DRIVEN REPAYMENT DOES NOT DO ANY OF THE ABOVE FOR THE MAJORITY OF FUTURE AND RECENT GRADUATE VETERINARIANS. LET’S FOCUS OUR EFFORTS ELSEWHERE.

Paul D. Pion, DVM, DIPACVIM (Cardiology)

Dr. Pion, holds a B.S. and a D.V.M. from Cornell University. He is board certified as a Diplomate of the American College of Veterinary Internal Medicine. Dr. Pion interned at the Animal Medical Center, completed a residency in Cardiology at UC Davis, a post-doctorate in Pharmacology at Columbia University, and coursework and research toward his PhD at UC Davis. Dr. Pion founded Veterinary Information Network with Dr. Duncan Ferguson in 1991 after partnering with him on the Pet Care Forum on America Online in 1990. Dr. Pion has worked full-time at VIN since 1993 and is the Chief Executive Officer, President, and a director of VIN. Prior to that, he was a full-time instructor and researcher at the University of California, Davis where he also practiced veterinary medicine and was responsible for breakthrough veterinary medical research on heart disease in cats. Among many honors, Dr. Pion has received a Physician Scientist Award from the National Institutes of Health, a Ralston Purina Small Animal Research Award, a National Phi Zeta Award and a Special Recognition Award from the American Animal Hospital Association. Dr. Pion has published extensively, including a cover article for the journal Science announcing a finding that elucidated the cause, cure, and ultimate elimination of a common and fatal feline heart ailment via reformulation of commercial feline diets. Paul co-authored a book for cat owners, Cats for Dummies. He lives in Davis California with his wife, 2 sons, daughter, and numerous pets.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “Student Loan Interest Rates and Repayment — Don’t Listen to Your Parents!”

Hi VIN,

My daughter is considering majoring in veterinary internal medicine. I understand the costs of education and her options for federal aid. I see from your web site that the starting pay rate is between $70,000 and $80,000. Can point me to a site that will show the national statistics for veterinarians with 5 or more years of experience.

Regards,

Irving

Hi Irving,

Thanks for leaving a comment! Couple of points of clarification — There are some undergraduate programs in animal science or veterinary science that some folks major in prior to attending veterinary school, but there is no major in veterinary internal medicine that I am aware of. Folks who attend veterinary school (at least in the U.S.) receive a doctorate in veterinary medicine. Those graduates are usually considered to be general veterinary practitioners. Some veterinarians go on to specialize after veterinary school. One of those specialties is veterinary internal medicine. I am married to a veterinary internal medicine specialist, aka “veterinary internist.” I mention that because the salary profiles for a veterinary specialist and general practitioner are very different both post-program completion and five years out.

For more salary resources, I would point you to the American Veterinary Medical Association (AVMA). They have a couple of different salary calculators based on their frequent surveys of veterinarians: https://www.avma.org/ProfessionalDevelopment/Pages/salary-calculator.aspx and https://myvetlife.avma.org/new-veterinarian/your-financial-health/veterinary-salary-estimator. If you live near a college of veterinary medicine, their libraries usually have copies of the AVMA salary reports that you can review. You can also refer to the BLS data on veterinarians: https://www.bls.gov/ooh/healthcare/veterinarians.htm.

For veterinary specialist income, there’s unfortunately very little public data available on salaries. There was one recent study from the OVMA published in 2016 that sheds a bit of light on that information: 2016 Report on Compensation and Benefits for Specialist Veterinarians. I just can’t find a direct link to the report 🙂

I hope that helps!