It’s been a head-spinning start to 2025. Federal student loan repayment has not been spared any uncertainty. For the 2025 graduating class, getting started in student loan repayment is more complicated than ever.

Much of the student loan uncertainty centers around the available repayment options, application processing, and forgiveness for income-driven repayment (IDR) plans.

Even amidst IDR plan uncertainty, getting started with a plan like Pay As You Earn (PAYE) or Income-Based Repayment (IBR) is the best strategy for a new veterinarian. The IDR plans ensure that your minimum monthly payment is not a burden as you get used to your first position post-graduation.

However, timing, logistics, and recent changes have made the transition to repayment challenging, particularly when it comes to student loan consolidation. As we await guidance from the courts, Congress, and the Department of Education, here are strategies for Class of 2025 veterinarians to consider to improve their chances for repayment success:

File a 2024 federal tax return

First and foremost, file a 2024 tax return, whether you need to or not. You can still voluntarily file a tax return, even beyond the April 15th filing deadline, even if you don’t meet the $14,600 income requirement for filing. You can and should file a tax return even if your parents claim you as a dependent on their taxes.

It shouldn’t cost you anything but time to file a tax return before you graduate. The IRS provides a list of providers who can help you file your taxes for free.

Why file a tax return? As the name implies, IDR plans require income documentation to calculate your minimum monthly payment. The “gold standard” information for IDR applications is the Adjusted Gross Income (AGI) from a recently filed federal income tax return. No matter what you choose to do after graduation, or when you start doing it, a recent tax return makes applying for an IDR plan much easier.

Time for a good student loan "physical exam"

Second, do a good “physical exam” of your student loans. Go to studentaid.gov, log in, and download a student aid data file. This file contains nearly all of your federal student loan borrowing history. However, certain federal student loans are not found in your student aid file. If you have Health Professions Student Loans (HPSL) or Loans for Disadvantaged Students (LDS), you will find those separately in your school financial aid account. Once you find them, you can add them to the VIN Foundation My Student Loans tool with the “Add Loans” button after you upload your federal student aid file.

Your student loan history and loan types will help to determine your IDR profile using the My Student Loans tool and lead you through the consolidation conundrum.

While you do not have to choose an IDR plan, they are helpful for most new graduate veterinarians with student loans to get started in student loan repayment. Knowing how to use IDR plans to your advantage can buy you some time and help you to jump-start your overall financial wellness as you get started in your veterinary career. They also provide you with valuable forgiveness credit in case you need it later.

Expert Tip:

Student Loan Forgiveness Credit

Better to earn student loan forgiveness credit and not need it than to realize you could benefit later and not have it. You never know where your career or life may take you.

Nearly every new graduate veterinarian needs to start thinking about repaying their student loans.

There are three ways to enter repayment after graduation:

- Do nothing and have your loans enter a fixed (often referred to as “standard”) 10-year repayment plan after your grace period expires;

- Apply for a different repayment option as your student loan grace period(s) expire;

- Apply for a Direct Consolidation Loan and end your grace period early.

Federal Student Loan Grace Periods

Direct Unsubsidized Loans and Direct Grad PLUS loans both have a 6-month post-graduation grace period. While no payments are required during this grace period, interest will still accrue. While you can make voluntary payments during your grace period, you cannot earn forgiveness credit during your grace period. Direct Unsubsidized Loans and Direct Grad PLUS loans should enter their post-graduation grace period status shortly within the first two weeks after graduation. Contact your financial aid office if this isn’t reflected in your studentaid.gov dashboard.

Health Professions Student Loans (HPSL) and Loans for Disadvantaged Students (LDS) have a 12-month grace period. It can take 30-60 days for HPSL and LDS to officially enter their grace period after graduation. No interest accrues during the grace period for these loans. HPSL and LDS can also be deferred during advanced training (internships and/or residency training with no interest accrual). To make HPSL or LDS eligible for IDR or PSLF, you must add them to a federal Direct Consolidation Loan. If you do not consolidate HPSL or LDS, they will enter a fixed 10-year repayment plan after the grace period ends. There is no other repayment option available for HPSL or LDS.

Loans have only one grace period. If you have older loans from before veterinary school that have already used up their grace period and have previously been in repayment, they will re-enter repayment shortly after graduation.

The 2025 Consolidation Conundrum: Why Consider a Federal Direct Consolidation Loan?

Consolidating your loans, by definition, means replacing one or more loans with a single new loan. For federal student loans, applying for a federal Direct Consolidation Loan replaces some or all eligible federal student loans with a new loan, named a Direct Consolidation Loan. The resulting interest rate for the consolidation loan is a weighted average of all the loans included in the consolidation.

Expert Tip:

Direct Consolidation Pros & Cons

Direct Consolidation Loan Advantages:

- Can make more of your balance eligible for IDR or Public Service Loan Forgiveness (PSLF)

- Option to end your post-graduation grace period early

- Earn forgiveness credit sooner

- Get a lower minimum monthly payment

- Weighted average interest rate for all loans included in the calculation

- Option to choose the longest available time-driven repayment term (30 years vs. 25 years for unconsolidated balances)

- Simplify your loan portfolio: one balance, and one place to go

Direct Consolidation Loan Disadvantages:

- Unpaid interest capitalization (interest from school and the grace period will be added to your principal)

- Loss of forgiveness credit for loans that were previously in repayment

- Loss of interest-free deferment options for HPSLs, LDS, or Perkins loans

- Loss of the option to target different loans (by balance, by interest rate) in repayment

The big questions for 2025 are: A) Should you consolidate? And if so, B) When should you consolidate?

So, what makes 2025 so different?

- The end of pandemic era federal student loan benefits

- Recent student loan interest capitalization changes and the loss of IDR plans with unpaid interest subsidies (SAVE/REPAYE)

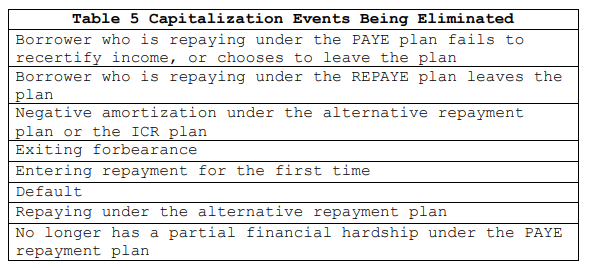

- Updated rules in 2022 eliminated the capitalization of unpaid interest for most federal student loan events:

“Entering repayment for the first time” is the most applicable to the new graduates’ consolidation conundrum. Before the elimination of this capitalization event, it didn’t matter if you consolidated or entered repayment without consolidation; your unpaid interest would capitalize, i.e., get added to your principal balance. Now, you choose between capitalizing your unpaid interest (consolidation) or forgoing unpaid interest capitalization (not consolidating).

Ideally, your unpaid interest would never capitalize. However, as previously stated, there are numerous advantages to consolidation in certain circumstances. All of them work best when the consolidation application is submitted as soon after graduation as possible.

Expert Tip:

Direct Consolidation nuts & bolts

- Application: https://studentaid.gov/loan-consolidation

- Direct Unsubsidized, HPSL, LDS must be in their grace period or repayment to be eligible for consolidation

- To end your student loan grace period early, you must select the “Do not delay processing” option in the application.

- The consolidation application allows you to select your repayment plan

- You have 180 days to add loans to a recently completed consolidation

Listen to the recent Veterinary Pulse Podcast on Student Loan Repayment:

Cases for a Direct Consolidation Loan

When does it make sense to consolidate and take the capitalization hit? It depends on your loan types, career plans, and likelihood of reaching student loan forgiveness. Two of those three require a crystal ball. While not an exhaustive list, the following are cases where applying for a Direct Consolidation Loan can be helpful for a new graduate veterinarian:

Consolidation Cases:

Starting a PhD, MPH, or direct-to-residency program shortly after graduation

Starting another academic program within 6 months of graduating from veterinary school is the most consequential circumstance for submitting a Direct Consolidation Loan after graduation. Commonly, these are PhD, MPH, or direct-to-residency programs at academic institutions. When you start another academic program (enrolled in school “at least half-time”) before your grace period expires, your loans automatically re-enter an in-school status and remain there until you complete that academic program.

Loans in an in-school deferment are not eligible for forgiveness. However, they accrue interest, sometimes for years, until you finish or leave the program and the grace period expires. To avoid extending repayment time and cost during these programs, use a Direct Consolidation Loan to end your grace period and apply for an IDR plan before you start the next program. Interest will still accrue, but you’ll be earning forgiveness credit for the low to zero payments made during your post-graduate program. You may even be able to earn some PSLF progress depending on the program. Once you get your loans into an IDR plan, submit a PSLF employment certification form to find out.

Consolidation Cases:

Starting an academic veterinary internship or other non-profit position shortly after graduation

All veterinary academic internships take place in 501c3 non-profit institutions. As long as you have your federal Direct Loans in a qualifying repayment plan during your internship, you should receive PSLF credit. The typical veterinary internship starts in June or July, shortly after most veterinary students graduate in May. New graduates’ student loans are normally in a grace period status when the internship starts. The only way to end the grace period early and start earning PSLF credit after you start your internship is to apply for a Direct Consolidation Loan as soon as your loans allow after graduation.

Expert Tip:

When consolidating, start the application as soon as your loans allow

Federal student loans are eligible for consolidation when they are in a grace period, repayment, or non-in-school deferment status. For new graduates, start your consolidation as soon as your Direct Unsubsidized Loans and/or HPSL/LDS loans officially enter their grace period. For Direct Unsubsidized Loans, that usually happens within 30 days of graduation. HPSLs can take longer, but shouldn’t be more than 60 days.

Consolidation Cases:

You have HPSL, LDS, or Perkins Loans, and you are likely to reach IDR forgiveness or PSLF

The classic consolidation example for a veterinarian is a new graduate with Direct Unsubsidized, Direct Grad PLUS, and Health Professions Student Loans. While Direct Unsubsidized and Grad PLUS loans are IDR and PSLF eligible, HPSLs are not. However, HSPLs are Direct Consolidation Loan eligible. Consolidating HPSLs will allow you to repay your entire loan balance with a single repayment plan AND make the entire balance forgiveness-eligible during repayment.

HPSL, LDS, and Perkins loans are not eligible for IDR or PSLF. They can only be repaid using a fixed 10-year payment plan. However, they are eligible to be included in a Direct Consolidation Loan. Once consolidated, the HPSL, LDS, or Perkins Loan balance will be eligible for IDR and PSLF.

Student debt-to-income ratio > 1 and you’re headed for PSLF? Consolidate your HPSL, LDS, or Perkins loans with your Direct Loans as soon as they reach their grace period so you can start earning PSLF credit as soon as possible.

Student debt-to-income ratio > 1, and you’re headed for IDR forgiveness? Consolidate your HPSL, LDS, or Perkins loans as soon as they reach their grace period so you can start earning IDR credit when your Direct Loans enter repayment. You may want to exclude your Direct Loans from your consolidation to avoid the unpaid interest capitalization on your Direct Loans. You can try timing your HPSL, LDS, or Perkins loan consolidation for around the time your Direct Loans finish their grace period. Example: If your Direct Loan grace period ends in November, submit your HPSL, LDS, or Perkins loan consolidation in September/October.

Student debt-to-income ratio < 1, or you’re otherwise confident you will not reach any student loan forgiveness? Do not consolidate your HPSL, LDS, or Perkins loans. Leave them as is and allow their longer grace periods with no interest accrual to play out. If you’re pursuing an internship or residency training, you can also defer HPSL, LDS, and Perkins Loans with no interest accrual for the duration of your training. If you have Direct Loans and HPSL/LDS/Perkins Loans, you will have separate payment accounts for them when they enter repayment. While any Direct Loans you have can use an IDR plan, your HPSL/LDS/Perkins Loans can only be repaid using a standard 10-year plan, often on a quarterly payment schedule. Make sure to keep track of your loans, loan servicers, and payment schedules for each loan.

Lost? Confused? We're here to help!

If you’re confused (it’s hard not to be right now), ask questions. Ignoring your student loans is never a good strategy.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options.

You can ask questions on the student debt message board or submit a Student Debt & Income “Signalment” form and we’ll create a new anonymous post to review your loans with you.

If you have questions on any of the available tools and options, reach out to [email protected].

We’re here to help!

Your support makes this information possible

Please support the VIN Foundation with a tax-deductible gift.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.