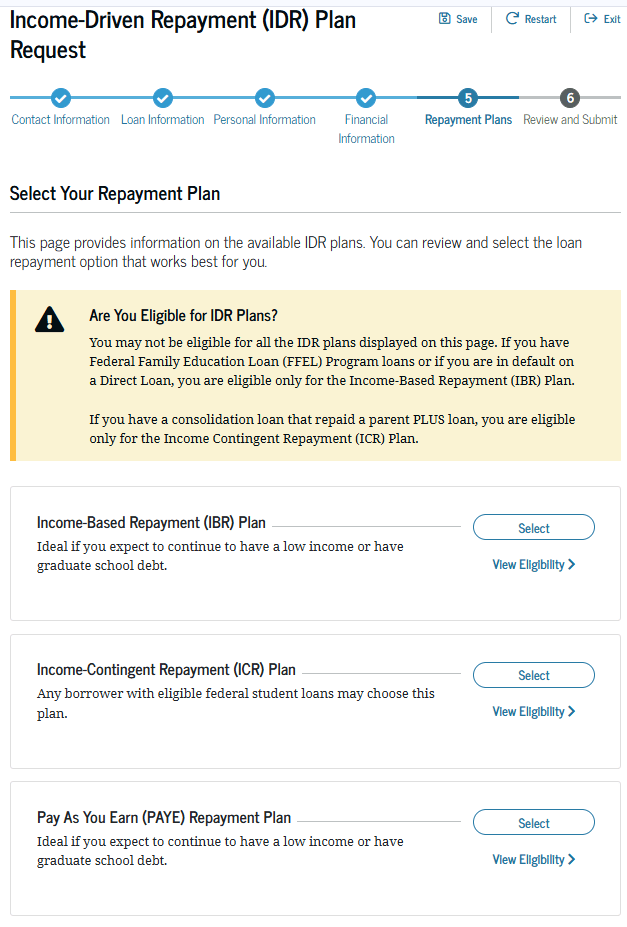

What IDR options are available in this latest update?

After a February ruling from the 8th Federal Circuit Court of Appeals, the Department of Education removed all Income-Driven Repayment (IDR) plan applications. Federal student loan servicers also paused processing of previously submitted applications. The temporary pause prevented all federal borrowers from applying for any IDR plan, recertifying their required income information for IDR plans, or in some cases, earning any IDR forgiveness or Public Service Loan Forgiveness (PSLF) credit.

About a month later, the IDR application is back. Borrowers are now able to submit an application for ICR, IBR, and PAYE repayment plans.

However, updated guidance provided by the Department of Education states, “Although the IDR application is now available, loan servicers are still updating their systems in accordance with the court’s actions. Servicers will begin processing applications in the near future. We will continue to update this page when new information becomes available, including when servicers resume processing IDR applications.”

Terrible Timing for IDR Uncertainty

Unfortunately, the recent IDR application pause corresponded with the earliest income recertification period for many borrowers using ICR, IBR, or PAYE. As we emerged from the pandemic forbearance benefits, the earliest IDR Anniversary Dates were February 2025. Your IDR Anniversary Date is the last day of your repayment schedule — the period of time your monthly payment is calculated from your income.

Anyone with February and March IDR Anniversary Dates has experienced the frustration of not being able to submit or see their IDR applications processed. When an IDR is not recertified (no matter the reason), the minimum monthly payment automatically updates to a fixed 10-year plan payment calculated from your balance on the date you started using an IDR.

For many veterinarians, this increases their minimum monthly student loan payment by multiples of their previous IDR payment, due one month after their Anniversary Date.

Expert Tip: How to find your IDR Anniversary Date

Upload a recent student aid data file into the VIN Foundation My Student Loans tool. Under any of the “Loan…” tabs, click the “Show Details” button. If your loans are enrolled in an IDR plan, then you’ll see data in the Anniversary Date column for your loans with a balance. If you have been uploading files regularly, then you may have a history of files to check your Anniversary Date over time.

Listen to the recent Veterinary Pulse Podcast on Student Loan Repayment:

IDR Recertification Relief for Some?

Along with the reactivation of IDR applications, ED provided guidance for borrowers who have been or will be trying to recertify their income.

Whether or not you need to act now depends on when you were due to recertify your income for your IDR, if and when you submitted an application, and the status of that application:

- If your IDR recertification application was recently processed appropriately, then you do not need to submit another application. Your IDR payment is set until you’re due to recertify your income next year. Check your IDR Anniversary Date to be sure.

- If you were required to provide updated income information on or before 2/20/2025 and submitted information that has not yet been processed, then your recertification date should be pushed out another year. There is nothing for you to do but confirm that your Anniversary Date is pushed into 2026.

- If you were due to update your income information before 2/20/2025 and your loan servicer recalculated your payment to a higher amount not calculated from your income, then you “must submit a recertification request as soon as possible,” according to the updated guidance. Start the electronic IDR application and have your income documentation ready. Follow up on your application until you see that it has been processed.

There is separate guidance for those who were required to recertify after 2/20/2025:

- Your recertification date should be extended another year.

- If your payment was already recalculated to a higher amount not based on your income, then you should see your payment revert to your previous monthly IDR payment amount and your recertification date pushed out another year. According to the updated guidance, “Loan servicers are actively working to move those affected borrowers back to the monthly payment amount based on their income and family size.” You may need to call your loan servicer to request a forbearance until they update your payment to the previous amount.

The recent guidance is very confusing. It is very difficult to know your past recertification deadline if it has passed or has already been updated. You may need to reach out to your loan servicer to check your loan status or see if they are expecting anything from you at this time. It’s also very difficult to know if what they tell you will match the guidance recently posted or which category you were or are in unless you have very good records for your student loans.

Managing IDR Uncertainty

Check your current student loan repayment plan, status, and minimum monthly payment for each loan. Grab a new copy of your federal student aid data file to upload into the VIN Foundation My Student Loans tool to see your repayment plan details and IDR Anniversary Date.

Math check your loan servicer using the monthly payment calculation details for your IDR plan. If your payment is higher than your income documentation supports for your IDR, then call your loan servicer. In most cases, loans in IDR should have a reasonable monthly payment that looks like what you’ve been paying recently, accurately reflects recent income information you provided in an IDR application submitted before 2/20/2025, and has an updated Anniversary Date showing a date in early 2026.

When all of that checks out, then you can stop worrying about your student loans…for now 🙂

You may even consider reactivating the autopay feature to receive a 0.25% interest rate discount. Previously, we had recommended deactivating autopay to prevent a higher-than-expected payment from being deducted from your account during the recertification uncertainty.

If you’re not seeing anything that matches the updated guidance for your student loans, then call your loan servicer. Confirm anything they tell you and keep at it until your loans match what you expect.

If you continue to have difficulty with your loan servicer, follow the casework tool provided by the Student Borrower Protection Center.

Thus far, it seems that any borrower using SAVE, PAYE, or ICR is no longer able to see their IDR forgiveness count. However, if you are using IBR, you should still be able to see your count on your studentaid.gov dashboard: “...only loans enrolled in the Income-Based Repayment (IBR) Plan that have accumulated enough time for forgiveness are eligible to be forgiven. The forgiveness information presented on this page is not applicable to you unless you are enrolled in the IBR Plan.”

**Anyone who is unable to see their IDR progress data will be unable to use the VIN Foundation Download My IDR Progress browser extension.**

If you can see your IDR payment history information while logged into studentaid.gov, then you can still download the details using the extension. You may also be able to see a summary of your IDR forgiveness progress via the studentaid.gov payment counter API. To access the API, log in to studentaid.gov, then open a new browser tab and go to https://studentaid.gov/app/api/nslds/payment-counter/summary.

Watch your student loans carefully

Other details to watch for in your student loan accounts (studentaid.gov and your loan servicer portal) include:

- Are you continuing to receive IDR forgiveness progress for ICR, PAYE, and IBR payments? Check your “IDR End of Payment Term” data in studentaid.gov. Grab a copy for your records using the VIN Foundation Download My IDR Progress browser extension.

- Are you continuing to receive PSLF progress for those working for an eligible employer? Check your “PSLF/TEPSLF Payment Progress” data in studentaid.gov. Submit a PSLF employment certification form if your count is lower than you expect.

- Has your unpaid interest been added to your principal balance (capitalized)? Monitor your principal and unpaid interest for unexpected changes. You should not see unpaid interest capitalization unless you’re moving from IBR 2009 or IBR 2014 to another repayment plan. With many payments changing and repayment plan requests being made, look closely for capitalization mistakes. When unpaid interest is capitalized, you pay more for your loans over time.

Have you grabbed a copy of your IDR progress?

V.1.0.8 Features:

- Download your IDR Forgiveness Payment History

- Automatically generates a CSV file for you to save to your device

- Automatically informs you when a new version of the extension is available

Lost? Confused? We're here to help!

If you’re confused (it’s hard not to be right now), ask questions. Ignoring your student loans is never a good strategy.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options.

You can ask questions on the student debt message board or submit a Student Debt & Income “Signalment” form and we’ll create a new anonymous post to review your loans with you.

If you have questions on any of the available tools and options, reach out to [email protected].

We’re here to help!

Your support makes this information possible

Please support the VIN Foundation with a tax-deductible gift.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

3 thoughts on “Application for Federal Income-Driven Repayment Plans Reactivated”

Thank you, Tony as always for the hard work and for helping veterinarians across the US!

What if I still have SAVE on my account? Should I apply for a different IDR? Before, it was saying I was going to transfer to standard repayment but now it’s back to SAVE. I can no longer tell what my next payments are going to be for some reason, only the very next one.

I also appear to have gotten very lucky with my IDR recertification, my last must have been December so no recertification until December 2026.

Hi Amber!

Thanks for posting your questions?

>>>What if I still have SAVE on my account?<<<

Believe it or not, that’s a good thing if you’re seeing SAVE listed on your account. It means your loans are in the interest-free general forbearance. That’s one of the best places your loans can be right now. While you aren’t receiving any forgiveness credit, your loans aren’t costing you antyhing either.

The SAVE general forbearance is scheduled to last, likely, through this summer. When we see some guidance on what happens next for folks in SAVE, then we can start thinking about moving to a different repayment plan.

>>>Should I apply for a different IDR?<<<

Not yet since you’re in the SAVE forbearance. However, you may want to explore your remaining IDR options. From an older student aid file I see for you in the My Student Loans tool, it looks like you’re in IDR profile 3. That means you could be headed to IBR 2009 once the SAVE forbearance ends if you’re sticking with an income-driven repayment plan.

>>>I also appear to have gotten very lucky with my IDR recertification, my last must have been December so no recertification until December 2026.<<<

Yes — as part of the recent pause in applications and the re-release of the updated IDR application, recertification dates were also pushed into the future. When I look at your older file, it shows Dec 2025 as the recertification date. It sounds like you’re seeing Dec 2026, which is great! Just know that SAVE and the general forbearance you’re in may not last that long, so you may need to do something before then.

We don’t have those details just yet, but stay tuned for more information on when you should act next…

And if you would like to dive deeper into your student loan details on the Student Debt Message Board area for veterinarians and veterinary students, please submit a secure Student Debt & Income “Signalment” form.

Sound like a plan?