Application for Federal Income-Driven Repayment Plans Reactivated

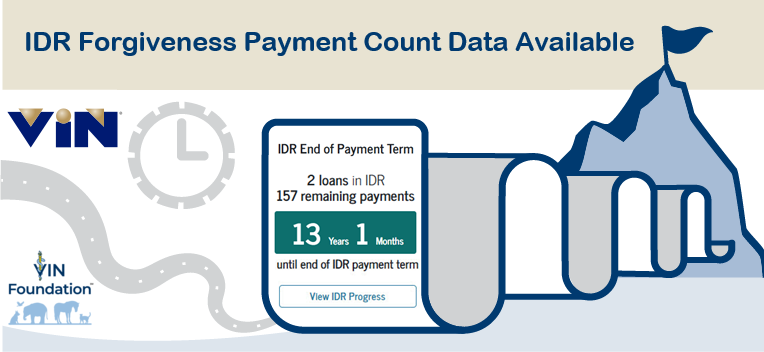

What IDR options are available in this latest update? After a February ruling from the 8th Federal Circuit Court of Appeals, the Department of Education removed all Income-Driven Repayment (IDR) plan applications. Federal student loan servicers also paused processing of previously submitted applications. The temporary pause prevented all federal borrowers from applying for any IDR […]

Application for Federal Income-Driven Repayment Plans Reactivated Read More »