Veterinary Students: Borrow Better

A Case Study Using the VIN Foundation In-School Loan Estimator

Student debt sucks. But for more than 80% of eligible U.S. students attending AVMA COE-accredited colleges of veterinary medicine, student loans are a necessary tool to achieve the dream of becoming a veterinarian.

For the 2024-2025 academic year, analyzing your borrowing is more important than ever. Why? Federal student loan interest rates for graduate school are the highest they have been in more than 20 years.

And why does that matter? Because, unlike many loans for undergraduate classes, nearly ALL of the loans you take for veterinary school start to accrue interest the moment you receive them.

It’s always easier to manage less student debt in repayment than more.

First years: The loans you take this year will be your most expensive loans because they have the most time to accrue interest before you graduate and enter repayment. Anything you can do to reduce the amounts you borrow early will help you with repayment later.

Second years: You now have a better idea of how much money you need to get through each semester. Can you use that experience to borrow less for this year?

Third and Fourth years: Borrowing gets a bit more complicated with clinics. Your tuition could be higher, your living expenses higher, and you may have interviews or externship visits planned. Build a good budget to know exactly how much you need to cover your expenses.

As we do with complex veterinary medical problems, let’s start with a case…

A first-year student at Colorado State’s (CSU) College of Veterinary Medicine is starting classes on August 12, 2024 as a resident of Colorado and requires student loans to meet her financial needs

What establishes how much you’re allowed to receive in student loans?

The school and your financial need, ie your student aid index from your Free Application for Federal Student Aid (FAFSA). As a veterinary student, you’re considered to be independent from your parents (regardless of how they claim you on their taxes). In nearly all cases, that means you’re eligible to receive student loans to cover the school’s Cost of Attendance (COA).

The COA for a Colorado resident attending CSU’s veterinary school is:

| Tuition & General Fees | $42,029 |

| Off-Campus Housing | $12,537 |

| Food | $4,248 |

| Transportation | $1,548 |

| Other Educational Costs | $1,746 |

| Books & Supplies | $1,680 |

| Health Insurance | $3,866 |

| Rabies Vaccine | $1,089 |

| Total | $68,743 |

Year 1 CSU COA Estimate:

As a baseline case, we’ll assume that you accept the Total COA provided by CSU for the 2024-2025 academic, $68,743.

When you attend veterinary school in the U.S., the first $40,500 of your financial need is covered by Direct Unsubsidized (DU) loans. The interest rate for DU graduate school loans received during the 2024-2025 academic year is 8.08%. That rate is fixed for the life of the loan.

Any financial need required above $40,500 can be filled by Direct Grad PLUS (DGP) loans up to the COA. Thus, your school’s COA sets your maximum borrowing limits. In this baseline, we need $28,243 more to reach the $68,743 COA. DGP loans have fixed interest rates one percentage point higher than DU loans or 9.08% for the 2024-2025 academic year.

Per CSU’s website for “Other Education Costs…If you borrow student loans, this amount will increase to account for any applicable loan fees.” DU and DGP loans have fees of 1.057% and 4.228%, respectively. The fees are added to your financial aid award, and then subtracted from the amount you receive when the funds are sent to you each semester.

DU award including loan fees $40,928

DGP award including loan fees $29,437

Year 1 Total loan amount $70,365

Total student loan disbursement for 2024-2025 academic year = $70,365. Half of that total will be disbursed in August 2024 ($35,182.50 first semester) and the other half in January 2024 ($35,182.50 second semester).

Interest accrues daily on DU and DGP loans when you receive them. Your first semester loans will accrue about 1,370 days-worth of interest, the average length of a four year veterinary program.

Borrowing for the second and third years at CSU will look similar. Each year, you’ll apply for financial aid and receive an award that aligns with the COA for each academic year. Chances are, your COA will increase each year. Over the last four years, the tuition and fees at CSU’s veterinary school have increased by an average of 1.9% per year. The estimates for non-tuition costs often increase each year too.

You have to pay the increased tuition and fees if you want to complete the program, but you might be able to adjust your budget so you’re able to reduce the amounts you need for the other costs.

When we build estimates using the In-School Loan Estimator, we often increase the tuition and fees but leave the other cost estimates the same for years 2 and 3. Your budget will help you decide whether or not you can do that. We can at least subtract out the Rabies Vaccine estimate since that is a one-time expense incurred in year 1.

Year 2 CSU COA Estimate:

- $42,828 (T&F with 1.9% increase)

- $25,625 (Other expenses, no increase, no rabies vaccine)

- Total COA = $68,453, not including loan fees

DU award including loan fees $40,928

DGP award including loan fees $29,135

Year 2 Total loan amount $70,063

Year 3 CSU COA Estimate:

- $43,642 (T&F with another 1.9% increase)

- $25,625 (Other expenses, no increase, no rabies vaccine)

- Total COA = $69,267, not including loan fees

DU award including loan fees $40,928

DGP award including loan fees $29,983

Year 3 Total loan amount $70,911

At CSU, Year 4 starts immediately after year 3 ends. There are three semesters: Summer, Fall, and Spring. The per credit hour charge at CSU is lower for 4th year than for the previous three years, but there are three semesters in the 4th year. For the final three semesters, we’ll estimate total tuition and fees of $44,129.

Since there is an extra semester, you will also be offered a higher living expense estimate. All of the other expenses in the COA outside of tuition and fees will increase to account for the extra time in school: $34,167. Your budget and post-graduation plans will help you decide how much of that you need to take. For this base case estimate, we’ll assume the full estimate is taken in student loans.

Year 4 CSU COA Estimate:

- $44,129 (4th-year T&F with another 1.9% increase at a lower per-credit hour rate)

- $34,167 (Other expenses, no increase but adjusted for extra summer semester, no rabies vaccine)

- Total COA = $78,296, not including loan fees

When you’re enrolled in school for twelve months vs. nine months, your DU loan limit also increases from $40,500 to $47,167.

DU award including loan fees $47,666

DGP award including loan fees $32,445

Year 4 Total loan amount $80,111

Since you start that semester in the summer and the summer semester is shorter, you will receive a smaller proportion of your loans in the summer semester (about 20%, $16,022), then receive the remainder split between Fall and Spring semesters (40% each, $32,044).

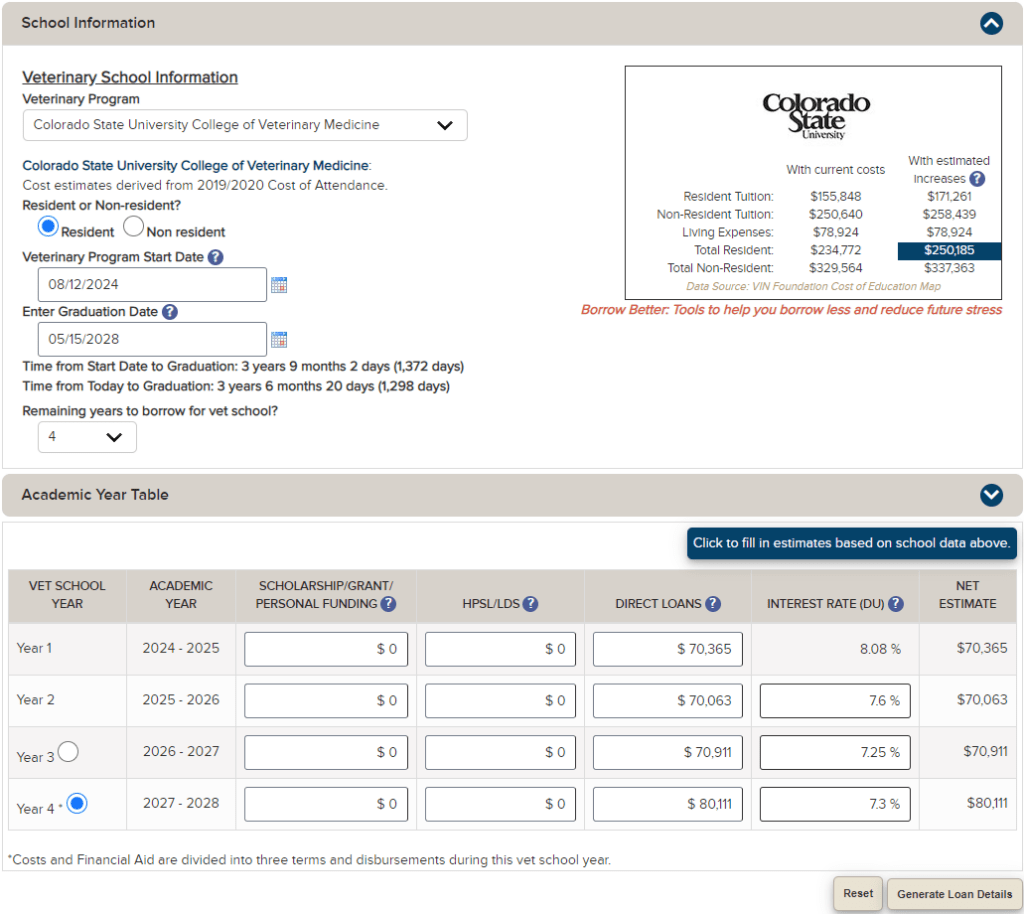

Now that we have all 4 years of estimated loan amounts, we head to the In-School Loan Estimator to enter the Direct Loan amounts per year and decide what interest rates to use for Years 2-4.

For Year 1 (2024-2025 academic year), we know the DU loan interest rate is set at 8.08% and the DGP rate is 9.08%. That is why you cannot edit that interest rate field for the current academic year in the Academic Year Table of the In-School Loan Estimator.

However, the interest rates for Years 2-4, have not been set yet.

The interest rates for Year 2 (2025-2026 academic year) will be set in May 2025 when the last 10-year treasury note auction is completed. The rate will be calculated from the high yield of the 10-year treasury on that last auction date before July 1st by adding 3.6 to the yield. Right now, the 10-year treasury yield is hovering around 4%. If it stays there through next May, the DU interest rates for the 2025-2026 academic year would be 7.6% (4.0%+3.6%). The DGP rate would be one percentage point higher at 8.6%. You don’t have to enter the DGP rate in the In-School Loan Estimator. It is automatically accounted for when you enter the interest rate for the DU loans.

It’s nearly impossible to predict future interest rates. That said, we do think it is reasonable to assume that the interest rates on student loans will be slightly lower next year compared to this year. Beyond next year, it’s anybody’s guess. In this base case, we assume another small decrease, then a slight increase for 4th year. Feel free to adjust the rates to anything you think is reasonable. Good news — the future always gets a bit more clear as you get closer to it 🙂

When you are done entering your loan amounts and interest rates, click the “Generate Loan Details” button. Behind the scenes, the In-School Loan Estimator will factor in all of your various loan disbursements with the appropriate loan limits and interest rates based on your entries. If you want to see the details, expand the “Loan Worksheet Detail” section.

In-School Loan Estimator CSU Base Case Result:

In this estimate, we project $291,450 borrowed with $48,117 of interest accrual by graduation for a base case total balance of $339,567 at a weighted average interest rate of 7.97%.

After running any In-School Loan Estimation, click the “Save/Share” button to get a link to your estimation. If you have any questions, include your Estimation link so we can review it with you. Here is the link for the base case example we have run: In-School Loan Estimator CSU Base Case Link

Now that we have a base case, we can make a few variations and work in some aspirations in our next post…

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.