— UPDATE, April 30, 2020 —

Climbing Mt. Debt — Student Loan Triage in the Age of COVID-19 Webinar Recording Available

— UPDATE, April 12, 2020 —

Stay tuned, stay safe, stay healthy — federal student loan relief is here!

— UPDATE, April 2, 2020 —

The big news — you don’t need to do anything! Your interest rates on federally owned student loans will be automatically set to 0% as of March 13, 2020 and payments suspended through at least September 30, 2020. Federally owned loans include:

If your interest rate has not yet been set to zero or your payments have not yet been suspended, give your loan servicers time to update their systems. Even if you have autopay setup with your loan servicer(s), your payments will be suspended. Any payments made since March 13, 2020 can be refunded to you. The payment refunds are not automatic — you would have to request a payment refund from your loan servicer.

You can choose to continue making payments to your student loans during the suspension. Per usual, any payments made to your student loans first go towards unpaid interest prior to March 13, 2020. If you have no unpaid interest, then your payments will go towards the principal. Make sure that it makes financial sense for you to make payments during this time. The reason we have received this student loan payment and interest suspension is because we are navigating uncertain times. If you anticipate any interruption to your income, you’ll want to have those funds that may have otherwise gone to student loan payments.

If you’re currently using an income-driven repayment plan:

For those using income-driven repayment, paying the minimum and planning for the forgiveness, the CARES Act changes are a huge financial benefit for your and your student loans.

You do not need to request a suspension or forbearance to receive the CARES Act benefits. They will be applied automatically to federally held student loans. The Department of Education has been quite careless in their interchanging forbearance and suspension. The CARES Act describes this special interest and payment waiver period as a “suspension.” However, your loan servicers are showing this as a forbearance. Usually, forbearance can have some negative consequences for your repayment plans, like the capitalization of unpaid interest and not counting the time towards forgiveness. However, this suspension is a special type of forbearance that will count towards forgiveness and not result in the capitalization of interest if you were using an income-driven repayment plan prior to the suspension period beginning.

If you have experienced a drop in your income during this pandemic, there is no need to request a forbearance for your student loans. If they are already federally held, then your payments and interest will be suspended automatically. If you had an automatic payment triggered or made a manual payment since March 13th, 2020, you can request that your loan servicer refund that payment to you.

If you have experienced a decrease in your income, you can also apply to have your payment reduced using an income-driven repayment plan. That will assure that your payment is lower or zero when the suspension period ends.

— UPDATE, March 27, 2020 —

Today, the House passed and the President signed the “CARES Act.” Within this $2.2 trillion package likes a relatively small but extremely beneficial provision titled “Temporary relief for federal student loan borrowers.”

Anyone with federally held Direct or Federal Family Education Loans will automatically receive a suspension of payments due through September 30, 2020.

During the suspension, there will be NO accrual of interest. This provision is in addition to the previous student loan interest waiver that took effect March 13, 2020.

There will be no negative reporting to consumer reporting agencies during the suspension and your federal held loans will be considered in good standing.

Within the next 15 days, you will receive notice from your loan servicer of federal held student loans regarding the payment suspension and interest waiver. You have the option to continue making payments during the suspension period. Any payments would first be applied to existing unpaid interest, outstanding fees, then principal.

Whether or not you should continue to make payments during this suspension will depend on the specifics of your circumstances. For example, if you are using income-driven repayment and planning for forgiveness, it doesn’t make a lot of sense to make payments during this suspension — enjoy the break in payments and use your extra funds to weather the economic impacts of the pandemic.

However, if you are using a standard or extended repayment plan and your situation allows you to make payments during the suspension, you’ll make a dent in your principal and reduce the time and interest cost for the duration of repayment.

— UPDATE, March 23, 2020 —

Let’s dive right in on one of the most pressing financial topics for our veterinary colleagues with student debt during the uncertainty around the COVID-19 pandemic. On Friday, March 13th, 2020 President Trump announced he was waiving the interest on student loans in the midst of the coronavirus crisis. On Friday, March 20, 2020, the Department of Education released a statement regarding changes to federally held student loans, including an eligible suspension of student loan payments and automatic student loan interest waiver:

But what does that mean for your student loans?

Well, (as always) it depends 🙂

Let’s look at a couple of provisions in this press release:

The interest rates for federally owned student loans will be set to zero percent for at least 60 days starting March 13, 2020. You do not have to request the interest rate waiver; it will be automatically applied retroactively to March 13, 2020. For example, my Direct Loan interest rates will be set to a 0% interest rate but my FFELs will not because they are owned by Navient.

The only thing that changes about your federally held student loans during this time is the interest rate. Any payments you make during that time will first go towards any interest balance you had prior to March 13, 2020, then principal.

They only thing new here is that the Department of Education is offering at least a two-month administrative forbearance for your federally held student loans. This discretionary forbearance would take your payment to zero for those two months and no interest would accrue on your loans for those two months. With an administrative forbearance, you do not have to pay the interest that accrues when that forbearance ends. But in this case, no interest accrued. However, it’s unclear whether or not unpaid interest from before March 13, 2020, would get capitalized after the administrative forbearance period.

Forbearance, even the administrative forbearance period mention in this special case, does NOT count towards income-driven repayment forgiveness nor public service loan forgiveness.

I do not recommend using this administrative forbearance. If your income has or will decrease, then apply to have your payment reduced using an income-driven repayment plan. If you have zero taxable income, then your payment can be zero but you will still receive credit towards forgiveness and you’ll make certain that your unpaid interest is not capitalized when your income goes up in the future.

No matter the repayment plan you’re currently using, continue making at least the minimum monthly payment due as long as your finances allow for it. Better yet, make sure you’re using autopay for your minimum monthly payment. You’ll receive a 0.25% interest rate discount on your Direct Loans and you ensure that your payments are made on-time and your loans remain in good status.

When renewing your income-driven repayment plan during this turbulent period of uncertainly, leave yourself and your loan servicer ample time to process your documentation; especially when you’re sending income documentation to your loan servicer.

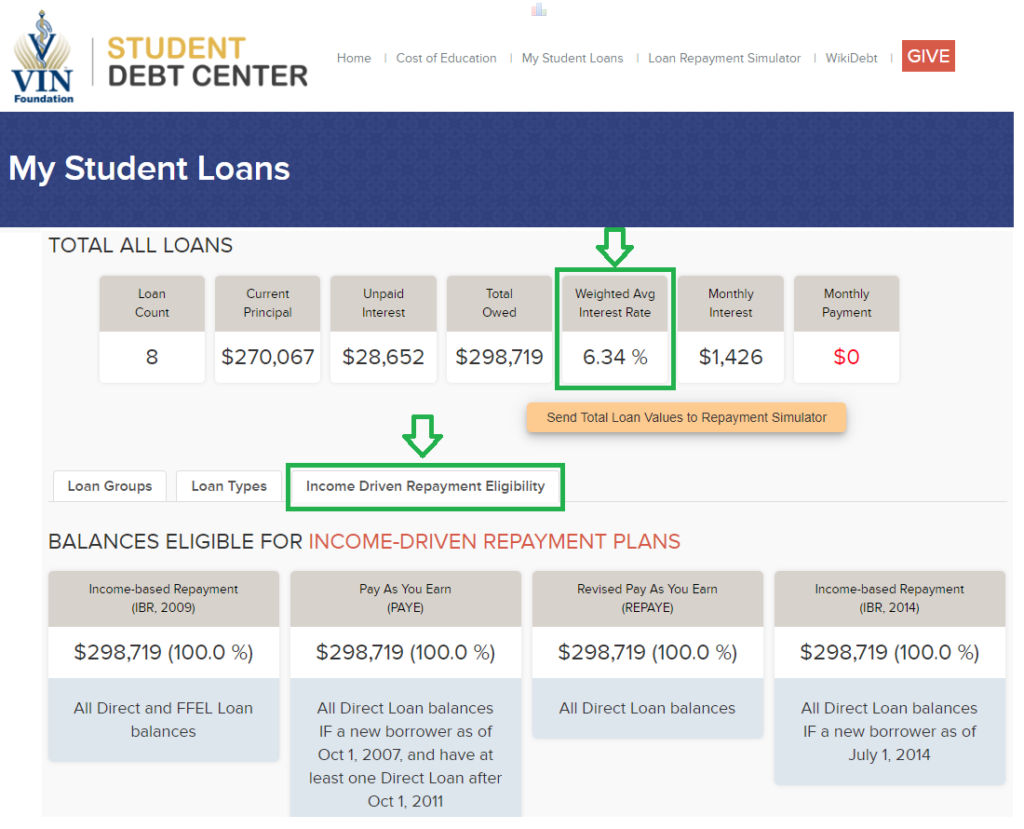

If you experience a decrease in income during this time, then apply to have your student loan payment reduced under an income-driven repayment plan. AVOID Deferment/Forbearance! I have seen a lot of articles related to student loans talk about utilizing deferment or forbearance if you’re no longer working. Even the Department of Education is recommending it with this special administrative forberance. Deferment and Forbearance are obsolete when you are eligible to use income-driven repayment options like IBR, PAYE or REPAYE.

Deferment and forbearance are detrimental because they pause the clock ticking towards forgiveness and when your deferment or forbearance ends, any unpaid interest balance you have will be capitalized, ie) added to your principal balance. The higher your principal balance, the more interest you will accrue long-term and the more you will pay. Even when the Department of Education waives interest temporarily, if you were to use a deferment or forbearance, any existing unpaid interest balance prior to the waiver could be added to your principal when the deferment or forbearance period ends. Instead, continue in your income-driven repayment plan or apply to use one — you’ll pay much less over time, you’ll be in repayment for a shorter period of time, and still receive the benefit of a low or reduce payment based on your financial situation.

— UPDATE, April 2, 2020 —

Since the passage of the CARES Act last week, many of the loan servicers are working to implement the new law. I have seen my interest rate change to zero percent for loans with Great Lakes and the interest rate for my wife’s loans with Navient change to zero percent. Some loan servicers state that it may take up to four weeks for the zero interest rate changes and payment suspensions to be reflected. However, all changes when made will be retroactive to March 13, 2020.

Stay tuned, stay safe and stay healthy.

2 thoughts on “COVID-19 Impact to Your Student Loans”

Pingback: The CARES Act: What Veterinarians Need to Know from a Personal Finance Perspective - Richer Life DVM

Thank you for sharing your ideas! There are, however, some pitfalls when it comes to clinic.

Once I was a college student, I wondered how one should tackle this

issue but I would constantly encounter some funny answers:

go google it or even ask a friend. What if my friends do not have sufficient knowledge or

expertise to assist me? What if I googled it several times and couldn’t locate the

answer? That’s when posts such as this one can give appropriate advice on the problem.