Paying back a veterinary school student debt load can be extremely stressful and confusing, particularly when we continue to see updates and changes to existing loan repayment programs.

In the last few years we’ve seen the pandemic forbearance, a special one-time forgiveness count adjustment, and a limited waiver (now expired) helping more borrowers reach Public Service Loan Forgiveness (PSLF).

Analyzing the various federal repayment options, programs, and changes then choosing the best pathway for your situation is challenging to say the least. Helping veterinary students, veterinarians, and those who work with them navigate their student loans and repayment options for more than 10 years, we’ve seen student loan forgiveness and the debates around it cause significant confusion. First, make sure you understand the differences between Public Service Loan Forgiveness (PSLF) and the potentially taxable forgiveness available with federal income-driven repayment (IDR) plans. While there is some overlap between the two programs, PSLF is different from IDR.

Many borrowers believe the student loan forgiveness is only open to those working for a non-profit. Anyone with federal student loans can be eligible for forgiveness, regardless of who they work for. PSLF does require you to work for certain non-profit employers, but you can still receive student loan forgiveness even if you never work or worked for a non-profit employer. Income-driven repayment plans result in student loan forgiveness if you reach the maximum repayment period for a specific plan and still have a balance.

Make sure you know the differences between PSLF and IDR forgiveness and whether or not you might be eligible for student loan forgiveness.

PUBLIC SERVICE LOAN FORGIVENESS:

Public Service Loan Forgiveness (PSLF) is a federal student loan program that resonates with many veterinary students and veterinarians. This is a benefit provided under the College Cost Reduction and Access Act of 2007, establishing a pathway to have certain student loans forgiven tax-free after ten years (120 months) of qualifying payments.

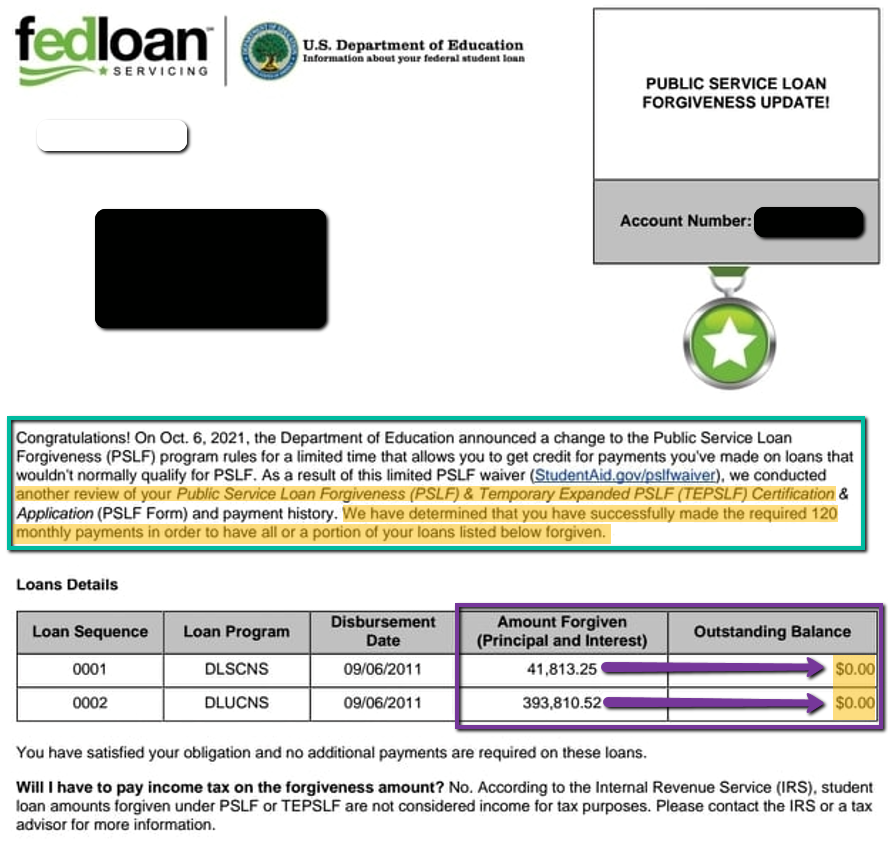

The first eligible payments could have been made starting in October 2007. That means we are beyond the ten-year threshold where people can have their student loans forgiven tax-free under PSLF. The early returns were not very encouraging. Numerous issues with the first rules and poor communication led to many denied applications. However, since then we have seen several improvements to help current and future borrowers receive PSLF, even retroactively in many cases.

If you have applied unsuccessfully for PSLF in the past, apply again. In recent years, borrowers have received a number of unique opportunities to help increase their PSLF payment count: Temporary Expanded Public Service Loan Forgiveness (TEPSLF), updated employment requirements that took effect July 1, 2023, and the one-time forgiveness count adjustment.

To date, more than 600,000 borrowers have received $42 billion in PSLF thanks to the various improvements made over the last couple of years.

The low first-round PSLF qualification rate was not a surprise for those who follow the student loan repayment landscape closely. Knowing whether or not you were making qualifying PSLF payments was nearly impossible in the early years of the provision. If you are working towards PSLF, make sure that you are submitting a Public Service Loan Forgiveness Employment Certification Form or using the PSLF electronic help tool at least each year or whenever you change employers. If you do, you can track your progress via your loan servicer (Mohela is the official loan servicer monitoring PSLF progress). You can also see your PSLF qualifying payment count in your student aid data file when you upload it to the VIN Foundation My Student Loans tool. Look for the PSLF Status tab in your My Student Loans report.

Veterinarians may qualify for PSLF if they work in positions such as academia (every U.S. veterinary teaching hospital is a 501c3 nonprofit), shelters, zoos, aquariums, state veterinarians, military veterinarians, working for the USDA veterinarians or any other federal government agency, other university research positions, lab animal medicine, many wildlife organizations, or teaching in veterinary technician programs (excluding private school programs), just to name a few.

Avoid these common concerns and pitfalls when it comes to PSLF:

PSLF is not going anywhere. While previous administrations have discussed eliminating PSLF and reducing the number of income-driven repayment options, no one has ever proposed eliminating PSLF or IDR forgiveness for existing student loans. Anyone with federal student loans has a master promissory note, i.e. a contract that spells out all of the repayment options and benefits available. Eliminating PSLF or IDR forgiveness for existing student loans would require Congress to break all existing student loan contracts. That is highly unlikely to happen. They have actually gone out of their way to not do that, consistently preserving older student loan provisions until there are no more loans governed under those contracts, or they offer a way to consolidate into a new loan type that has different contractual terms.

What is usually proposed or chatted about in the media is to eliminate or significantly alter PSLF or IDR forgiveness for future borrowers – students who have not started borrowing yet who could have a different contract with different provisions. Don’t worry – nothing like that is even on the table right now.

In fact, Congress passed and the President signed into law TEPSLF in 2018 which expanded the original PSLF benefits and helped borrowers who were denied PSLF the first time around get a second shot at tax-free forgiveness.

Starting on July 1, 2023, several improvements have also been made to the regulations around PSLF qualifying payments:

- Late and lump sum payments can be PSLF eligible

- Certain periods of deferment or forbearance can be PSLF eligible

- Consolidation will no longer restart your PSLF clock. Instead, borrowers who consolidate loans with differing amounts of qualifying payments will receive a weighted average of PSLF credit after consolidating.

- Relaxed full-time employment requirements to make it easier for some contract employees and those who work at least 30 hours per week for a qualifying employer to receive PSLF credit.

One surefire way to not earn PSLF is to not try or miss out on the new or even time-limited opportunities to receive PSLF credit. Set yourself up for success. Know if you need to consolidate your loans to maximize your PSLF credit or switch to the most beneficial qualifying repayment plan going forward, like SAVE. If you have questions, reach out for help! You can also review the “Most direct path to Public Service Loan Forgiveness (PSLF) for Veterinarians” document in the VIN Foundation WikiDebt resource.

TAX-FREE STUDENT LOAN FORGIVENESS UNDER PSLF:

PSLF is a benefit you apply for and might receive IF you do all of the right things for a period of at least 120 months, or 10 years. Before you apply for PSLF, make sure you have made 120 monthly qualifying payments to federal Direct Loans using an income-driven repayment plan (ICR, IBR, PAYE, REPAYE, the new SAVE) or a standard 10-year plan, while working full-time as an employee of a federal, state, local, tribal entity, or 501c3 organization. If you’re working towards PSLF or expect to receive PSLF in the future, then submit the PSLF Employment Certification Form or use the electronic PSLF Help tool at least annually to receive confirmation of your progress.

SPECIAL OPPORTUNITIES: TEPSLF has significantly relaxed the original PSLF requirements and provides a limited pot of money for borrowers who may have been using the wrong repayment TEPSLF will require you to consolidate any non-Direct Loans in order to receive this special retroactive consideration.

TEPSLF will exist until it runs out of funds.

Once you’ve made 120 qualified monthly payments, you can apply to have your remaining student loan balance canceled under PSLF. If granted, your remaining eligible federal student loan balance will be forgiven tax-free. If you qualify for PSLF under TEPSLF or the limited waiver, you can even receive a refund of payments you have made after meeting the 120 qualifying payments.

PSLF is the holy grail of student loan repayment if you can get it! Don’t let the early returns or horror stories dissuade you from earning PSLF. Veterinarians are currently receiving PSLF. Learn from the mistakes of others and you will be eligible for tax-free forgiveness sooner rather than later.

TAXABLE STUDENT LOAN FORGIVENESS:

There is another type of student loan forgiveness that confuses many borrowers, even though they may be using plans where their monthly payments are based on their taxable income. Income-driven repayment plans like ICR, IBR, PAYE, and REPAYE (soon to become SAVE) have maximum repayment periods. The periods are 20 or 25 years depending on your loans and repayment plan. If you reach the maximum number of payments under an income-driven repayment plan, any remaining balance is forgiven. Let’s call this income-driven repayment forgiveness (IDRF).

The two major differences between IDRF and PSLF.

- IDRF can be treated as taxable income. However, currently there is a tax exemption for anyone who receives student loan forgiveness between 2021 and 2025.

- IDRF does not require an application for forgiveness, rather it is automatically granted once you reach the maximum number of payments while using forgiveness-eligible repayment plans.

The calendar year in which forgiveness occurs will be important because this forgiven debt will be treated as taxable income if the student loan forgiveness tax-exemption is not extended beyond 2025. If considered taxable income, you will report the balance forgiven on your tax return after you receive a 1099-C for the amount canceled (aka forgiven). Your tax liability will depend on your total income and the federal (and any state) income tax rates the year forgiveness occurs. To estimate your student loan forgiveness tax liability, review the Forgiveness Planning Module in the VIN Foundation Student Loan Repayment Simulator and read the WikiDebt section on forgiveness planning.

Avoid these common concerns and pitfalls when it comes to IDR Forgiveness:

“I don’t work for or have never worked for a non-profit, so student loan forgiveness doesn’t apply to me.”

Incorrect. Anyone who has federal student loans has the option to use a forgiveness-eligible repayment plan. PSLF happens to be an additional, accelerated forgiveness option IF you happen to be employed by a qualifying organization while using one of the forgiveness-eligible repayment plans.

PSLF requires you to work for a qualifying organization while making forgiveness-eligible student loan payments for at least 10 years. At that point, you are eligible to apply to have your loans forgiven tax-free under PSLF.

IDR forgiveness requires you to make qualifying payments based on your taxable income and family size for a maximum period of 20 or 25 years (depending on your loan types and repayment plan). If you still have a balance remaining when you reach your maximum repayment period, the remainder is forgiven. Forgiven balances can be treated as taxable income when your loans are canceled. However, the American Rescue Plan has exempted student loan forgiveness from taxability for the tax years 2021-2025.

“I was planning to pay based on my income using an income-driven repayment plan like PAYE, REPAYE or IBR, but after seeing so few people get PSLF, I’m not sure that is the right strategy for me.”

While confusion caused by the early data on PSLF and the constant calls to eliminate student loan forgiveness is certainly understandable, there are details we need to clarify between PSLF and the IDR forgiveness you can earn using repayment plans like ICR, IBR, PAYE, and REPAYE. If you’re unfamiliar with these acronyms, review the VIN Foundation WikiDebt income-driven repayment comparison table.

Not all student loan forgiveness is created equal. There are two general types of student loan forgiveness:1) Public Service Loan Forgiveness which is always tax-free, and 2) Income-Driven Repayment, which can be taxable, unless there is a special tax-exemption in place. Right now, anyone who receives student loan forgiveness between 2021 and 2025 will not have to pay taxes on any amount of student debt forgiveness.

PSLF or IDR forgiveness is a potential result for any borrower. However, not all borrowers will reach forgiveness. Borrowers with a starting student debt to income ratio less than one will likely pay their balance to zero before reaching forgiveness. With a starting student debt to income ratio greater than one, you are likely to reach forgiveness, whether it is under PSLF or IDR. The higher your student debt to income ratio, the more likely you are to reach student loan forgiveness. The difference then becomes when you reach forgiveness and whether or not your forgiveness will be taxable or non-taxable.

The key point is that ANYONE with U.S. federal student loans can be eligible for forgiveness. Even borrowers with older loans can see student loan forgiveness sooner rather than later under the limited one-time forgiveness count adjustment. Make sure you check your eligibility for this extremely beneficial opportunity and act if necessary before the December 31st deadline.

STUDENT LOAN FORGIVENESS TAKE-HOME POINTS:

The early struggles of folks who have applied for PSLF does not mean you will be denied PSLF. There are also numerous current and planned improvements to PSLF to help improve the success rate. Many of the current improvements will provide retroactive PSLF credit to those who normally would not be eligible for it. Know how to receive PSLF credit before some of these opportunities expire if you may have earned it to have your loans forgiven sooner.

Forgiveness received under PSLF is also very different from the forgiveness received under income-driven repayment plans. Taxable forgiveness does not require an application and will happen when/if you reach the maximum repayment period for income-driven repayment. There are additional limited opportunities available to receive retroactive forgiveness credit, regardless of the repayment plan(s) you have been using.

For the majority of recent graduate veterinarians who have federal student loans, income-driven repayment is an essential part of a financial wellness plan. Don’t let the early news on PSLF dissuade you from using income-driven repayment. Also, don’t discount working towards PSLF if that matches with your veterinary career aspirations. If you’re not sure how to evaluate your income-driven repayment plan eligibility or compare the various repayment options, try the tools available on the VIN Foundation Student Debt Center.

For those who are worried about their student loan repayment options and benefits: read your current master promissory note, review your student loans and repayment options using the VIN Foundation My Student Loans tool, check with your loan servicer on your income-driven repayment and/or PSLF progress, and simulate your remaining costs using the VIN Foundation Student Loan Repayment Simulator.

If you need help, please do not hesitate to reach out to VIN and VIN Foundation for some guided assistance in making sense of your student loans and repayment options.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

1 thought on “Student Loan Forgiveness: Taxable or Tax-Free?”

Interesting take on student loans!