Special time-limited expansions to PSLF

Public Service Loan Forgiveness (PSLF) is a compelling student loan repayment benefit for many veterinarians, but understanding the rules for this program can be a challenge. Borrowers must be an employee of a federal, state, tribal entity or 501c3 nonprofit while using an income-driven repayment (IDR) plan to repay their federal Direct student loans. After 120 monthly qualifying payments, or 10 years, the remaining balance may be forgiven tax-free.

PSLF got off to a rocky start, with few applicants approved during the initial years of eligibility. This has made some borrowers hesitant to pursue PSLF or caused them to give up on student loan forgiveness programs altogether. However, VIN Foundation addresses many common PSLF myths and misconceptions in the taxable vs tax-free forgiveness blog post.

The early PSLF failures spurred some changes. Over the last few years, there have been a number of improvements to the program including the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) and Limited PSLF Waiver. With each update, the program has greatly expanded forgiveness eligibility. Both TEPSLF and the limited waiver mostly help those who may have been previously denied PSLF or weren’t able to receive PSLF credit because they had the wrong loan types or used the wrong repayment plan(s). Anyone who gets retroactive PSLF credit can even receive a refund of payments made after meeting the 120 qualifying PSLF payments threshold. We have seen this happen recently for a number of veterinarians.

While the limited waiver has an end date of October 31, 2022, TEPSLF does not — it ends when funding runs out. As of now, there is still funding available. TEPSLF eligible applicants are processed on a first-come, first-served basis.

The limited PSLF waiver offers a significant opportunity for borrowers with Federal Family Education Loans (FFELs). These loans have been a problem-child for many of the student loan forgiveness programs. Discontinued in July 2010, FFELs have not normally been eligible for PSLF credit, regardless of your employer or repayment plan used. This is precisely what the limited waiver addresses. No matter what federal loan types you had (Directs or FFELs) or which repayment plan you were using, as long as you were making payments while working for an eligible employer, you can receive PSLF credit for any of those payments made after October 1, 2007. The only catch is you must consolidate your FFELs into a Direct Consolidation and submit a PSLF employment certification form before the end of the October 31, 2022 to receive retroactive PSLF credit under the limited waiver.

“The only catch is you must consolidate your FFELs into a Direct Consolidation and submit a PSLF employment certification form before the end of the October 31, 2022 to receive retroactive PSLF credit under the limited waiver..”

These PSLF expansions may also benefit borrowers who did not realize their job was with a qualifying employer. Veterinarians may qualify for PSLF if they work in positions such as academia (every U.S. veterinary teaching hospital is a 501c3 nonprofit), shelter, zoo, aquarium, state veterinarians, military veterinarians, working for the USDA or any other federal government agency, other university research, lab animal medicine, many wildlife organizations, or teaching in veterinary technician programs (excluding private school programs), just to name a few. Check out the PSLF employer search tool to look for your employer.

We’ve learned through helping veterinarians on the VIN and VIN Foundation Student Debt Message Boards that they often have spouses who could also benefit from PSLF. If you’re married to a teacher, firefighter, police officer, or government employee, have them check in on their PSLF status if they have student loans.

What do I need to do to benefit from the PSLF expansions?

If you worked for a non-profit or government organization since Oct 2007 AND made any kind of payments to your student loans during that time you may be eligible for additional forgiveness time. You can review what loan types you have and which repayment plan you are using with the VIN Foundation My Student Loans tool.

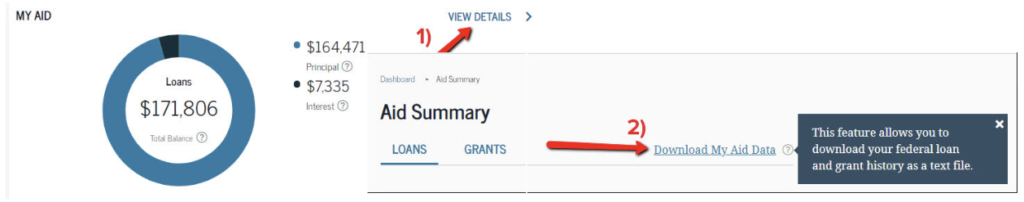

To use the My Student Loans tool, first head over to studentaid.gov and find your student aid data file. When you’re logged in, look for a “Download My Aid Data” link:

That will generate an ugly-looking TXT file containing all of your important federal student loan borrowing details. You can upload that file into the VIN Foundation My Student Loans tool. We have some alerts set to help you understand your loan types and whether you have the types of loans that would need to be consolidated before the end of the waiver period to be considered. We can also help you check-in on your PSLF progress if you have some documented qualifying payments made on your Direct Loans thus far in the PSLF Status tab.

After you complete your Direct Consolidation Loan, head over to the PSLF Help Tool to submit your employment certification form electronically, if your employer is identified as eligible in the database. You’ll need the federal Employer Identification Number (EIN) to use the tool. There are a number of places to look for an employer EIN, but the easiest is probably from your most recent W2.

You may want to hurry – this limited waiver opportunity ends on October 31, 2022.

Not sure if or how this applies to you? If you need any personalized help, VIN and VIN Foundation are here to help. The secure Student Debt & Income Signalment Form and special student debt message board areas are available for any veterinary student or veterinarian who needs help with their student loans.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.