Recent student loan announcements have many confused about federal student loan consolidation.

Many veterinarians have long been perplexed by student loan repayment options. Previously the most beneficial repayment options have been available only to those with newer student loans. Recent updates have changed that dynamic. However, it is still difficult to know what to do (if anything) and when to do it.

The pandemic forbearance benefits, one-time forgiveness count adjustment and the one-time student debt cancellation could help any veterinarian with student loans – but how do you know if you qualify for them or what you need to do to be eligible for these benefits?

The short answer is: if you used student loans for any higher education prior to July 2010, then you may need to act by using a Direct Consolidation Loan. Otherwise, you just need to make sure you are taking advantage of all the benefits available to you.

Jump to common student loan consolidation Q&A:

Need a how to video? Watch the Direct Consolidation “how to” video on the VIN Foundation YouTube Channel below:

Prior to July 2010, Federal Family Education Loans (FFELs) were major portions of student loan portfolios. FFELs come in two main flavors: privately held and federally held. While most recent student loan benefits are available only to federally held types, there are some opportunities for privately held FFELs if you consolidate them. One of those opportunity windows closed on Sept 29th when the Dept of ED sneakily announced that privately held FFELs could no longer be consolidated into the special cancellation benefits. However, there is still good reason for many of those FFEL holders to consolidate prior to the end of 2022.

If you would like to follow or join discussions with veterinarians from all graduation years and student loan types, visit the VIN and VIN Foundation Student Debt Message Board areas. That’s where we provide personalized help to veterinarians and veterinary students on their student loans and repayment options. From those discussions, we see that many veterinarians are left with more questions once they start digging or begin their Direct Consolidation application.

Federal Student Loan Consolidation FAQs:

Should I consolidate? Which loans? All or just FFELs?

The answers depend on your student loan types.

The first step is a student loan physical exam. Log in to your studentaid.gov account, obtain your student aid data file, and bring that file over to the VIN Foundation My Student Loans tool.

The detailed information in your studentaid data file is consistent for everyone. To make sure we’re all working from the same baseline information, this is the most reliable way to decode your student loan history and details.

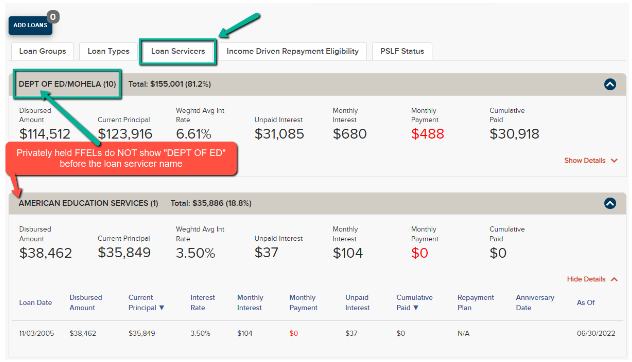

Buried in your student aid data file are loan servicer details that will tell you if you have federally held vs. privately (or sometimes referred to as commercially) held student loans. All federally held student loans will have “DEPT of ED” listed ahead of your loan servicer name. As shown below, you’ll see this breakdown in the Loan Servicers tab of your VIN Foundation My Student Loans Summary.

The absence of Dept of ED in the loan servicer name signifies a privately held student loan. Privately held loans found in your studentaid data file can be consolidated into a Direct Consolidation Loan – even if you have previously consolidated. Another common concern is that FFEL consolidation loans cannot be consolidated again. They can. In fact, they must be consolidated in order to be considered for either the one-time cancellation benefits OR the one-time forgiveness count adjustment.

Unfortunately, if you did not submit a Direct Consolidation Loan application for your privately held loans before Sept 29th, 2022, then your new Direct Consolidation loan is NOT eligible for the special cancellation benefits. However, if you did submit your consolidation before that date, then you should still be eligible for up to $20,000 of loan cancellation benefits. The application for the cancellation benefits has been released and is available on studentaid.gov. Update: The cancellation benefits have been put on hold until the courts decide if it can proceed.

Although the arbitrarily imposed consolidation deadline is unfortunate, the cancellation benefits were not the only reason to consolidate. The special one-time forgiveness count adjustment is probably a bigger reason to consolidate your federally held or private FFELs into a Direct Consolidation Loan.

FFELs have very limited methods for reaching student loan forgiveness. The only income-driven plan that can be used for FFELs is IBR 2009. And FFELs are not eligible for Public Service Loan Forgiveness (PSLF).

If you have FFELs and are interested in newer income-driven repayment plans like PAYE or REPAYE, or work for eligible PSLF employers, you need to consolidate your FFELs into a Direct Consolidation Loan.

Normally, consolidation resets to zero any forgiveness qualifying payments you have already logged. However, the one-time forgiveness count adjustment eliminates that reset AND will give you forgiveness credit for any past repayment time – as long as you consolidate BEFORE the one-time forgiveness count adjustment is completed.

According to a recently release Deptartment of Education Fact Sheet, “Borrowers who do not have eligible loans will need to apply for consolidation no later than May 1, 2023, to ensure they benefit from the one-time account adjustment.” I recommend consolidating as soon as possible, especially after what happened on Sep 29, 2022. Consolidating may even provide you with bonus forgiveness time if you have older loans that have been in repayment before veterinary school.

If you are hoping to reach PSLF, then make sure you review the limited PSLF waiver details. This particular waiver expired Oct 31, 2022. As long as you submitted a consolidation of FFEL program loans and a PSLF employment certification form before the expiration date, you will still be eligible for PSLF credit even if the consolidation is processed after the deadline.

Finally, we can answer the Should you consolidate question. If you have FFELs, yes. And do so as soon as possible. If you have a mixture of FFELs and Direct loans, then you can either choose to consolidate the FFELs only, choosing the loan servicer who holds your Direct Loans to assure your loans are all in one place; or you can consolidate ALL of your loans into a new Direct Consolidation Loan.

The only consolidation contraindication is if you have been using IBR 2009 since it started in 2009 or a combination of ICR and IBR 2009 where you’re very close to forgiveness now or have a significant amount of unpaid interest. If that is the case, carefully crunch some numbers using the VIN Foundation Student Loan Repayment Simulator, complete your Student Debt & Income Signalment form, and visit the Student Debt Message Board areas to see if consolidation makes sense for you.

What if I didn’t consolidate privately held FFELs prior to September 29, 2022?

If you didn’t submit a Direct Loan Consolidation application of your privately-held FFELs prior to September 29, 2022 you won’t be eligible for the one-time student debt cancellation. However, you are currently able to take advantage of the one-time forgiveness count by completing a federal consolidation of those loans. Submit your consolidation as soon as possible to make sure your loans are considered in the one-time forgiveness count adjustment. The consolidation deadline is currently the end of 2024. However, consolidating sooner will also make your new consolidation loan eligible for the remaining pandemic forbearance benefits.

What happens to my interest rate if I consolidate?

Good news – your Direct Consolidation Loan interest rate(s) is a weighted average interest rate based on your existing loans. You do NOT have to worry about your interest rate increasing to some higher market-based rate. A weighted average works by factoring in the principal balance for each loan with their respective interest rate. If you have $100,000 of student loans and $90,000 of that has an interest rate of 6% and $10,000 of that has an interest rate of 3%, your weighted average interest rate will be closer to 6% than 3%. Mathematically, that example would result in a weighted average rate of 5.7%.

You’re going to pay the same amount of interest whether you consolidate or not. Most people worry too much about their student loan interest rates. Your overall student loan repayment options and strategies go way beyond an interest rate. The constellation of federal student loan benefits are worth any of the current interest rates.

That said, many FFELs do have interest rate discounts applied that may cumulatively be greater than 1%. Historically, those discounts have not transferred over during the consolidation process. Most likely, your interest rate will be a weighted average of the interest rate listed for your respective loans in your studentaid data file. You can see a weighted average for all of your loans in the VIN Foundation My Student Loans summary.

When you do consolidate, your weighted average will get rounded up to the nearest 1/8th of 1%. In our simplified example, 5.7% will become 5.75%. Then, after the pandemic forbearance benefits end, you can enroll in auto-pay to receive a 0.25% interest discount. That makes our example weighted average interest rate 5.5% after the autopay discount.

If you want to see what your actual weighted average interest rate will be if you consolidate, then you can also start a consolidation loan at studentaid.gov. As you walk through the next steps you will see your interest rates displayed for each existing loan as well as a weighted average for the consolidation loan. You can also exit the application without consolidating if you don’t like what you see or have more questions about the process.

What repayment plan do I choose for the new Direct Consolidation loan?

Many borrowers with older loans will find their new consolidation loan eligible for income-contingent repayment (ICR), the older version of income-based repayment (IBR 2009), and Revised Pay As You Earn (REPAYE) income-driven repayment options. Time-driven repayment options are also available (standard, extended, graduated repayment options).

During the consolidation process, you can input your most recent adjusted gross income (AGI), tax filing status, state of residence, and family size to determine which repayment plan may have the lowest monthly payment or payment most similar to your current repayment plan.

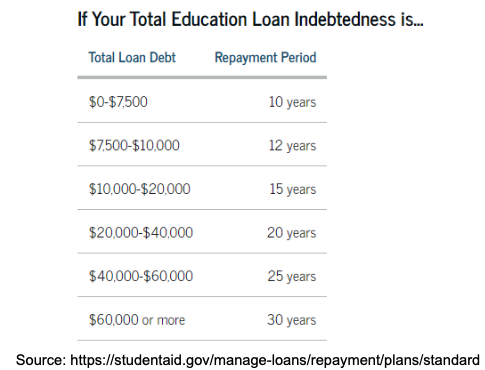

After the one-time forgiveness count adjustment, many seasoned veterinarians will either receive student loan forgiveness or be only years away from receiving student loan forgiveness. If you have time remaining before reaching forgiveness, you’ll want to choose a forgiveness eligible repayment plan going forward. All of the income-driven plans are forgiveness-eligible repayment plans. The only time-driven plan that is forgiveness-eligible is a Standard 10 year repayment plan. The standard amount of time is dependent on your overall consolidated student loan balance.

IBR 2009 is probably the best option, as long as you’re able to get in. IBR has a partial financial hardship test that requires you to have a calculated payment that is less than a standard 10 year plan payment to use it. Depending on your recent taxable income and tax filing status, if your student debt to income ratio is less than one, then you’ll likely not be able to use IBR 2009.

ICR is another option. There is no partial financial hardship test, but the payment will be the lesser of a standard 12 year plan payment plus a factor accounting for your income, or 20% of your ICR discretionary income.

REPAYE can work too. Once again, there is no partial financial hardship test. If you’re married and your spouse has taxable income, you’re not likely to find any monthly payment relief compared to what you were paying. But REPAYE is a great option going forward for those who are single, have a single income earning household, or otherwise have a remaining student debt to income ratio greater than one.

Last but not least, you can make standard 10 year plan payments to satisfy any remaining forgiveness requirements. The problem is you may not be able to choose a standard 10 year plan during the consolidation process if your balance is greater than $7,500.

As shown in the Dept of ED table above, the standard plan repayment period is a function of your remaining consolidated student loan balance. Most veterinarians who are exploring this option have remaining balances greater than $7,500 which means their new Direct Consolidation Loan standard plan will have a repayment period greater than 10 years. The only forgiveness-eligible standard plan payment is a fixed 10-year plan payment.

Good news — It’s not terribly important which repayment plan you choose to get through the consolidation process while the pandemic forbearance benefits are still active or before the one-time forgiveness count adjustment is completed.

However, if you do not select an income-driven plan during your consolidation application or can’t select a standard 10 year plan, then make sure to review your available repayment options and select a forgiveness qualifying plan after the pandemic forbearance benefits end (12/31/2022 recently extended again into 2023, possibly through Aug 2023) or once your forgiveness count adjustment is applied, whichever comes first.

Sometimes, there are magic words you can try with your loan servicer to get the desired result. If you are unable to switch your loans into a standard 10 year plan payment after your consolidation is complete, then try requesting an “Alternative Repayment Plan.” Then request a “fixed term of 10 years” for the alternative plan.

If all else fails, you can make payments under any repayment plan that are equal to a standard 10 year plan amount to continue making eligible forgiveness payments. Contact your loan servicer to confirm what that fixed 10-year plan payment amount would be to assure you’re making forgiveness eligible payments going forward. Document everything, including your request to make forgiveness eligible payments along with your loan servicer response just in case you need to provide that information at a later date.

Confused by any of this? It’s understandable.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to studentdebt@vinfoundation.org.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

3 thoughts on “Common Student Loan Consolidation Questions and Answers”

Pingback: Pricey Physician: I wish to repay my loans once imaginable - Information -

Pingback: Dear Dr. Debt: I want to pay off my loans as soon as possible – News – We Help Debt

Thanks for sharing. I really appreciate it that you shared with us such informative post, great tips and very easy to understand.