It’s been a confusing year in student loan repayment, to say the least. We continue to see changes even as we approach the end of 2025.

We have two ongoing points of frustration and one suggestion to round out 2025.

- IBR application issues: Partial Financial Hardship update

- SAVE may be ending sooner rather than later.

- Now is the best time to review your student loan repayment options

Removal of the IBR Partial Financial Hardship test

Legislation from this past summer updated the Income-Based Repayment (IBR) plan to remove the partial financial hardship requirement but maintained the monthly payment cap. That means anyone can use IBR, and their payment will never be more than a standard 10-year plan payment, no matter their income or remaining student loan balance.

The IBR update is helpful for those otherwise stuck in the SAVE forbearance and those with lower student debt-to-income ratios who are nearing the forgiveness finish line. Generally speaking, when your student debt-to-income ratio (DIR) is one or less, you would not likely pass the partial financial hardship test, or be able to use IBR.

While the IBR update took effect when the new law was signed on July 4, 2025, the Department of Education’s application system has been slow to reflect the change.

According to the Monday, December 22nd update provided by the Department of Education, “The One Big Beautiful Bill Act (OBBBA) allows borrowers who don’t have partial financial hardship to enroll in the Income-Based Repayment (IBR) Plan. On Dec. 22, 2025, we updated our systems, including Loan Simulator, to implement this change. Borrowers who previously could not enroll in the IBR Plan because they lacked partial financial hardship will now see IBR as an option when using [the Department of Education] Loan Simulator, and they can enroll in the IBR Plan using the online income-driven repayment (IDR) plan application. As more information becomes available, we will update this page.”

Anyone who is not seeing IBR as an option when they apply for an income-driven plan should call their loan servicer and reference this recent announcement to help get their loans into the IBR plan.

SAVE Ending Soon?

Hopefully, we’ll see that system update completed soon because we just learned that the SAVE forbearance could be ending sooner rather than later. Litigation around the SAVE repayment plan reached a potential settlement that will require borrowers in the SAVE forbearance to choose another repayment option. Per the Department of Education, “While the settlement agreement is still pending court approval, we encourage borrowers to … explore other available repayment plans.”

The timeline for ending SAVE or choosing another plan is not yet available. In the meantime, anyone in the SAVE forbearance should get prepared for another repayment plan.

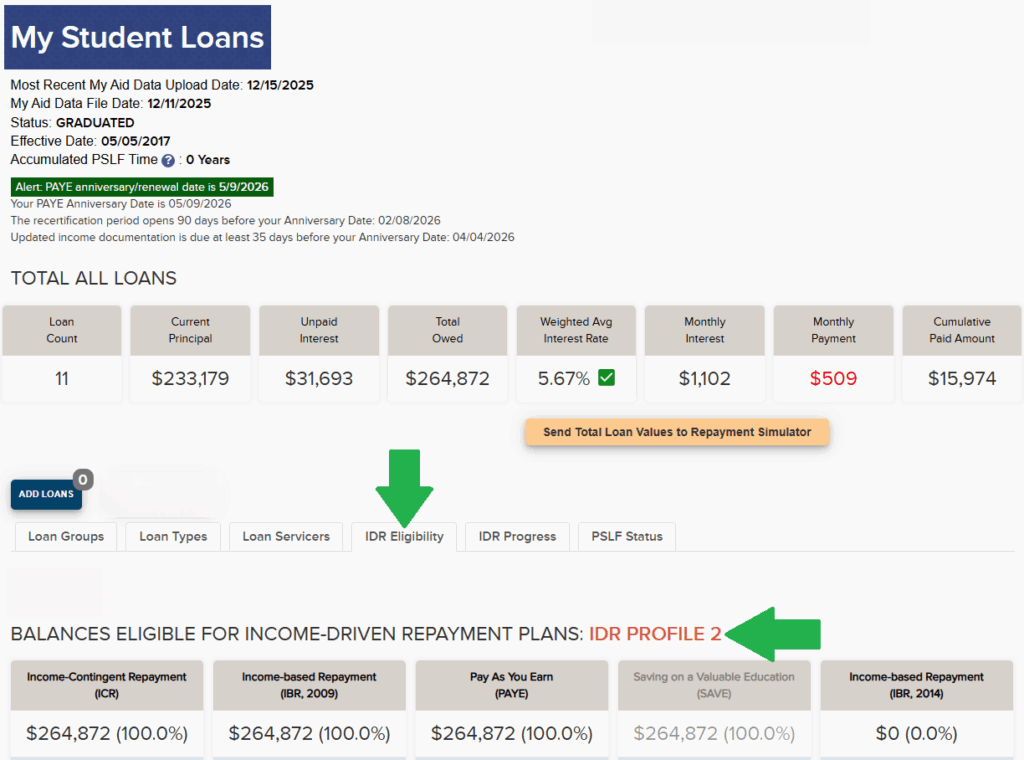

“What repayment plan do I use after SAVE?” has been the most common student loan question of 2025. To see your next best available income-driven repayment (IDR) option, upload your federal student aid data file into the VIN Foundation My Student Loans tool and check your “IDR Profile” in the IDR Eligibility tab.

WikiDebt: What is your IDR Profile?

Your IDR eligibility is determined by your loan types and borrowing history. With ambiguous criteria and changing rules, one of the most difficult aspects of federal student loan repayment is knowing which repayment options are available for your loans. The VIN Foundation My Student Loans tool attempts to clarify the confusion and provide a simplified description of your IDR eligibility via the IDR Profile.

There are six different VIN Foundation IDR Profiles:

- IDR Profile 1: Eligible for ICR, PAYE, SAVE, and IBR 2014, and RAP (once available)

- IDR Profile 2: Eligible for ICR, IBR 2009, PAYE, SAVE, and RAP (once available)

- IDR Profile 3: Eligible for ICR, IBR 2009, SAVE, and RAP (once available)

- IDR Profile 4: Eligible for IBR 2009 only

- IDR Profile 5: Eligible for ICR only

- IDR Profile 6: Eligible for RAP only

See the WikiDebt IDR Profiles page for more detail.

The most common IDR Profiles we see for veterinarians are 1, 2, or 3. Here are short-term repayment guidelines for your IDR Profile:

- IDR Profile 1 or 2: Choose PAYE

- IDR Profile 3: Remain in SAVE Forbearance, or choose IBR or ICR, whichever payment is lowest.

Now is the best time to review your student loan repayment options

Whether you are applying for your first or a new student loan repayment plan, the end of the calendar year is one of the best times to evaluate your options.

Choosing a new income-driven repayment plan requires you to submit income documentation.

If your income has decreased since the last time you provided income information, you should apply to have your payment reduced in your current income-driven plan.

The period immediately before filing your next tax return gives you the most choices to minimize your monthly student loan payment.

You can use either the adjusted gross income (AGI) from your most recently filed tax return (i.e., 2024), your 2025 end-of-year income information (i.e., W-2), your first paystub in 2026, or potentially wait until after you file your 2025 tax return. Use the income information that will result in the lowest minimum monthly payment for your circumstances.

For example, let’s say your income in 2025 decreased compared to your income in 2024. You can use a recent paystub or your 2025 W-2 as income documentation for your income-driven repayment plan application.

On the flip side, if your income increased in 2025, then you may want to apply using your previous tax return, before you file your 2025 tax return.

What if you got married in 2025, and this will be the first time you need to decide whether to file taxes jointly or separately? Consider getting your 2025 tax return filed before you apply for your income-driven plan to make it easier to reflect your current marital and tax filing status.

Preparing for more changes in 2026

The new Repayment Assistance Plan (RAP) is coming by July 1, 2026. You can explore how RAP looks for you in the VIN Foundation Student Loan Repayment Simulator. With the SAVE forbearance potentially ending before RAP is available, you may need a bridge to get you to RAP. Choose PAYE if you are eligible, ICR if it is the lowest monthly payment for you, or IBR if neither PAYE nor ICR is the best option for you. If you are in IBR or plan to use IBR before switching to RAP, please note that your unpaid interest will capitalize (get added to your principal) when you leave IBR. Generally speaking, avoid unpaid interest capitalization when possible.

Need student loan help?

Have more questions? Post a comment below or email [email protected].

We’re here to help!

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “Federal Student Loan Repayment: 2025 Year-End Wrap and Preparing for 2026”

I plan to leave SAVE and enter old IBR. I’m trying to determine the best of these options for me: ” You can use either the adjusted gross income (AGI) from your most recently filed tax return (i.e., 2024), your 2025 end-of-year income information (i.e., W-2), your first paystub in 2026, or potentially wait until after you file your 2025 tax return. Use the income information that will result in the lowest minimum monthly payment for your circumstances.”

What is the difference between using your 2025 W2 and your 2025 tax return? Which numbers are they looking at? (Other options are worse for me- Married and filed jointly in 2024, salary increased in 2026).

Hi Carrie,

Thanks for posting!

>>>What is the difference between using your 2025 W2 and your 2025 tax return?<<<

It really depends on how complicated your taxes are. However, if your taxes are relatively simple, then your 2025 W-2 wages (Box 1) will be pretty close to your 2025 tax return Adjusted Gross Income (AGI). The major difference is the timing. Your W-2 wages for 2025 are available now. You tax return is not due until April 15th, 2026. So you won’t be able to use your 2025 tax return AGI until you file your tax return and it is available via the IRS Data Retrieval Tool in studentaid.gov.

If you have a recertification date coming up soon or you need to choose another plan before your tax return is filed, or your income decreased in 2025 and your payment would be lower, then you can use your W-2 as income documentation of your income-driven plan application.

>>>Which numbers are they looking at? (Other options are worse for me- Married and filed jointly in 2024, salary increased in 2026).<<<

They will look at whatever you provide them. If you use the electronic application and have them pull in your most recent tax return information, then they are using your 2024 tax return AGI. If you filed jointly, then your 2024 tax return AGI includes your and your spouse’s income.

If your income increased in 2026, then wait until you have to use your 2026 as your income documentation. That won’t be until you file your 2026 tax return in early 2027. In the meantime, as we covered in the blog post, you can use your 2024 tax return AGI, your 2025 W-2 wages, or your 2025 tax return after you file it.

Clear as mud? 🙂