Don’t miss out on this special one-time forgiveness count adjustment opportunity.

“Any borrower with loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if you are not currently on an IDR plan.”

All that changed with the April 19th, 2022 announcement from the Dept of Education (ED). To paraphrase the current President, this is the big f-ing [student loan] deal that you’ve been waiting for to alleviate your student debt stress, particularly those of you who have been in repayment for a decade or more.

If you haven’t looked closely at your student loans for 10 years or more, or you graduated veterinary school around 2014 or before, you really should pay very close attention to the recently announced changes.

—

Check out the special Climbing Mt. Debt Case Study video showing how one veterinarian may save more than $65,000 in loan repayment costs using the one-time forgiveness count adjustment:

—

Thankfully, most borrowers won’t have to do anything to benefit from the new changes. However, some will. The problem is that it is not obvious who needs to act and who does not to make sure you are considered for the special one-time forgiveness count adjusment.

Anyone with federal student loans is now eligible for forgiveness, regardless of the repayment plan(s) you’ve been using.

But let’s say you graduated veterinary school in 2000 and for whatever reason have a balance remaining on your federal student loans. Under the one-time forgiveness count adjusment, you could be eligible for forgiveness consideration for the last 20+ years of repayment. This would mean that you have less than 3 years before any remaining balance would be forgiven. Essentially, your previous repayment time (and some deferment/forbearance time) will be adjusted to count towards the forgiveness progress normally reserved for income-driven repayment plans.

How do I know if I need to do anything with my loans to be considered for automatic forgiveness?

If you find privately/commercially held FFELs in your student loan portfolio, then you need to consolidate those FFELs into a federal Direct Consolidation Loan before the end of April 2024 to be eligible for forgiveness consideration.

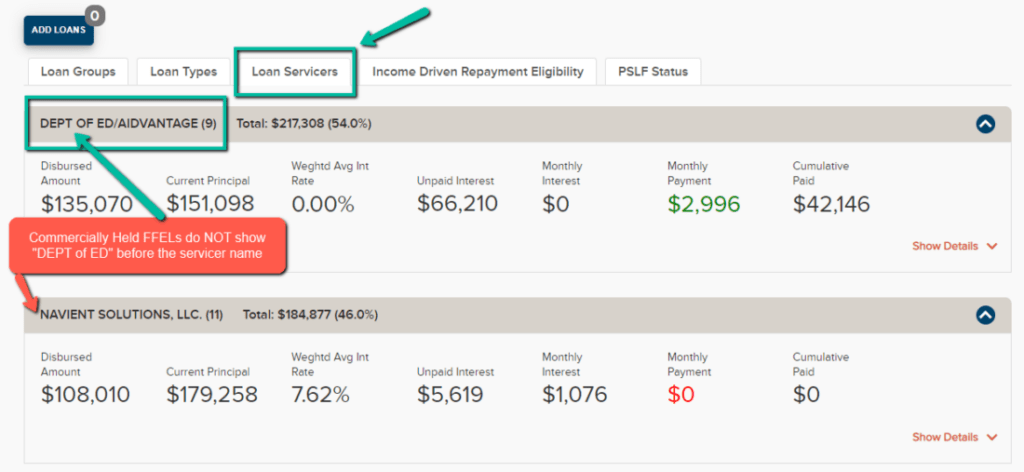

How do I identify a federally held vs. privately held FFEL?

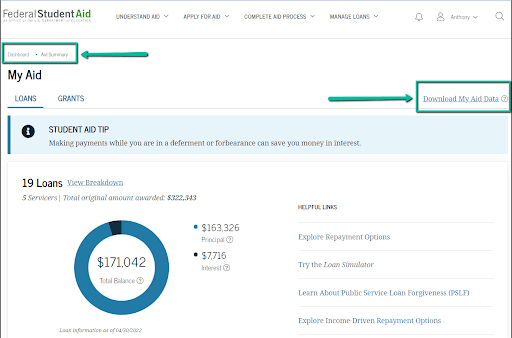

Next, look for your federal student aid data file on the Aid Summary page of your Dashboard. You are looking for a button/link to “Download My Aid Data.” That will generate an ugly-looking text file (TXT) that contains all of your federal student loan borrowing history. There is a video tutorial available on the VIN Foundation My Student Loans page to help you locate your student aid data file.

However, if you do not see a “DEPT OF ED” ahead of your loan servicer name for your FFELs, then you have privately managed or “commercially held” FFELs. These are the loans that must be consolidated into a Direct Consolidation Loan before the end of April 2024 2023 to be eligible for forgiveness consideration.

What if I find privately held FFELs in my federal student loan portfolio?

To keep your loan portfolio as simple as possible, choose a loan servicer that keeps as much of your portfolio with the same servicer as possible. For example, in the image above showing both federally held and privately held student loans, consolidate the privately held loans only, and choose the loan servicer who manages your federally held loans (Aidvantage in the image). Be aware that consolidation will add any unpaid interest you have to your principal for the loans being consolidated. Using the image above again as an example, consolidating the privately held loans with Navient into a Direct Consolidation Loan to be managed by Aidvantage will also capitalize the $5,619 of unpaid interest to the principal. The resulting Direct Consolidation loan for the example will have a principal balance of $184,877.

Capitalization is not a reason to avoid consolidation. The special forgiveness consideration will generally outweigh the impact of any unpaid interest capitalization. However, you may want to do a good “physical exam” of your student loans with the help of VIN or VIN Foundation on the freely available Student Debt Message Board areas before you consolidate to be sure it makes the most sense for you.

Some additional good news: Any privately/commercially held FFEL balance you consolidate will also be eligible for the pandemic forbearance benefits, recently extended into 2023, possibly through August 2023. that are in place through at least December 31, 2022. Whichever repayment plan you choose, no interest and no payment will be due through the remainder of that period. However, to assure that your post-consolidation and post-special-forgiveness-recount repayment time is forgiveness eligible, choose an income-driven repayment plan.

A few minutes of your time to save significant time, money, and stress on your student loans

This all probably sounds like a lot of work. Actually, it takes longer to write it out than it does to do these steps. But for many of you who have been in student loan repayment for a long time, this is well worth the small effort to maximize these special benefits.

Ideally, once the one-time forgiveness count is complete (by July 1, 2024), you will have a better idea of the exact number of months and years of qualifying student loan forgiveness time. Some will even receive retroactive forgiveness if they surpass 20-25 years of eligible repayment time (likely 25 years for most veterinarians). Any payments made beyond that forgiveness period will be refunded to you. Bonus!

Borrowers who have reached the required number of years in repayment to receive forgiveness should receive word as their loans are reviewed. All others will see their count adjustments applied before July 1, 2024.

Again, this is a big f-ing deal. Student loan forgiveness could be closer than you realize, particularly if you have been paying on your student loans for a long time. Don’t miss out on this unique opportunity to rid yourself of your remaining student loan debt sooner and cheaper.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected] – we’re here to help!

15 thoughts on “Got Federal Student Debt? You’re Now Closer to Forgiveness Than You Think”

Great post! and incredible blog! Very helpful post! I must say. Simple & interesting. Wonderful work!

Thanks for sharing. I really appreciate it that you shared with us such informative post, great tips and very easy to understand.

Im having a hard time understanding fully…If I graduated undergrad in 2007 and vet school in 2016 and have Dep of Ed loans from both schools, would I qualify for this special forgiveness or no? Thanks:)

Hi Katie, thanks for posting! Chances are that if you finished undergrad in 2007 and started veterinary school in 2016, you had about 9 years of repayment time on those undergraduate loans before borrowing for veterinary school. If you still have a balance on any of those undergraduate loans and consolidate them with your veterinary school loans, you can increase your forgiveness qualifying time under the one-time forgiveness count adjustment. Since you have veterinary school loans, I would highly recommend that you submit a student debt and income signalment form so we can go through your loans in a bit more detail with you over on the VIN and VIN Foundation Student Debt Message Board area.

Hi Tony and team.

I heard about this on Wednesday’s webcast, and have been reading more about it since.

Looking at my loans in the Student Debt Center (and examining the raw text file from studentaid dot gov), I hold a single Direct Consolidated loan thru MOHELA, which has a ‘repayment begin date’ of June 2020. Looking at the history of the Stafford Unsubsidized loans that were consolidated into that loan, they also show a ‘repayment begin date’ of June 2020, even though I did make some payments towards those loans before 2020, while I was still in school.

Is there a possibility that I benefit from an adjustment to reflect the timing of the first payments made prior to consolidation? Or do those not count, since the loans themselves were not yet “in repayment”?

Thanks!

Hi Andy,

Thanks for joing the recent Climbing Mt. Debt Webinar and posting! If your only remaining loan is a Direct Consolidated loan, then you simply wait to receive your count adjustment. We are expecting those counts to be applied in 2024 for anyone who hasn’t already passed the threshold needed to receive forgiveness. If you have previous repayment time on those loans that were included in your consolidation, then you will receive an adjusted count to reflect that. If not, then you should receive at least 3-4 years of credit form the June 2020 date when you consolidated your loans. Clear as mud? 🙂

Hi Andy, Thanks for posting a comment! My apologies for the delayed reply — it’s been a bit crazy on the student loan front since that webinar 🙂

Your interpretation is correct — since the loans were not officially in repayment, that would not count towards the forgiveness count adjusment. In-school deferment and grace period time is not eligible to be included in the forgiveness count adjustment, even if you make payments during that time.

This will not help if we had an in school deferment correct? For instance, my first loan went into repayment in 2009 but then was deferred the next month when I went back to school. I graduated fully in 2017 with my doctorate. This happened a few times so if I were to consolidate, I would only gain the 3-4 months total payments not the full 8 years from 2009-2017. Is this thinking correct?

Hi Sandy,

Thanks for posting! You are correct: in-school deferment time is not counted in the one-time count adjustment. Looking at your student aid file that you uploaded to the My Student Loans tool, I would agree with your thinking. You do have one small FFEL program loan remaining that would be eligilbe for REPAYE (SAVE) if you wanted to consolidate that one loan into a new Direct Consolidation loan. That would allow you to get them all into SAVE, preserve the forgiveness time you have now (probably 6 years), and avoid the unpaid interest capitalization. But you could also leave them as is.

Hi Sandy,

Thanks for posting a comment! In-school deferment and grace period time is not counted in the special forgiveness count adjustment. If your loans were in an in-school deferment until you graduated in 2017, then your repayment time would have started after you graduated and your grace period ended. If you had a break at all during that borrowing where you were not enrolled in school for more than 6 months, then you could have some extra repayment time, but it doesn’t sound like it from your comment.

Your information is so thorough and I appreciate it so much. Despite the detail you have provided, I am still having trouble understanding if I qualify and if I should be consolidating and/or adjusting my IDRP. Thank you for all of this, it is really appreciated!

Hi Jenny, thanks for posting a comment! Through the magic that is VIN and VIN Foundation, I can see too that you have submitted a student debt and income signalment form. We’re a little behind on replies but we shall get to yours soon. But more importantly, you have the answer to your question in the student aid file you provided with your signalment form. Upload your file to the VIN Foundaiton My Student Loans tool. You’ll see an alert pop up if we detect the type of loans that would warrant consolidation before the end of the year. I took a quick peak at your file and I see that you CAN benefit from using a Direct Consolidaiton Loan before the end of this year. You should receive a couple of years extra forgiveness time after you consolidate and the count adjustment is applied in 2024. You also will need to switch your loans from IBR 2009 to SAVE — better to do that via consolidation so you can earn the extra forgiveness time than to just switch in your scenario. Hope that helps and we’ll catch you over on the VIN Foundation Student Debt Message boards for a more comple “physical exam” of your loans in the next week or two.

Thank you so much for this!

What about time in forbearance? Does that go towards the total count?

Hi Allison,

Thanks for posting your comment! As a veterinarian, I was able to see your student aid data file in the VIN Foundation My Student Loans tool. You have the loan types that must be consolidated first before you will receive any forgiveness credit under the one-time count adjustment. After your loans are consolidated, you will be in the group of folks whose loans will be reviewed and the count applied in 2024. Any repayment time and certain forbearance time is counted in the adjustment. I would review this recently updated page on the studentaid.gov website for more information: https://studentaid.gov/announcements-events/idr-account-adjustment

If you need additional assistance, please post to the VIN or VIN Foundation Student Debt message board area and/or complete a student debt & income signalment form: https://surveys.vin.com/s3/VF-StudentDebtAndIncomeSignalmentForm