Documenting income is a source of financial, emotional, and logistical stress for those with student loans as well as for the loan servicers who process the applications.

In general, there are three ways to document your income: 1) the Adjusted Gross Income (AGI) from a recent tax return, 2) providing alternative documentation, like a paystub or offer letter, or 3) indicating that you have no taxable income.

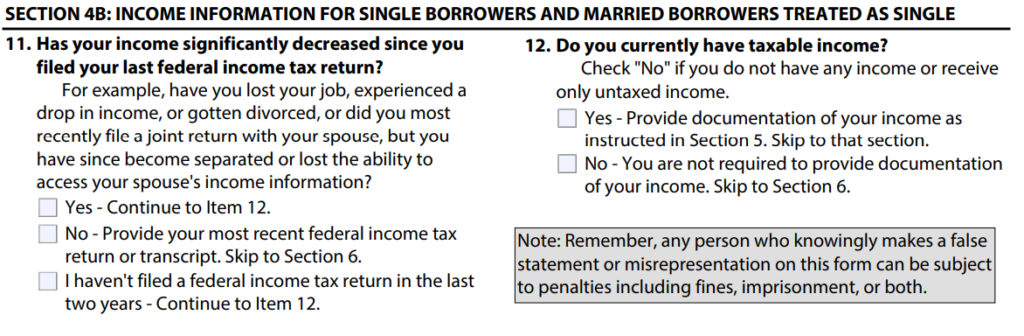

In the previous version, the income documentation question (Section 4B, 4C, or 4D) stated: “Has your income significantly changed since you filed your last federal income tax return?”

The “significantly changed” portion of that question has been a significant point of contention for many veterinarians using IDR. If your income increased, what defined a significant change? In many cases, that wording led some borrowers to submit both tax returns and paystubs to their loan servicers to let them figure it out.

Spoiler Alert — you do NOT want to let your loan servicers figure out the best repayment plan for your circumstances.

Pick the IDR plan that is best for you and choose a single form of income documentation from the three listed above that most closely matches your current situation and satisfies the rules. If you let your loan servicer pick for you, you may not like nor understand the results. If they request additional documentation, then provide it. But start with one and go from there.

The recent update to the IDR Plan Request form makes the income documentation algorithm a little easier to navigate. The income sections (4B, 4C, 4D) ask: “Has your income significantly decreased since you filed your last federal income tax return?” Notice the small, yet significant, difference? Instead of wondering what to do if your income has increased, you now can more comfortably use your most recent tax return unless your current income is less than the AGI from your most recent tax return.

Essentially, ED is favoring the use of your tax return for income documentation. If you are able to answer NO to the updated question about your income significantly decreasing, then applying/renewing your IDR plan is easier, quicker, and reduces the likelihood of mistakes by your loan servicer.

Your monthly income-driven payment amount is also not a mystery. The calculation is straightforward. If you are applying for or renewing your income-driven repayment plan, you should know ahead of time what your monthly payment is going to be. If your loan servicer calculates something different than you expect, then you have a reason to call and compare notes.

An income-driven monthly payment is a percentage of your “discretionary income.”

Discretionary income = Your adjusted gross income – 150% of Federal Poverty Guidelines

Let’s review each variable in the equation.

Adjusted Gross Income (AGI) is pulled directly from your tax return. It is the basis for determining the federal income taxes you pay. If you use a tax return, AGI is found on line 7 of your form 1040.

If you utilize alternative documentation, your gross income is not the same as your AGI. If you have pre-tax deductions from your paystub, like 401k contributions, health insurance premiums, health savings account contributions, or other items that are subtracted from your gross income, make sure to account for those in your alternative documentation submission. Together with indicating your pre-tax deductions and your pay frequency, you should calculate an annualized taxable income that you will use in the discretionary income formula.

Family size is defined in the IDR Plan Request and “always includes you and your children (including unborn children who will be born during the year for which you certify your family size), if the children will receive more than half their support from you.” Family size can also include other people who live with you and receive more than half of their support from you.

If you are married, your family size includes your spouse, regardless of your tax filing status. The only exception to counting your spouse is under REPAYE if you indicate that your spouse’s income documentation is not reasonably attainable.

Now we can fill in all of the variables in the discretionary income equation. For example, let’s say you are married, have one young child, and the last time you filed your taxes, you filed jointly. The AGI (Line 7) from your recent tax return shows $135,645. You are renewing your income for PAYE. Your discretionary income is —

$135,645 – 1.5*$21,330 = $103,650

PAYE requires you to pay 10% of your discretionary income each month:

0.10*$103,650 = $10,365/year or $864/month