Choosing a repayment plan for your federal student loans has never been more challenging. Recent court rulings, administrative changes, loan servicer processing delays, and new laws have created uncertainty around the federal income-driven repayment (IDR) plans.

And just recently, the Department of Education announced the end to the zero-interest benefit of the Saving on a Valuable Education (SAVE) plan forbearance starting August 1st, forcing many borrowers to select a new repayment plan quickly.

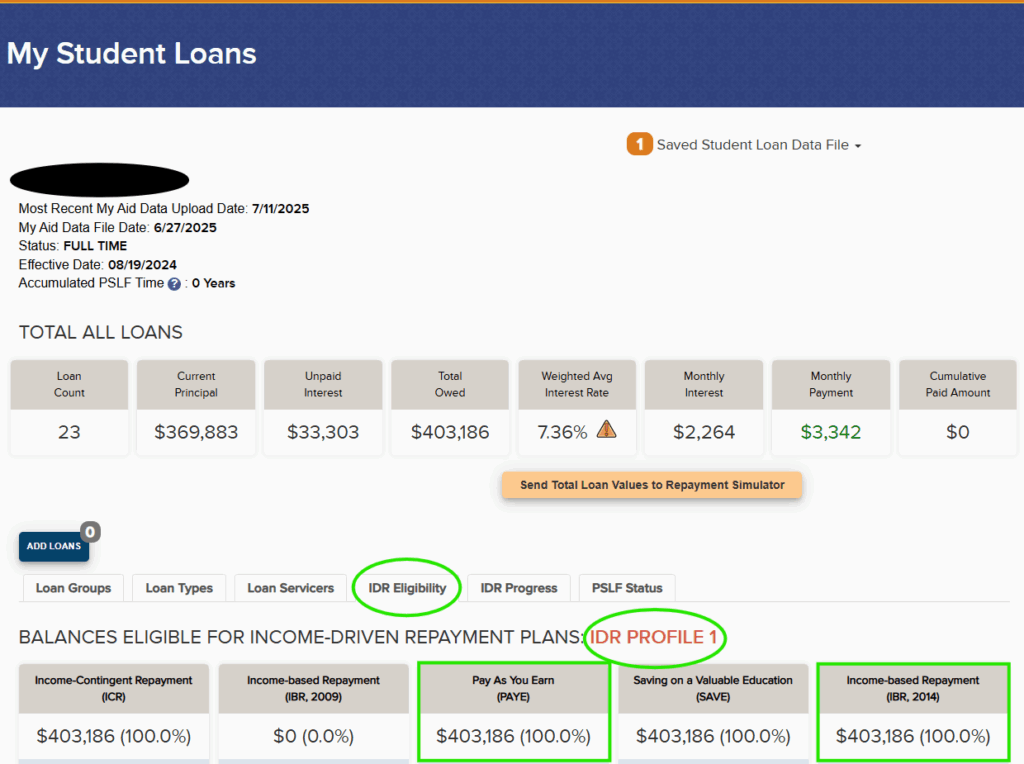

When evaluating and selecting an IDR plan, it helps to know your IDR Profile. Your federal student loan types and borrowing history determine your IDR Profile. VIN Foundation created the IDR Profile to help simplify the IDR plans available to a borrower.

You can see your IDR profile when you upload your federal student aid data file to the VIN Foundation My Student Loans tool and check the “IDR Eligibility” tab:

If you’re in either IDR Profile 1 or 2, you’ll have access to Pay As You Earn (PAYE) — your next best repayment option after SAVE, at least in the short term.

Expert Tip: Know Your IDR Profile

- Grab a student aid data file from studentaid.gov;

- Upload it to the VIN Foundation My Student Loans tool;

- Review the IDR Eligibility tab

Why Choose PAYE over IBR 2014?

PAYE first became eligible for borrowers in 2012. To be eligible, you must have received your first federal student loan after October 1, 2007, and receive at least one loan after October 1, 2011.

Income-Based Repayment (IBR) comes in two flavors: the original became available in 2009 (IBR 2009). It has a maximum repayment period of 25 years for graduate and professional school borrowers such as veterinarians. Its minimum monthly payment is 15% of the borrower’s discretionary income, and the monthly payment is no more than what the borrower would pay on a 10-year fixed payment schedule.

An updated version of IBR came out in 2014 (IBR 2014), available to borrowers who received their first federal student loan after July 1, 2014. IBR 2014 has a maximum repayment period of 20 years and a minimum monthly payment of 10% of discretionary income, with a similar payment cap.

You are either eligible for IBR 2009 or IBR 2014. They are mutually exclusive.

Borrowers eligible for both PAYE and IBR 2014 are in IDR Profile 1. They are typically those who graduated from school more recently. PAYE and IBR 2014 are very similar repayment options. The minimum monthly payments would be the same for either.

Borrowers eligible for PAYE and IBR 2009 are in IDR Profile 2. There’s really no good reason to use IBR 2009 over PAYE.

In the recently passed legislation, unfortunately, PAYE will be phased out on July 1, 2028, even for those currently using it. The new law also amended IBR 2014, and a new income-driven plan called the Repayment Assistance Program (RAP) will be available starting July 1, 2026.

In the meantime, you need to get your loans to 2026 before you decide if RAP is right for you. If you’re in either IDR Profile 1 or 2, then choose PAYE.

The main difference between PAYE and IBR is how they treat your unpaid interest. Let’s say you have about $25k of unpaid interest when you graduate from veterinary school. You are not charged additional interest on your unpaid interest until or unless it capitalizes = gets added to your principal. Why does that matter? Unpaid interest is treated differently between PAYE and IBR when you leave those plans, such as choosing the new RAP when it becomes available.

If you have to leave PAYE, then your unpaid interest does not get capitalized. However, when you leave or have to leave IBR, your unpaid interest will get capitalized.

Ideally, we try to avoid any capitalization. The higher your principal, the more interest accrues and the higher your repayment costs.

If my dog were in IDR Profile 1 or 2…

If you’re a new graduate and you will be selecting a repayment plan as your grace period ends, choose PAYE. Having your loans in PAYE will decrease the chances of your unpaid interest capitalizing when you have to move out of PAYE by July 1, 2028.

If your loans are in the SAVE forbearance and you are trying to select another forgiveness-eligible plan, then choose PAYE. You’ll need to select a new repayment plan before July 1, 2028, but using PAYE in the short term will help you decrease your repayment costs.

If your loans are already in IBR 2014, leave them in IBR 2014. There’s nothing wrong with being in IBR 2014. However, if you try to switch your loans into any other repayment plan, your unpaid interest will get capitalized (added to your principal). Again, try to avoid the capitalization if possible. If you choose to leave IBR 2014 for RAP later, your unpaid interest will be capitalized. So be it. We can more critically evaluate that scenario as RAP becomes available.

What if I’m not interested in another income-driven plan?

Understandable. The constant changes are enough to make anyone look for another repayment strategy.

Federal student loans can also be repaid using a number of time-driven repayment plans. These plans determine your payment based on your balance, interest rate(s), and the time you choose to repay the loan.

For loans that are not consolidated, you can choose a time-driven plan a repayment period between 10 and 25 years, depending on the amount you borrowed. Most veterinarians are eligible for a 25-year time-driven plan.

Consolidated loans can use a 30-year time-driven plan as long as your consolidated balance is greater than $60,000. Most veterinarians are eligible for a 30-year repayment option for consolidated loans.

Your remaining repayment time in the time-driven plans accounts for any time your loans have already spent in repayment. For example, if your loans have been in repayment for 5 years (not including forbearance or deferment time), then you would have 20 years remaining on a 25-year time-driven plan. Your minimum monthly payment will be calculated to repay your balance in that remaining 20-year period. The shorter your remaining repayment period, the higher your minimum monthly payment.

While you can choose any of the time-driven repayment options, be aware that the minimum monthly payments in most cases will be much higher than you’re required to pay using an income-driven plan. There is likely a reason you were using an income-driven plan, right?

You also will not receive any forgiveness credit for payments made using a time-driven plan. Better to receive forgiveness credit and end up not needing it than to find out later that you could have had your loans forgiven, but were not earning forgiveness credit.

Income-driven plans are still available and still very helpful, particularly if your student debt balance exceeds your annual income.

Need student debt help? I know I do 🤯

Have more questions? Post a comment below or email [email protected].

We’re here to help!

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

11 thoughts on “Student Loan Repayment: Trying to leave the SAVE forbearance? Choose PAYE.”

IDR3 category currently in SAVE forbearance. Is the recommendation for me to still switch to PAYE? Thanks!

Hi Meredith,

Thanks for your post!

I can see from the student aid file you uploaded to the VIN Foundation My Student Loans tool that you’re in IDR Profile 3 — that means you won’t be eligible for PAYE. You have access to IBR 2009 and ICR income-driven repayment plans. You can choose either of those (pick the one with the lowest minimum monthly payment) or you can leave your loans in the forbearance. Just know that if you do not switch, you’ll accrue interest and receive no forgiveness credit.

You can receive forgiveness credit using IBR 2009 or ICR. ICR will only be available through July 1, 2028. If you do choose ICR, then you’ll need to choose another plan (IBR 2009 or the new Repayment Assistance Program) before ICR is eliminated.

Since you have some unpaid interest, know too that if you move to IBR then choose RAP later, your unpaid interest will get capitalized. Depending on what your monthly payment is using IBR or ICR, you may have less unpaid interest or more. Unfortunately, switching out of IBR is a capitalization trigger (adds your unpaid interest to you principal). It’s not the end of the world, but something to be aware of since it can increase your long-term repayment costs, particularly if you don’t reach forgiveness.

Generally, we try to avoid unpaid interest capitalization when we can.

If you’d like more detailed help, submit a new Student Debt & Income Signalment form and we’ll add it to your student debt discussion that we have going on the message boards!

Hi Meredith,

If you’re in IDR Profile 3, then you will not be eligible for PAYE. You would need to switch to either IBR 2009 or wait until the new Repayment Assistance Plan (RAP) is available for an income-driven repayment option.

It looks like we have a more detailed discussion going for you over on the VIN and VIN Foundation Student Debt Message Board — looking forward to hearing your thoughts on your student loan “physical exam” there 🙂

Hi I’m trying to leave SAVE forbearance and PAYE is an option. Going with PAYE, will my monthly months count for forgiveness credit?

Hi Dave,

Thanks for posting! Yes — payments made using PAYE count for forgiveness credit. Per the recent tax and spending legislation, PAYE will no longer be available after July 1, 2028. That’s a few years away, but you’ll want to start thinking about which repayment plan(s) you will benefit from when PAYE is eliminated.

Good luck! 🙂

Hi!

I’m really concerned about MOHELA. I’ve been reading about lawsuits and unethical practices. Is this true? If so, do I need to do anything?

Also, will my adjusted count to forgiveness be honored? Thanks!

Hi Craig,

Welcome back 🙂 And thanks for posting on the VIN Foundation blog!

Unfortunately, all the federal student loan servicers are terrible and you can’t choose another (except during consolidation — but consolidation is not a great idea for most borrowers right now). There’s not much you can do about terrible loan servicing other than to watch them very closely, double-check their math and everything they tell you, and call armed with information when you find something that is not quite right.

You may have to ask for a supervisor or someone there that is experienced with income-driven plans for any questions related to SAVE, PAYE, IBR or recent changes. Write down who you speak with and what you are told.

>>>Also, will my adjusted count to forgiveness be honored?<<< It should be. The trick is finding your IDR forgiveness progress data. Right now, that can be tough to find. You can try the "back door" by logging into studentaid.gov, then opening up a new browser tab and enter https://studentaid.gov/app/api/nslds/payment-counter/summary.

That will show you some ugly-looking text for your forgiveness count. Keep a copy of it for your records. If you need some help interpreting it, complete a new secure Student Debt & Income Signalment form like you did a couple of years ago and include it with your submission or post the forgiveness count data in your dedicated anonymous discussion in the VIN Foundation message board area available to veterinarians.

Hope that helps! Looking forward to continuing to help in any way that we can 🙂

Hi Dr. Bartels,

Thank you so much for this useful advice! I’m a 2025 grad in IDR Profile 1. I recently selected PAYE as my IDR plan based on this information as well as the lovely VIN 2025 Student Loan Repayment Playbook (big thank you for that as well!)… but then I started wondering, what if the new RAP is ~awful~ compared to IBR 2014? Obviously there’s no way to predict this, but it does have me worried. Once PAYE is phased out, will I have to option to choose between IBR 2014 and RAP, or will I essentially be forced to select RAP? I’m concerned I will end up regretting choosing PAYE if IBR 2014 somehow becomes unavailable to me and RAP ends up being worse than IBR 2014. Any thoughts on this?

Hi Rhiannon,

Thanks for posting! And great question.

>>>what if the new RAP is ~awful~ compared to IBR 2014? Obviously there’s no way to predict this, but it does have me worried. <<< The new Repayment Assistance Plan (RAP) is going to be pretty awful compared to IBR 2014. We already do know that from the details in the law that created RAP. While RAP does have a few nice features, it’s financially awful compared to IBR 2014 in most cases.

The reason for choosing PAYE over IBR 2014 now is to prevent your unpaid interest from capitalizing if it ends up that you could benefit from RAP or some future plan that might be more beneficial. Unfortunately, leaving IBR results in your unpaid interest capitalizing (being added to your principal). The higher your principal, the more interest accrues, and the more you’ll pay in repayment (unless you reach Public Service Loan Forgiveness).

>>>Once PAYE is phased out, will I have to option to choose between IBR 2014 and RAP, or will I essentially be forced to select RAP?<<< According to the new law, as long as you do not receive a loan after July 1, 2026, you will be eligible for IBR 2014 even as PAYE is phased out after July 1, 2028. As we saw this summer when the recent tax and spending law changed student loan repayment, keep an eye out for future changes. We can't predict what the next set of changes will be, but if past is any prologue, there will be future changes to student loans. For now, choose the best plan available given the information we have right now. For you, that looks like PAYE, then likely switching to IBR 2014 as PAYE is phased out...unless, something changes between now and then, right?

Each year, re-evaluate your options. As your circumstances change or as we see more student loan changes, we can adjust course if need be.

What do you think — sound like a plan?

I am in IDR profile 2 and currently been in SAVE forbearance since graduating in 2022 (not paying anything monthly but also not making progress toward forgiveness). Should I stay in SAVE forbearance for the time being and then switch when forced to (I don’t know what that date is). If I wait to switch until SAVE is gone, can I still switch to PAYE for now and then switch to IBR 2009 when I have to? Or do I switch to PAYE now and start paying so at least I’m in PAYE until switching to IBR 2009 in 2028? It’s all so confusing. I am worried I will somehow not be eligible to switch to IBR 2009 and being forced onto RAP which would not be ideal. Thanks so much for your help!!

Hi Cassidy,

Thanks for posting! A few thoughts on your comments and concerns…

>>>Should I stay in SAVE forbearance for the time being and then switch when forced to (I don’t know what that date is).<<< It depends. What would your payment be using PAYE if you were to apply now using either your 2024 tax return AGI or some recent income information? If you can get a reasonable monthly payment that works for your budget, then apply now. You're able to use PAYE until July 1, 2028, when it is scheduled to be officially eliminated. >>>If I wait to switch until SAVE is gone, can I still switch to PAYE for now and then switch to IBR 2009 when I have to? Or do I switch to PAYE now and start paying so at least I’m in PAYE until switching to IBR 2009 in 2028? <<< Yes -- either would be OK. You can apply for PAYE now or any time before it is eliminated. You can also choose to remain in the SAVE forbearance for as long as they let you. But unless something changes between now and July 1, 2028, you will have to choose another plan before then (either IBR or RAP if you want to continue using an income-driven plan) or one of those will be selected for you. Ideally, you would choose the plan that works best for you. Don't let them choose the plan for you. >>>I am worried I will somehow not be eligible to switch to IBR 2009 and being forced onto RAP which would not be ideal.<<< The recent law says that you have the option to choose a plan that you're eligible for before July 1, 2028. That would be IBR 2009, RAP, or another time-driven option. If you're still using a plan that is scheduled for elimination on July 1, 2028, then you're likely to be placed into RAP if you don't select another. It's not clear (yet) if you'll be able to move from RAP to another plan (like IBR 2009). So don't let them choose a plan for you :-) If you decide to be in RAP, great! But make sure you're making that decision instead of letting it be made for you. >>>I am in IDR profile 2 and currently been in SAVE forbearance since graduating in 2022 (not paying anything monthly but also not making progress toward forgiveness). <<< I agree that you're in IDR Profile 2. However, it looks like your loans were in repayment from 9/1/2023 – 11/19/2024 before being place in forbearance. So you may have some forgiveness-eligible time? It’s worth a more recent detailed dive into your student loans.

You do have a discussion going in the VIN Foundation Student Debt Message Board area. If you login to the Student Debt Center, you’ll see a link to your Message Board discussion in the navigation bar with a little red alert icon next to it. Click that and post some updated income information and we can go from there.

Sound like a plan?