Poverty guidelines are used for many different U.S. government programs. One of the most important uses for veterinarians is the Discretionary Income calculation used to generate the minimum monthly student loan payment of federal income-driven repayment plans (IBR, PAYE, REPAYE). Income-driven student loan repayment plans are extremely helpful for those veterinary graduates with student loan balances greater than their annual incomes.

Here’s an example of how you can use the poverty data to math check your loan servicers:

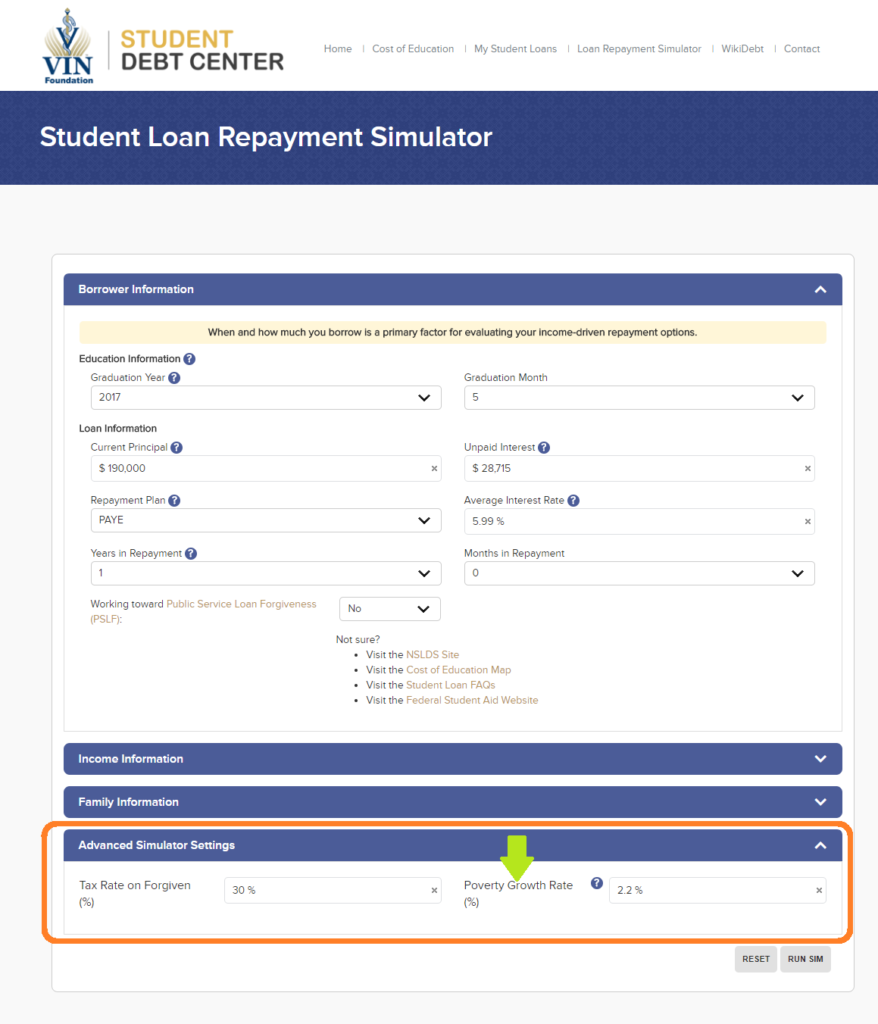

How will the Poverty Guidelines Growth Rate impact your loan repayment simulations?

And don’t forget the new My Student Loans tool in the VIN Foundation Student Debt Center — where you can upload your student aid data file to summarize the loan data you’ll need to enter into the simulator.

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “Estimate Your Minimum Monthly Student Loan Payment”

Hello Dr. Bartles, I am so glad I found this. I am an upcoming first year at LSU’s vet program and I am starting to feel the weight of my student loans. I figure that by the end I will accrue roughly 260k plus interests in loans by the time I am finished with school. Part of me is trying hard not to panick and I could really use some financial advise on how to handle debt.

Thanks for the feedback, Sabrina! And congrats on starting vet school this Fall 🙂 The great news is you haven’t started borrowing for vet school yet. That means you have some control over what happens. Scrutinize your financial aid awards closely. Try to minimize the amount o Direct Grad PLUS loans you take, look for any/all opportunities to obtain scholarships and grants, look into Health Professions Student Loans, and be sure to return/refuse loan award amounts offered to you in excess of what you need. If you borrow more than you need, you can return the extra amounts within 120 days and you won’t be charged the interest or fees for that loan. It’s always better to return/reduce your excess loan award amounts rather than pay the interest while you’re in school. Build your budget, find some roommates and do the best you can to borrow only what you need. Tools like the VIN Foundation Cost of Education Map can help while you’re in school and the VIN Foundation Student Loan Repayment Simulator can help you choose your repayment options as you finish vet school. Good luck and please feel free to reach out with any additional questions as you work your way through veterinary school — we’re here to help!