The recently updated 2018 Health and Human Services (HHS) poverty guidelines determine your minimum monthly student loan payment.

Poverty guidelines are used for many different U.S. government programs. One of the most important uses for veterinarians is the Discretionary Income calculation used to generate the minimum monthly student loan payment of federal income-driven repayment plans (IBR, PAYE, REPAYE). Income-driven student loan repayment plans are extremely helpful for those veterinary graduates with student loan balances greater than their annual incomes.

HHS poverty guidelines are updated annually in January based on recent inflation data. If you’re applying to use income-driven student loan repayment or renewing your annual income documentation in the coming days/weeks/months, your minimum monthly payment calculation will use the recently updated poverty guidelines for your family size and state of residence. You should always double-check your loan servicer to make sure your minimum monthly student loan payment is correct. Loan servicers like Navient, Nelnet, Great Lakes and FedLoan Servicing frequently make mistakes and usually not in a way which benefits you.

Here’s an example of how you can use the poverty data to math check your loan servicers:

Let’s say you’re renewing your PAYE plan this February. You’re married, you have one child, and you filed your most recent tax return jointly and plan to file your 2017 tax return jointly as well. Maybe your combined taxable income is $150,000 and your family size is 3. Your minimum monthly PAYE payment is based on a measure called Discretionary Income, which is dependent upon your taxable income and family size:

Discretionary Income = Taxable income – 150% of the poverty guidelines for your family size and location.

The 2018 federal poverty guideline for a family of 3 in the lower 48 states is $20,780. (If you live in Alaska or Hawaii, the poverty guidelines will be higher.)

In this example, your Discretionary Income = $150,000 – 150%($20,780) = $118,830

PAYE is 10% of your Discretionary Income = $11,883/year or $990/mo.

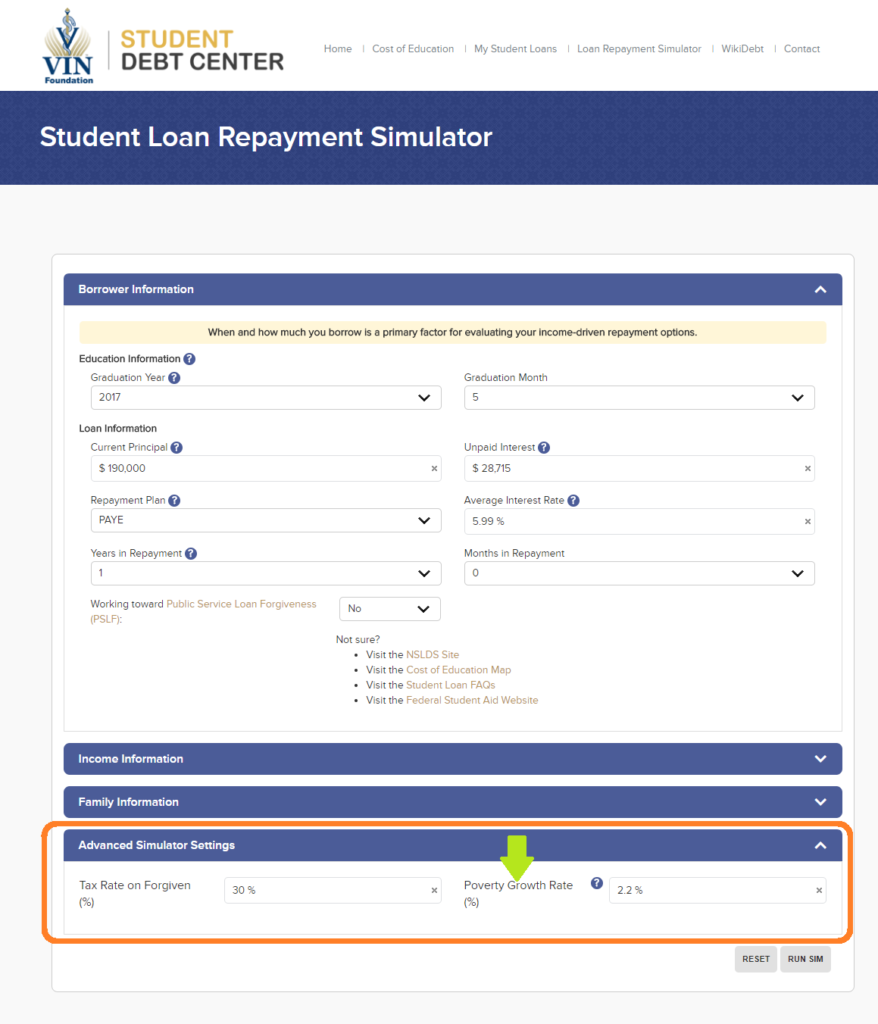

Take this opportunity to check your loan servicer, re-evaluate your loan repayment plan, and run some loan repayment simulations using the VIN Foundation Student Loan Repayment Simulator.

You’ll find a “Poverty Growth Rate (%)” field in the “Advanced Simulator Settings” of the Loan Repayment Simulator.

This setting adjusts HHS Poverty Guidelines over time by the rate you specify. Generally speaking, poverty guidelines track inflation but with a one year lag. Changes for 2018 used inflation adjustments between 2016 and 2017. The 2019 poverty guidelines will be based on inflation between 2017 and 2018, which has been 2.1% (unadjusted).

Recent inflation trends have been below the long-term historical average of 3-3.5%; however, inflation is on a current trajectory to return to a more average value in the coming years.

How will the Poverty Guidelines Growth Rate impact your loan repayment simulations?

The higher the poverty guideline growth rate you enter, the lower your total student loan repayment costs. Inversely, the lower value you use, the higher your total repayment costs. It’s impossible to know exactly what inflation will do in the future, but history is a good gauge. Stick to a conservative estimate for simulations using something between 2-3% for the duration of loan repayment.

Happy Simulating!

And don’t forget the new My Student Loans tool in the VIN Foundation Student Debt Center — where you can upload your NSLDS files to summarize the loan data you’ll need to enter into the simulator.

As always, if you have questions or feedback on the Student Debt Center resources, please do not hesitate to ask!

Tony Bartels, DVM, MBA

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “Estimate Your Minimum Monthly Student Loan Payment”

Hello Dr. Bartles, I am so glad I found this. I am an upcoming first year at LSU’s vet program and I am starting to feel the weight of my student loans. I figure that by the end I will accrue roughly 260k plus interests in loans by the time I am finished with school. Part of me is trying hard not to panick and I could really use some financial advise on how to handle debt.

Thanks for the feedback, Sabrina! And congrats on starting vet school this Fall 🙂 The great news is you haven’t started borrowing for vet school yet. That means you have some control over what happens. Scrutinize your financial aid awards closely. Try to minimize the amount o Direct Grad PLUS loans you take, look for any/all opportunities to obtain scholarships and grants, look into Health Professions Student Loans, and be sure to return/refuse loan award amounts offered to you in excess of what you need. If you borrow more than you need, you can return the extra amounts within 120 days and you won’t be charged the interest or fees for that loan. It’s always better to return/reduce your excess loan award amounts rather than pay the interest while you’re in school. Build your budget, find some roommates and do the best you can to borrow only what you need. Tools like the VIN Foundation Cost of Education Map can help while you’re in school and the VIN Foundation Student Loan Repayment Simulator can help you choose your repayment options as you finish vet school. Good luck and please feel free to reach out with any additional questions as you work your way through veterinary school — we’re here to help!