Student loan repayment is financially and emotionally stressful. The earlier you have a student loan repayment strategy, the more time, money, and stress you can save yourself throughout repayment. As a veterinary student and new veterinary graduate, you can take action to jumpstart your financial wellness and minimize your student loan repayment costs.

It all starts with a tax return. While most veterinary students are not required to file a tax return during school, you can (and should) voluntarily file a federal tax return before you graduate, ideally during the last year of veterinary school. Doing so can really help with your post-graduation student loan repayment strategy and improve your financial wellness. For example, if you’re graduating in the spring or summer of 2021, file a federal tax return before April 15th of 2021 even if you don’t have to.

It’s hard to have an income less than zero. Thus, with your AGI from your last year of veterinary school available, you can truthfully answer “no” and secure a $0/month payment using IDR for the first 12 months of repayment.

A zero dollar minimum payment on your student loans for the first 12 months will free up valuable resources to jumpstart your financial wellness. The money you are saving on student loan payments will allow you to:

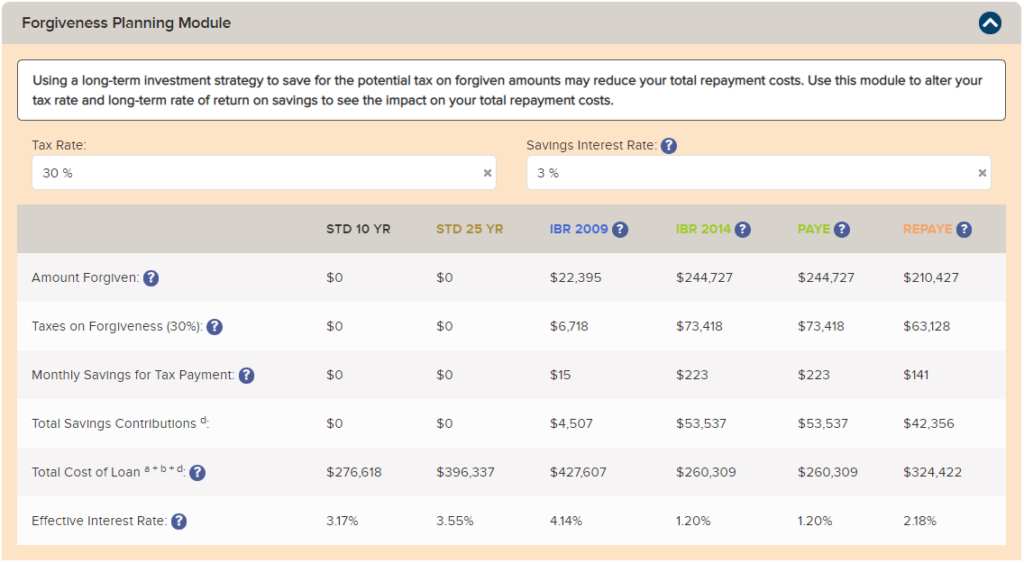

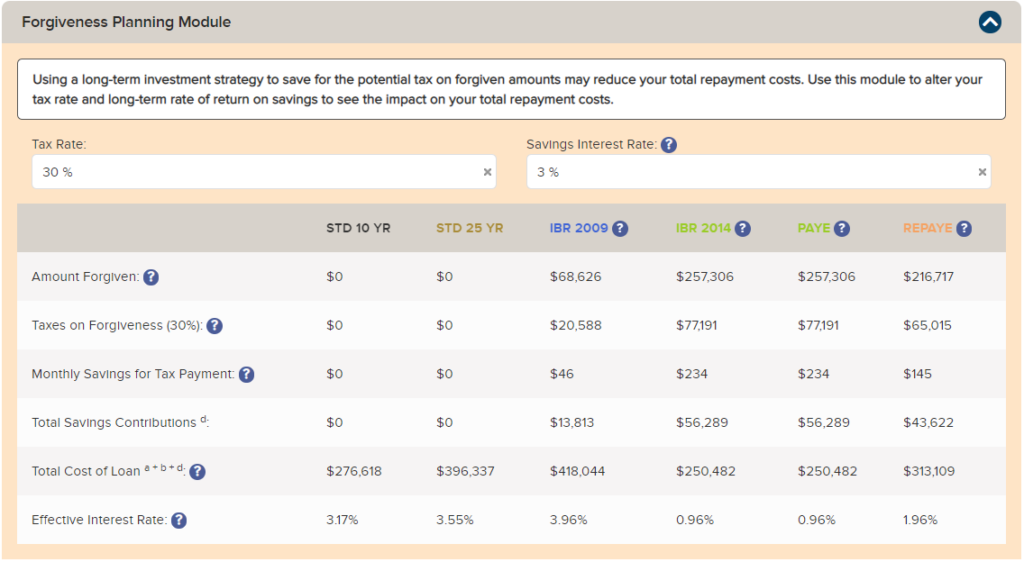

The average reported veterinary student debt to income ratio is 2.1 for the U.S. 2020 graduating class. Thus the average veterinary graduate is likely to benefit from a PAYE student loan repayment strategy that can include paying a tax on student loan forgiveness 20 years after starting repayment.

When you anticipate reaching a tax on student loan forgiveness, the most beneficial financial strategy is to pay the minimum your income requires and plan for the tax due on forgiveness. Filing a tax return before you graduate helps to minimize your early payments and reduce the overall total student loan repayment cost you experience with forgiveness.

You will probably start your first private practice job about midway through the calendar year after graduation. When the first April 15th tax filing deadline after your graduation comes around, even if you’re earning the equivalent of $100,000 per year, only about half will be taxable income for that year.

When you renew your income-driven repayment documentation, once again, you’ll be able to answer “no, your income has not significantly decreased since you filed your most recent tax return.” The result will be another twelve months of low student loan payments using your income-driven repayment plan. It’s not until your third year of repayment (starting month 25 of repayment) when you can expect to have an IDR payment more closely representing a full year of taxable veterinary income.

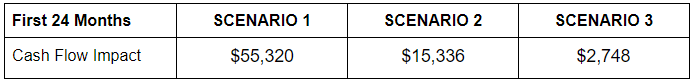

Let’s assume we have a 2021 veterinary school graduate with $210,000 of student debt at 5.75% and a $95,000 income in private practice. She did not have a tax return on file at graduation and is planning to pay her student loans off as fast as possible, sticking with the standard 10-year repayment plan. Her minimum monthly student loan payment would be about $2,305/month for the duration of repayment and $55,320 for the first two years (24 months) of repayment.

Next, let’s say the new graduate uses her salary as income-documentation for the PAYE repayment plan. The minimum monthly payment for the first 12 months would be $629/month. For the second 12 months of repayment, their minimum monthly payment would be about $649/month. The total payments made during the first 24 months of student loan repayment using PAYE would be about $15,336.

Finally, let’s look at the same new graduate but assume she has a tax return with a zero AGI on file at graduation (filed April 15th the year of graduation). She consolidates her student loans using a federal Direct Consolidation Loan, ends her grace period, applies for PAYE using her most recent AGI, and chooses FedLoan Servicing/PHEAA as her loan servicer. She enters the first 12 months of PAYE with a $0/month payment that also counts towards forgiveness. Let’s assume her first tax return on file as a veterinarian shows an AGI of $47,500, about half of her annual veterinary salary. Her second 12 months of repayment will have a minimum monthly payment of about $229/month. The total payments made during the first 24 months of student loan repayment using PAYE and your tax returns would be about $2,748.

Below is a comparison chart of the cash flow impact to the new graduate example above during the first 24 months of student loan repayment after veterinary school. The higher the numbers, the less you have a available to build other areas of your financial wellness:

Comparing Scenario 1 to Scenario 2, we see you can free up $39,984 over the first 24 months of repayment. Comparing Scenario 1 to Scenario 3, you can free up $52,572; and comparing Scenario 2 to Scenario 3, you can free up $12,588.

Notice also, Scenario 3 produces the lowest projected repayment costs (including the tax due on forgiveness), even compared to a standard 10-year plan strategy. By paying less in the first 24 months, you also help to minimize your total projected student loan repayment costs as well.

You can access significant amounts of money by filing a tax return before graduation and using those tax returns for your IDR strategy for at least the first two years of repayment.