IDR Foregiveness Count Update

On April 28, 2025, the Department of Education removed forgiveness count data from many borrowers’ studentaid.gov dashboard, citing a recent federal court injunction: “As a result, your IDR payment count and payment history are temporarily unavailable.”

Thus far, it seems that any borrower using SAVE, PAYE, or ICR is no longer able to see their IDR forgiveness count. However, if you are using IBR, you should still be able to see your count on your studentaid.gov dashboard: “…only loans enrolled in the Income-Based Repayment (IBR) Plan that have accumulated enough time for forgiveness are eligible to be forgiven. The forgiveness information presented on this page is not applicable to you unless you are enrolled in the IBR Plan.”

**Anyone who is unable to see their IDR progress data will be unable to use the VIN Foundation Download My IDR Progress browser extension.**

If you can see your IDR payment history information while logged into studentaid.gov, then you can still download the details using the extension. You may also be able to see a summary of your IDR forgiveness progress via the studentaid.gov payment counter API. To access the API, log in to studentaid.gov, then open a new browser tab and go to https://studentaid.gov/app/api/nslds/payment-counter/summary.

As one federal administration ends and another begins, let’s use this transition period to review where we stand with federal student loan repayment.

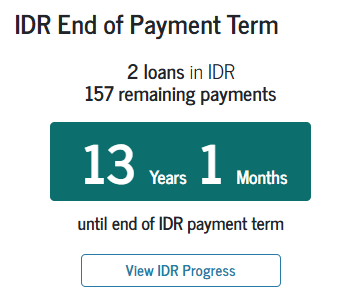

Last week, the Department of Education (ED) began posting the forgiveness payment count data for borrowers using income-driven repayment (IDR) plans. Look for your “IDR End of Payment Term” data in your studentaid.gov dashboard.

The IDR counter shows how much longer you have in years and months until you reach student loan forgiveness. Click the “View IDR Progress” button to find more details, including a “Payment History” tab. You can also filter by “Qualifying” and “Not Qualifying” payments in the “Payment Status” filter to see which payments have counted toward forgiveness or which have not counted.

If you do not see an IDR counter in your studentaid.gov dashboard, then try accessing the payment counter API:

Step 1) Log in to studentaid.gov

Step 2) Open a new browser tab and go to https://studentaid.gov/app/api/nslds/payment-counter/summary

The data is going to look really ugly as it is not formatted well for viewing. If you need help interpreting your payment count, post it anonymously to the Student Debt Message Boards available to veterinarians and veterinary students.

Review your IDR progress detail carefully. If your count is lower than you expected, submit a complaint to Federal Student Aid or reach out to the federal student loan ombudsman to request a recount.

Return of a REPAYE-like Option?

ED also laid out a timeline for the Saving on a Valuable Education (SAVE) plan forbearance and preparation for a return to a Revised-Pay-As-You-Earn (REPAYE)-like plan. Updated repayment plan calculations will not be available until at least September 2025, with updated payments resuming in December 2025 for those in SAVE. In the meantime, no payments are due, no interest accrues, but no forgiveness credit is received. Income recertifications for the updated SAVE plan have been pushed out to early 2026.

Setting repayment expectations for those in the SAVE forbearance is a welcome change. However, the outgoing administration may not get to control much of what happens after they are gone. An 8th Federal Circuit court ruling and/or update from the incoming administration may change that plan and timeline. Enjoy the forbearance while it lasts, but keep your eyes open for further updates.

Borrowers may apply for other available IDR plans if they do not want to remain in the SAVE forbearance.

Listen to the recent Veterinary Pulse Podcast on Student Loan Repayment:

Forgiveness credit, but no forgiveness?

As a quick review, there are four IDR plans available to federal student loan borrowers

- Income-Contingent Repayment (ICR)

- Income-Based Repayment (IBR)

- Pay-As-You-Earn (PAYE)

- Saving on a Valuable Education (SAVE)

Forgiveness as a feature of the IDR plans created by ED (ICR, PAYE, REPAYE/SAVE) is also blocked by the SAVE litigation. The ongoing litigation does not impact IBR. Borrowers using an IBR plan are eligible for forgiveness.

ICR, IBR, and PAYE are the only plans currently providing IDR forgiveness progress. While you can still apply for SAVE, it has been blocked by the 8th Federal Circuit Court. Anyone who applies for SAVE will first receive a processing forbearance. Interest will accrue, no payments are due, but forgiveness credit is received for two months. After the 60-day processing forbearance, SAVE applicants are eligible for a general forbearance. Interest no longer accrues but no forgiveness credit is earned for those in the SAVE general forbearance.

ICR and PAYE were phased out to new applicants on July 1, 2024. However, with the pending litigation, ED re-opened ICR and PAYE to new applicants on Dec 16, 2024. All Direct Loan borrowers are eligible for ICR. ICR is also the only IDR plan available to Parent PLUS borrowers who consolidate their Parent Plus loans into a Direct Consolidation loan. Only certain Direct Loan borrowers are eligible for PAYE.

You can still receive IDR forgiveness and PSLF credit for payments made using ICR and PAYE, but no forgiveness will be granted for the ED-created IDR plans while the litigation is ongoing. You should be eligible for PSLF if you reach the required 120 qualifying payments while using ICR or PAYE. Expect delays on any forgiveness applications or inquiries. If you have reached the end of your IDR payment term or qualifying PSLF payments, you can request a forbearance while your forgiveness is processed.

IBR comes in two flavors: IBR 2009 and IBR 2014. First available in 2009, the earlier version of IBR is available to both Direct Loan and Federal Family Education Loan borrowers. IBR was then updated and improved for new borrowers in 2014. Only Direct Loan borrowers who received their first loan after July 1, 2014, are eligible for IBR 2014. IBR was enacted under separate legislation and is not part of the ongoing SAVE litigation. Borrowers using an IBR plan are eligible for IDR forgiveness and PSLF.

Confused about where you should be right now?

Income Recertifications and Updated Poverty Guidelines

If you have been using ICR, PAYE, or IBR, you could be due to recertify your income information early this year. The first Anniversary Dates we’ve seen in quite some time are set for this February 2025. Income information is due 35 days before your Anniversary Date.

You can find your IDR Anniversary Date on your loan servicer website, studentaid.gov, or by uploading your student aid data file into the VIN Foundation My Student Loans tool. Always check your Anniversary Date in your student aid file against what your loan servicer is telling you.

The HHS Poverty Guidelines were updated for 2025 on January 15th. The data will be used in the IDR discretionary income formulas to calculate the minimum monthly payment due for your IDR plan.

For example, a single veterinarian with an income of $130,000 and a family size of 1 will have a PAYE minimum monthly payment of $888/mo in 2025 compared to $895/mo in 2024.

Expert Tip: Check your IDR plan and Anniversary Date.

If you don’t know your IDR plan Anniversary Date, it’s time to look. Renewal information is due at least 35 days before the Anniversary Date.

Recertifications for many borrowers using ICR, PAYE, and IBR plans are due this year, possibly as soon as this month if you have an Anniversary Date in February. Anyone in the SAVE forbearance will not have to recertify their income information for at least another year.

You can find your renewal information on your loan servicer website, studentaid.gov, or by uploading your student aid data file into the VIN Foundation My Student Loans tool. Always check your Anniversary Date in your student aid file against what your loan servicer is telling you.

Review the Find Your Anniversary Date blog post for more information.

Lost? Confused? We're Here to Help!

If you’re confused (it’s hard not to be right now), ask questions. Ignoring your student loans is never a good strategy.

You can ask questions on the student debt message board or submit a Student Debt & Income “Signalment” form and we’ll create a new anonymous post to review your loans with you.

We’re here to help!

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.