Uncertainty sucks. It’s hard enough to make decisions about the future when we have some reasonable expectations of what may happen next. It’s nearly impossible when the path forward is cloudier than usual. With a recent court ruling blocking the new SAVE income-driven repayment plan and a frustrating response by the Department of Education (ED), that is where we are with federal student loan repayment right now. Many questions from veterinarians on the student debt message boards fall into the following category of FAQs:

Direct Consolidation Loan FAQs

I submitted a Direct Consolidation loan application that is still being processed…

Review the current status of your consolidation application in your “My Activity” stream of your studentaid.gov account. If you submitted your application via paper or PDF, check with Aidvantage (a federal student loan servicer that processes consolidation applications). Processing times often take 30-60 days and may take longer right now.

You may see your consolidation processed but your IDR application ignored, particularly if you selected SAVE for your repayment plan. Those who have had their consolidation applications processed recently are reporting that their loans are being placed in a “standard” or “level” consolidation plan, which is a 30-year fixed plan for anyone with a balance greater than $60,000.

Check the status of your income-driven repayment plan application. If it is still in process, then you are allowed a 60-day processing forbearance that will accrue interest but still count toward forgiveness. After the 60-day processing forbearance, you can request a general forbearance that will not accrue interest but also does not count towards forgiveness.

My Direct Consolidation loan application was processed, but I’m in a standard or level repayment plan…

It appears that loan servicers are putting all recently consolidated loans into “standard” consolidation plans. Standard consolidation repayment plans are also known as “level” or “fixed” repayment plans.

The timeframe of the plan is determined by the amount consolidated. Any balance above $60,000 is placed in a 30-year fixed (level) repayment plan.

If your standard consolidation plan payment is lower than it would have been using an income-driven repayment plan, then leave it alone for now. If your standard plan payment is higher than it would have been using an income-driven plan, then request a forbearance while your income-driven repayment application is processing.

Any repayment plan is still eligible for the one-time forgiveness count adjustment. The adjustment was due to be applied by Sep 1st. It has not been applied yet and no updated guidance has been provided on when the count will be applied. Once the adjustment is applied, then you will need to use a forgiveness-eligible plan to continue earning forgiveness credit.

I graduated from veterinary school in 2024, submitted a Direct Consolidation Loan application, and ended my grace period…

Review the current status of your consolidation application in the “My Activity” stream of your studentaid.gov account. If you submitted your application via paper or PDF, check with Aidvantage (a federal student loan servicer that processes consolidation applications). Processing times often take 30-60 days and may take longer right now.

You may see your consolidation processed but your IDR application ignored, particularly if you selected SAVE/REPAYE for your repayment plan and elected to end your grace period early. Recent grads who have had their consolidation processed and ended their grace periods are reporting that their loans are being placed in a “standard” consolidation plan. That is most likely a 30-year fixed (level) plan and requires a much higher payment than anticipated. There will be no way to get back into your grace period after consolidation. Request a forbearance from your loan servicer and confirm that your IDR application is still in review. If not, then submit a new IDR application for either SAVE/REPAYE or PAYE. Use the VIN Foundation IDR profile criteria to guide your repayment plan selection.

General Consolidation Process During Administrative Stay

Anyone who is applying for consolidation or IDR right now can only do so using a paper application or submitting a completed PDF to their loan servicer. Per ED, “Borrowers may apply for IDR plans and/or consolidate loans by submitting a PDF application to your servicer by uploading it to your servicer’s web site or mailing or faxing it to your servicer.”

If you’re consolidating and applying for IDR, submit those applications to Aidvantage. They are processing the consolidations for all of the remaining loan servicers. If you’re submitting an IDR application only, submit it to your loan servicer(s).

Keep excellent records (submission details, date of submission, date of receipt, etc) of any applications you submit and confirm receipt by your loan servicer(s). Follow the application closely and look for anything unexpected. Since the applications are going to take a long time to process, if you have payments that are due during that time frame, you may need to request a forbearance pending the completion of your application.

Per ED, “If servicers need time to process a borrower’s IDR application, servicers will move the borrower into a processing forbearance for up to 60 days. Interest accrues during this short-term processing forbearance, and it is eligible for PSLF and IDR for up to 60 days. If the borrower’s application is not processed within in 60 days, the borrower will be moved into a general forbearance that does not count toward PSLF or IDR until their application is processed. Interest will not accrue in this general forbearance.”

Income-Driven Repayment Application FAQs

I applied for PAYE or ICR before the July 1st phase out…

Check your current repayment plan details: repayment plan name, minimum payment amount due, and next payment due date. There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

Verify the status of your income-driven repayment plan application:

- Log in to your loan servicer(s) website and review your application status.

- Next, log in to your studentaid.gov dashboard, and review your “My Activity” stream. If you don’t see an application listed there, submit another.

Per ED, “Borrowers may apply for the following income-driven repayment (IDR) plans: SAVE (previously known as REPAYE) and Income-Based Repayment (IBR)…We encourage borrowers to review the specifics of each IDR plan as borrowers make the best choices for their circumstances. For example, if a borrower enrolls in IBR and then moves to a different repayment plan, accrued and unpaid interest will capitalize.”

Not sure which repayment plan you’re currently using? Use the VIN Foundation My Student Loans tool:

-

- While you’re logged into studentaid.gov, download a recent copy of your federal student aid data file and upload that TXT file into the My Student Loans tool.

- Review your repayment plan details.

- Ask any questions about what you’re seeing in the Student Debt Message Board.

If you were expecting a lower payment using PAYE or ICR than you’re paying now and your application is on hold, then consider requesting a forbearance until your PAYE or ICR application is processed. Make the forbearance request via your loan servicer(s).

Per ED, “Borrowers should note that under the court’s injunction, no new enrollments are being accepted for the PAYE or ICR Plans, with two exceptions: borrowers who applied for the PAYE or ICR Plan before July 1, 2024, and borrowers who applied for the PAYE or ICR plan between July 18 and August 9, if approved for that plan, and borrowers with a consolidation loan that repaid a parent PLUS loan can continue to enroll in the ICR Plan (but not the PAYE Plan).”

My loans are in ICR, PAYE, or IBR before the July 18th court ruling that blocked SAVE…

Verify your current repayment plan details: name, minimum payment amount due, and next payment due date:

There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

Confirm that you’re using the autopay feature with your loan servicer(s) to receive a 0.25% interest rate discount, even if your minimum payment due is $0/month.

As long as you continue to make your minimum payments on time each month, you will receive forgiveness credit, even if your minimum payment due is $0/month. Exceptions to that include borrowers who are using SAVE since the court injunction and borrowers in a general forbearance.

Review your IDR eligibility in the VIN Foundation My Student Loans tool and confirm that you are using the most beneficial IDR plan available to you (IDR profile resource).

If your income has decreased and you could benefit from a lower monthly payment than you have now, submit a paper or PDF request to your loan servicer(s) to have your monthly payment recalculated. Consider requesting a forbearance until your IDR application is processed. Make the forbearance request via your loan servicer(s).

I applied for SAVE before the July 18th court ruling that blocked SAVE…

If your SAVE application was not processed before the court ruling, then it is most likely temporarily paused.

Check your current repayment plan details: repayment plan name, minimum payment amount due, and next payment due date. There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

Verify the status of your income-driven repayment plan application:

- Log in to your loan servicer(s) website and review your application status.

- Next, log in to your studentaid.gov dashboard, review your “My Activity” stream. If you don’t see an application listed in either place, submit another.

If you applied for PAYE or ICR before the July 1st phase-out or during the July 18th-August 9th window when they were accepting applications to PAYE and ICR again, then reach out to the federal student loan ombudsman to see how you can best document your intention to use a plan that has been phased out.

Per ED, “Borrowers may apply for the following income-driven repayment (IDR) plans: SAVE (previously known as REPAYE) and Income-Based Repayment (IBR)…We encourage borrowers to review the specifics of each IDR plan as borrowers make the best choices for their circumstances. For example, if a borrower enrolls in IBR and then moves to a different repayment plan, accrued and unpaid interest will capitalize…

Borrowers should note that, under the court’s injunction, no new enrollments are being accepted for the Pay As Your Earn (PAYE) or Income-Contingent Repayment (ICR) Plans, with two exceptions: Borrowers who applied for the PAYE or ICR Plans before July 1, 2024, and borrowers who applied for the PAYE or ICR Plan between July 18 and Aug. 9, 2024, if approved for that plan. Borrowers with a consolidation loan that repaid a parent PLUS loan can continue to enroll in the ICR Plan (but not the PAYE Plan).”

Not sure which repayment plan you’re currently using? Use the VIN Foundation My Student Loans tool:

- While you’re logged into studentaid.gov, download a recent copy of your federal student aid data file and upload that TXT file into the My Student Loans tool.

- Review your repayment plan details.

- Ask any questions about what you’re seeing in the Student Debt Message Board.

Not sure which repayment plan you should be using? Review your IDR eligibility in the VIN Foundation My Student Loans tool and use your IDR profile to guide your selection.

If you were expecting a lower payment using SAVE than you’re paying now, then consider requesting a forbearance until your SAVE application is processed. Make the forbearance request via your loan servicer(s).

My loans were in SAVE before the July 18th court ruling that blocked SAVE…

Verify your current repayment plan details: name, minimum payment amount due, and next payment due date:

There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

If you were enrolled in SAVE before the recent court ruling blocking SAVE or you are able to get into SAVE after July 18th, your loans have been or will be placed in a general forbearance. During this SAVE forbearance, no payment is due and no interest will accrue. Unfortunately, no forgiveness credit is currently granted for this period of forbearance.

The SAVE forbearance will last until the legal situation is resolved and servicers know what the appropriate monthly billing amounts should be.

I would like to continue earning forgiveness credit and considering a switch to Income-Based Repayment (IBR)...

If you are going to apply for an income-driven plan while applications are paused, then select SAVE/REPAYE as your plan. Unfortunately, it’s too risky to move to IBR right now. If/when you are placed in IBR, switching out of IBR in the future results in unpaid interest capitalization. Capitalization adds your unpaid interest to your principal balance. Switching from an income-driven plan other than IBR does not result in unpaid interest capitalization.

Your federal student loans charge you interest on your principal only (federal student loans do not compound). The higher your principal or the more unpaid interest gets added to your principal (via capitalization), the more you’ll pay in the long run, whether you reach forgiveness or not.

IBR has more explicit forgiveness language than the other IDR plans and could be a viable fallback option if there is a major shakeup to repayment options going forward. It’s just too soon to make that switch to IBR now.

Unfortunately, not only will it be logistically challenging to get into IBR right now, but if you do need to switch away from IBR later, then any unpaid interest would get capitalized. If you are headed for IBR, be reasonably sure you’re staying in that plan to help you minimize any future unpaid interest capitalization.

Regardless of the SAVE litigation outcome, you want to limit the capitalization of unpaid interest when possible.

Here’s the idea —

If SAVE is eliminated, presumably, we go back to a world before SAVE. Maybe that world includes REPAYE, PAYE, and ICR again. If you can end up in any of those plans, then you won’t see any unpaid interest added to your principal.

If SAVE is not eliminated and you want to use it, then it’s better cost-wise if you’re coming from somewhere other than IBR to prevent any unpaid interest from being added to your principal when you leave IBR.

If you ultimately have to end up back in IBR, you want that to be a switch into IBR that is unlikely to have you switching out so you can avoid any future unpaid interest capitalization.

Public Service Loan Forgiveness (PSLF) FAQ

I was earning PSLF credit before the July 18th court ruling that blocked SAVE…

Verify your current repayment plan details: name, minimum payment amount due, and next payment due date:

There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

If your PSLF qualifying payment count is lower than you expect, then submit a PSLF employment certification form.

If you’re using an IDR plan other than SAVE, you will continue to earn PSLF credit as long as you’re making your minimum payment on time each month while working for a PSLF-qualifying employer.

If you’re using SAVE, any payments made after the July 18th court ruling will not count towards PSLF. If you have reached or nearly reached the 120 monthly qualifying payments required to receive PSLF, then you could be able to buy back forgiveness credit for this period of forbearance once the SAVE litigation concludes.

You can also consider switching to a different IDR plan to receive PSLF credit while using an IDR plan other than SAVE. However, beware that all IDR application processing has been paused until the SAVE litigation resolves or ED allows for processing to continue.

2024 Graduating Veterinarians FAQ

I graduated from veterinary school in 2024 but have not done anything with my student loans yet…

You have two options:

- Use a federal Direct Consolidation Loan, end your remaining grace period (leave the “Expected Grace Period End Date (month/year)” entry in the consolidation application blank), apply for SAVE/REPAYE using your 2023 tax return, and try to get a $0/mo minimum payment for the next 12 months.

Consolidation usually takes 30-60 days with electronic applications. Since all applications have to be submitted via paper or PDF right now, processing times could be longer.

Be aware that your IDR application submitted with your consolidation will most likely not be processed during this administrative stay period. That means you could see your consolidation go through but not be assigned an income-driven plan. Rather, your new consolidation loan will likely be placed in a “standard” consolidation plan. This is a fixed or level repayment plan with a payment based on your balance, interest rate, and time to reach zero. For most veterinarians, your standard consolidation plan will be a 30-year fixed repayment plan. If that happens, request a forbearance until your IDR application can be processed.

Submitting a consolidation and IDR application will put you in a position to earn forgiveness-eligible time once your IDR application is processed, hopefully back to the date your consolidation loan entered repayment.

The only downside of consolidation is that it comes with unpaid interest capitalization. However, most 2024 grads have relatively low unpaid interest balances due to the prolonged pandemic forbearance benefits. Generally speaking, the added forgiveness time and 12 months of no/low payment (once your IDR application is processed) outweigh the impact of capitalization.

Consolidation is especially beneficial if you have non-Direct loan types like Health Professions Student Loans (HPSL), Loans for Disadvantaged Students (LDS), Perkins Loans, or Federal Family Education Loans (FFEL). - Leave your loans unconsolidated. If you have only Direct Loans from veterinary school, you can apply for SAVE/REPAYE using your 2023 tax return as you near the end of your six-month grace period. You will not receive any forgiveness credit until your grace period ends and you will not see your unpaid interest capitalized. Hopefully, the SAVE litigation and administrative stay will be resolved by the time most 2024 veterinarians’ grace periods end. If not, then request a forbearance after you submit your application for SAVE/REPAYE.

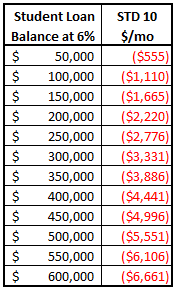

Be aware that if you do not select a repayment plan before your grace period ends, your loans will enter a Standard (STD) 10-year repayment plan. For most veterinarians, that will be a very high monthly payment:

One-time forgiveness payment count adjustment FAQ

Does the SAVE court ruling impact the one-time forgiveness payment count adjustment?

No. According to ED, forgiveness is still happening for any borrower who has reached the required 20 or 25 years of payments needed to receive forgiveness. For those who have not yet reached the required number of payments to receive forgiveness, any repayment plan and certain periods of deferment and forbearance will be counted as forgiveness-eligible until the count adjustment is applied. The forgiveness count adjustment was set to be applied by September 1, 2024. That has not happened yet and there is no update on when that adjustment will be applied.

It’s unlikely that anyone who is currently using SAVE will receive forgiveness credit for any payments made from July 18th when the court blocked SAVE and until there is a resolution of SAVE litigation.

If you are close to reaching forgiveness after the payment count adjustment is applied and you’re using SAVE, you can either wait for the SAVE litigation to resolve or consider switching to a different forgiveness-eligible repayment plan to continue earning forgiveness credit. Currently, IBR would be the only other IDR plan you would be able to switch to. However, all IDR application processing has been paused until the SAVE litigation resolves or ED allows for processing to continue.

Not using an income-driven plan FAQs

I was not using an income-driven plan before the July 18th court ruling that blocked SAVE, but I would like to now…

Check your current repayment plan details: repayment plan name, minimum payment amount due, and next payment due date. There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

Not sure which repayment plan you’re currently using? Use the VIN Foundation My Student Loans tool. While you’re logged into studentaid.gov, download a recent copy of your federal student aid data file and upload that TXT file into the My Student Loans tool. Review your repayment plan details. Ask any questions about what you’re seeing in the Student Debt Message Board.

Not sure which repayment plan you should be using? Review your IDR eligibility in the VIN Foundation My Student Loans tool and use your IDR profile to guide your selection.

Compare your current minimum monthly payment to the best available option for your IDR profile. If the IDR plan payment is lower than your current monthly payment, then submit an IDR plan application. Beware: IDR applications are currently paused pending the SAVE administrative stay. You can still apply but it will not be processed. Continue making payments under your current repayment plan or request a forbearance from your loan servicer(s) until your IDR application is processed.

If your current monthly payment is lower than an IDR plan payment would be, wait at least until your one-time forgiveness count adjustment is applied. Then consider applying for an IDR plan.

I was not using an income-driven plan before the July 18th court ruling that blocked SAVE and I do not plan to use one…

You are not affected by the recent court ruling blocking SAVE or the removal of the electronic IDR and consolidation applications. Continue making payments under your current repayment plan.

Verify your current repayment plan details: name, minimum payment amount due, and next payment due date:

There are three places you should check: 1) Your loan servicer(s) website, 2) Your federal student aid account via studentaid.gov, and 3) the VIN Foundation My Student Loans tool.

Confirm that you’re using the autopay feature with your loan servicer(s) to receive a 0.25% interest rate discount.

You will still receive a one-time forgiveness payment count adjustment for any federally-held student loans. Consider reviewing your repayment strategy after your count adjustment is applied to see if there is a path for you to reach forgiveness.

Lost? Confused? We're Here to Help!

No matter where you fall during this period of extreme uncertainty in student loan repayment, make sure to keep excellent records of any applications you submit and confirm receipt by your loan servicer(s).

Follow your application(s) closely and look for anything unexpected. Since the applications are going to take a long time to process, if you have payments that are due during that timeframe, you may need to request a forbearance pending the completion of your application.

Document all calls and communications with your loan servicers with names, dates, and the topics covered. Request a full history of your loan repayment and account history from your loan servicer, especially if you have questions about your account(s) or loan balance. Never assume that what you are told is what actually happens with your loans. You can verify by checking studentaid.gov and frequently reviewing new student aid data files in the VIN Foundation My Student Loans tool.

Right now, student loan repayment is quite chaotic. It will get better, hopefully, sooner rather than later. There are ways to navigate the chaos, but it will take a bit longer and could be a bit more frustrating than usual for a little while longer.

For many of you, working through these IDR issues will serve you best in the short and long term. For those who say “Why not just use a different repayment plan?” You certainly can, but the monthly payments will be much higher and they will not be forgiveness-eligible. That can prolong your repayment and have you paying more than you otherwise have to.

If you’re confused (it’s hard not to be right now), ask questions. And ignoring your student loans is never a good strategy.

You can ask questions on the student debt message board or submit a Student Debt & Income “Signalment” form and we’ll create a new anonymous post to review your loans with you.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

2 thoughts on “September 2024 Student Loan Update: FAQs and What’s Next?”

I have $384,000 in loans (consolidated) including GRAD PLUS loans. I am approved to buy a home but the $0 due from my students loans is actually hurting in that FHA must use .05% of loan balance (about $2,000/mo) as a “payment” amount when calculating mortgage income to debt ratios. I applied for the SAVE back in April 2024 (payments would be about $150/mo) but that is deferred and showing $0 due. I was told I can apply for an IBR plan (about $300/mo) and that would work for my needs but I am now told that the IBR is also paused due to the lawsuits. Is there a way to be placed on the IBR plan now? Or any IDR plan? I need to have a monthly due $ amount that is lower than $2,000/mo.

Hi Greg,

Thanks for your question! You’re correct. When you have a student loan payment that is $0 for any reason (deferment/forbearance/low income), FHA lenders are required to use 0.5% of your total balance to estimate your monthly payment. For folks with higher student loan balances, that estimate can be a much higher payment than you would be paying using any income-driven repayment plan (like IBR). This can cause issues, like you’re experiencing, when you apply for a mortgage, specifically and FHA loan.

Applications to apply for or switch to income-driven plans have been on pause since a federal appellate court blocked the SAVE plan (July). Applications and income recertifications should resume soon, according to the Dept of ED (https://www.ed.gov/higher-education/manage-your-loans/save-plan). I don’t know if you’re eligible for PAYE, but the Dept of ED also moved to reopen that plan as well. I expect that to happen in mid-December.

Unfortunately, I don’t see a quick way for you to get documentation of a payment less than $2,000/mo. You can certainly apply to switch to IBR or PAYE (when it reopens) to get into the queue, but it could be several weeks before you receive documentation of a monthly payment that is not zero. A few things you can try: 1) Submit documentation to your lender showing what your SAVE payment would have been and/or write up a document that shows what your IBR payment would be using your current income to show them what you expect that student loan payment to be. 2) Submit an IDR request to change plans, hope they process it quickly, and as soon as you have confirmation of your payment schedule with your new income-driven plan monthly payment, submit it to your lender. It could be a while before you see that updated payment information hit your credit report. 3) Leave your loans in the SAVE forbearance and build up a 20% down payment so you can seek a conventional loan. While FHA loans have these sorts of rules that may not play well with higher student loan balances, conventional loans do not. Hope that helps! Good luck 🙂