For the forgiveness planning module on the Loan Repayment Simulator, how are taxes on any gains generated while saving for forgiveness accounted for? I’m assuming there will be long-term capital gains on any stocks or bonds a person might be using to grow their money to meet the tax bill, which would eat into the total amount available at the end?

Shouldn’t there be some sort of calculation on the capital gains or standard income taxes on the investment income earned in addition to the taxes on the forgiven amount?

What are capital gains and how are they taxed?

A capital gain is incurred when you sell a capital asset for more than what you paid for that asset. A capital asset is anything significant you own for personal or investment purpose, like a home, car, stock, bond, etc.

Taxes on capital gains work a bit differently from ordinary income tax brackets. And just like other tax concepts, the details are going to be highly specific to the individual circumstances. The tax on capital gains can differ depending on how long you held the asset. If you hold a capital asset for longer than one year prior to selling it, then long-term capital gains tax rates apply. If you sell a capital asset you hold for less than one year (short-term), then the gains are taxed at ordinary income tax rates. Since we’re focusing on forgiveness planning that takes place over 20-25 years, we’ll assume long-term capital gains rates will apply to most forgiveness savings plans.

The capital gains tax for most individuals using capital assets in their forgiveness savings plan will likely fall into the 15% long-term capital gains bracket. This will apply only to the value of your capital assets above what you paid for the assets, ie the gain.

Accounting for capital gains taxes in your student loan simulations

Having run thousands of loan repayment simulations for thousands of veterinary colleagues, the long-term capital gains tax on most forgiveness savings plans will be quite low for most and are probably already accounted for in the overall estimate of the taxes in the Forgiveness Planning Module. We have set the VIN Foundation Student Loan Repayment Simulator default settings to err on the side of overestimating your forgiveness tax rather than underestimating. We would rather you reach forgiveness with more money than is required for the potential tax on student loan forgiveness rather than less.

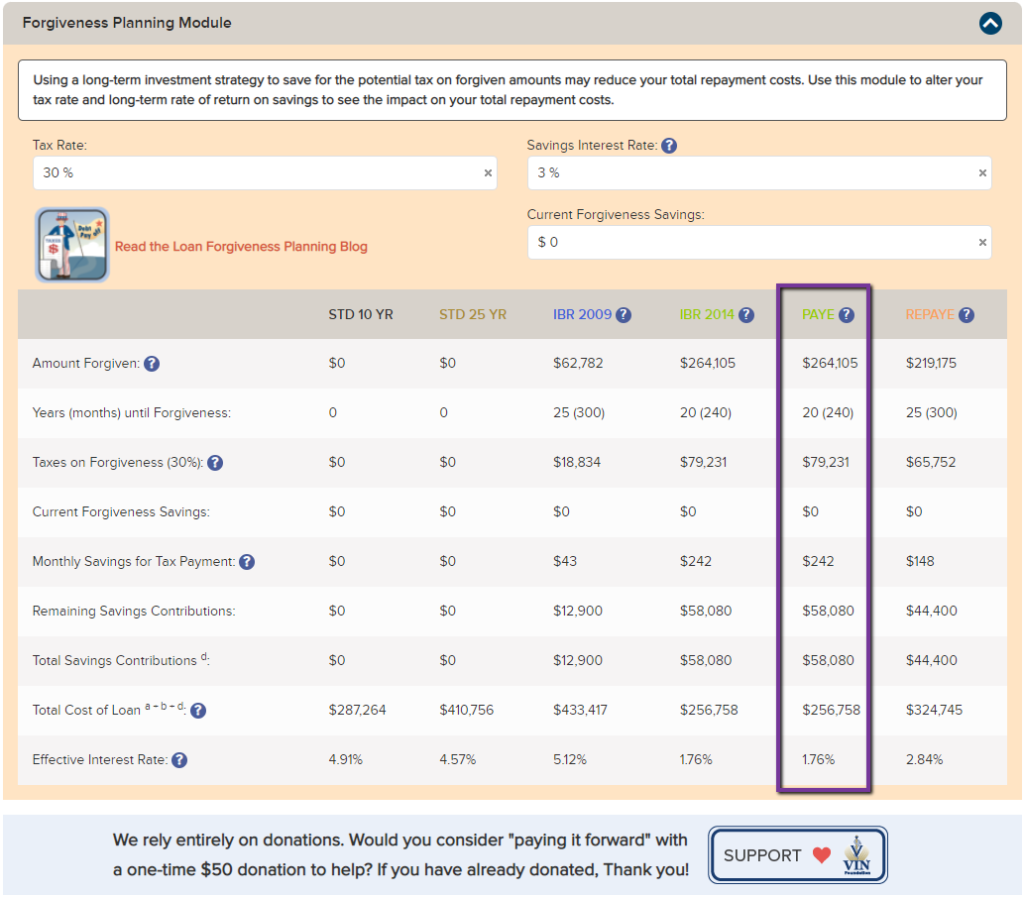

If you were to sell all of your forgiveness planning capital assets in the year that your tax is due, then yes, you might also have to cover 15% on the long-term gains you realize from those investments. For instance, let’s run a sample simulation using the default entries in the VIN Foundation Student Loan Repayment Simulator. Focusing on the PAYE income-driven repayment plan in the Forgiveness Planning Module, we see there is an estimated $79,231 needed to cover a potential tax on student loan forgiveness assuming a tax rate of 30% on the $264,105 forgiven balance. If I invest $242/month in capital assets receiving an average 3% return per year, I will have contributed $58,080 and have $79,231 available for the anticipated forgiveness tax.

Projecting capital gains taxes

Let’s say I put all of those savings into an exchange-traded fund or mutual fund and sold 100% of that fund the year forgiveness occurs. Chances are, I would incur a long-term 15% capital gains tax on the $21,151 ($79,231-$58,080) of gains realized on that sale. My additional 15% capital gains tax would be $3,173 in that example — a pretty small portion of that total, particularly if we’re talking about that amount over a 20-year savings horizon.

My guess is that very few borrowers will manage their forgiveness savings funds where they sell all of their forgiveness plan assets in the year they experience forgiveness. As you become more familiar with how taxes work and how to legally diminish their impacts, you’ll actively minimize your tax liabilities or work with an accountant who can help you minimize your taxes.

Most likely, there will be a gradual unwinding of forgiveness planning assets that will help to reduce any taxes on capital gains for your forgiveness planning fund. Some of those taxes on gains may even be offset by any capital losses that you realize in your forgiveness year or any other investment losses you have carried forward over the savings horizon. Just as you are taxed on any capital gains, certain loss amounts can also be deducted from your gains. Losses that are not used in a given tax year can even be carried over into future years where they can be applied.

For borrowers who expect to have large student loan balances forgiven and are required to be (or choose to be) very aggressive with their forgiveness planning, they might expect higher capital gains taxes along the way and should factor that in accordingly. When I run simulations for those folks, I normally estimate a higher total forgiveness tax rate in the simulator which results in a higher monthly savings projection to help account for the possible extra taxes in their cases.

Student Loan Repayment Simulator Settings

Along with many other assumptions in the Loan Repayment Simulator, like annual income increases, estimated tax rates, and expected annual returns, there will be some variability based on the user’s outlook on topics like taxes and returns on investment. The good news is that any user can account for their particular outlook in the simulator and adjust any of those inputs to match their outlook accordingly.

Right now, we set the default tax rate on student loan forgiveness at 30%, but you’re free to change that upwards or downwards to meet your best guess for your situation. Personally, I think the default tax rate is already an overestimate of the potential tax most will pay on student loan forgiveness. Thus, any capital gains tax is likely accounted for in that initial overestimate. For folks who want to be even more cautious about their potential tax due, they can increase that projected tax rate or do a healthy rounding up of their monthly projected forgiveness savings.

Coming back to our example simulation to pull all of this together, it’s quite likely that the additional $3,173 in potential capital gains tax is more than accounted for in the total I’m saving for the anticipated forgiveness tax. However, if that is still not sufficient for a particular user, then I would suggest a healthy rounding of the $242/mo suggested forgiveness savings plan to something like $250/mo. That should more than cover any worst-case scenario capital gains tax if I didn’t already have that covered in my projections already.

1 thought on “Student Loan Forgiveness Planning: Capital Gains Taxes”

What a wonderful post, you have put quite a lot of effort into this one, I can tell. Love everything about this, great post. Hope to see more such posts from you soon.