Brace yourself, this is a long one. We’ve got a lot to cover with the recent recertification pause and confusion around renewals vs. switching repayment plans. Read straight through if you have a large mug of coffee or use the Table of Contents feature to quickly navigate to your section of interest.

Income-Driven Repayment (IDR) Recertification Pause Extended…Again.

Renewal season was here briefly but has been postponed again. Previously, the earliest income-driven plan recertifications were due before this month, March 2024. Now, the earliest anyone is due to renew is late September 2024, according to the most recent announcement from the Department of Education. Even those of you who provided updated income information recently for your renewal may see your payment lowered to your previous monthly payment.

What does IDR Recertification mean?

When you use an income-driven plan, like ICR, IBR, PAYE, or SAVE, you will have an “Anniversary Date.” This is usually one year from your previous income-driven plan schedule start date. However, it’s been three years or more for some people since they have been required to recertify their income information. And a lot has changed over that time.

This is great news for anyone with an IDR Anniversary Date in 2024 as it sounds like you can keep your previous or current lower IDR monthly payment for even longer. While this recent announcement is short on detail, it appears that anyone who has an Anniversary Date before November 1, 2024, can assume their next Anniversary Date is November 1, 2024.

If you provided updated information already, if that information doesn’t lower your payment, you can wait until later this summer to provide information again.

Caution: Multiple deadlines approaching

Any opportunity to have your student loan payment be lower for longer is generally a good thing. However, you also need to be aware of other important deadlines that could be even more beneficial than a postponed recertification date:

- Most important: The deadline to consolidate and receive the maximum benefit from the one-time forgiveness count adjustment is

AprilJune 30, 2024. If you can increase your forgiveness-eligible time or get more of your loans to be eligible for a better IDR (like SAVE), then submit a Direct Consolidation Loan application before the April 30th deadline. - Nearly as important: The PAYE phase-out on July 1, 2024, for those who are in The Pickle, ie eligible for PAYE but not IBR 2014. If you are eligible for PAYE and could benefit from using it, then you need to be in it before July 1, 2024.

What’s the difference between recertifying and switching income-driven plans?

You recertify the required income and family information for your current IDR plan. This recertification is normally required annually, but the pandemic forbearance benefits have postponed normal renewals now into September 2024. You can also choose to have your payment recalculated to a lower amount at any time if your income has decreased. You do not have to wait for your recertification period to get a lower payment.

Switching IDR plans means you are leaving one IDR and applying for another, like moving from PAYE to SAVE, or SAVE to PAYE, or IBR to SAVE or PAYE. When you switch, you must provide updated income information, regardless of your current Anniversary Date.

People often confuse their renewal period with whether or not they should switch repayment plans and when. It’s understandable. Timing is one of the most complex parts of income-driven repayment. While there can be overlap between switching plans and your annual renewal period, think of them as two different events with their own specific timelines.

Expert Tip

If you don’t know your income-driven repayment plan Anniversary Date, it’s time to look. You can find your renewal date on your loan servicer website, studentaid.gov, or by uploading your student aid data file into the VIN Foundation My Student Loans tool. Always check your Anniversary Date in your student aid file against what your loan servicer is telling you. Review the Find Your Anniversary Date blog post for more information.

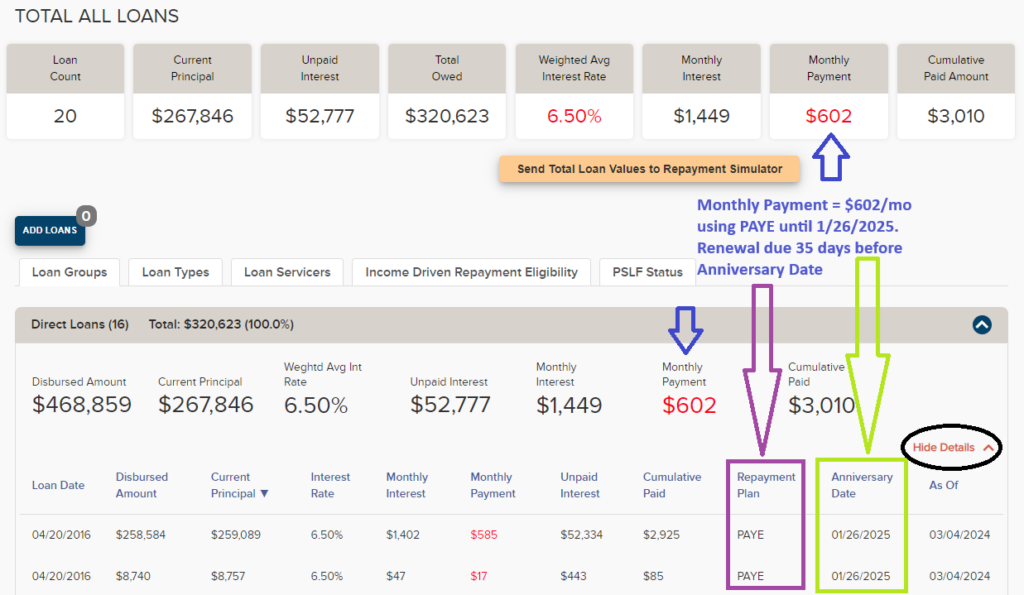

Source: www.vinfoundation.org/mystudentloans; My Student Loans summary for a 2015 DVM using PAYE. Shows how you can find your repayment plan, monthly payment, and Anniversary Date information. Click the “Show Details” button in a Loan Group or Type section to see the plan and Anniversary Date information.

Think of your Anniversary Date as your expiration date — the last day of your income-driven plan payment schedule. You need to provide income information before your Anniversary Date to prevent your payment from increasing to an amount resembling a fixed 10-year plan payment. New guidance suggest that you need to provide income information at least 35 days before your Anniversary Date.

You may even see your loan servicer incentivize you to provide your renewal information at least 35 days before your Anniversary Date, agreeing to keep your payment as is if they take too long to process your renewal information. Since the loan servicers have been taking too long to do everything with federal student loans, plan to submit your information at least 35 days before your Anniversary Date.

For example, if your Anniversary Date is November 1, 2024, then you should receive renewal notices from your loan servicer as early as August 2024. To follow the renewal guidance, you should provide updated information around the week of September 25th (35 days before Nov 1) to make sure your new payment is calculated on time. Your updated payment will not start until after your Anniversary Date, the statement following November 1st in this example.

Expert Tip

Many borrowers mistakenly think that if they provide income information too early, their minimum payment will go up early. When you are renewing your income information for your current repayment plan, providing your income information will update your payment for the 12 months beginning after your Anniversary Date. Use your renewal window strategically to help keep your monthly student loan payment as low as the rules will allow.

Why not just provide your income information much earlier?

Because your renewal window officially opens about 90 days (3 months) before your Anniversary Date. If you try to provide income information before your renewal window opens, it will likely be ignored. Many of the loan servicers have been sending out renewal notices this year, particularly for anyone with an Anniversary Date in March, April, or May. With the recent recertification pause, you can ignore those recent renewal requests until later this summer.

What if my Anniversary Date shows a date in the past?

First, make sure you’re reviewing a recent student aid data file (obtained within the last 30 days). Most Anniversary Dates have been updated in the recent files. If you still see an Anniversary Date in the past, then assume it is either November 1, 2024 or later. No one should have an Anniversary Date that is before November 1, 2024. Note: You can (and should) receive a request from your loan servicer to renew your income before November 1st (many of you already have). Recertification notices start 90 days before your Anniversary Date. You can ignore any of those notices you receive before August 2024 with the recent pause on recertification.

How do I recertify my income for my IDR plan?

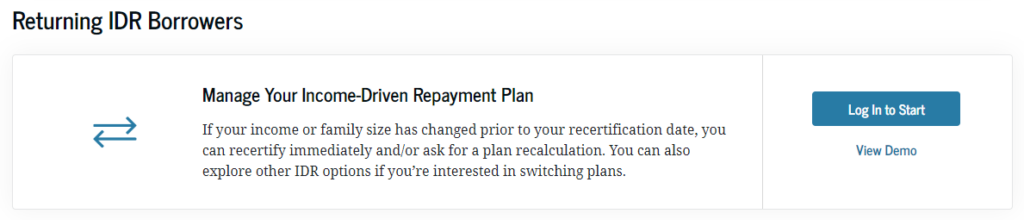

To renew or recertify your income for your existing plan, visit https://studentaid.gov/idr/. Use the “Manage Your Income-Driven Repayment Plan” option under the “Returning IDR Borrowers” section.

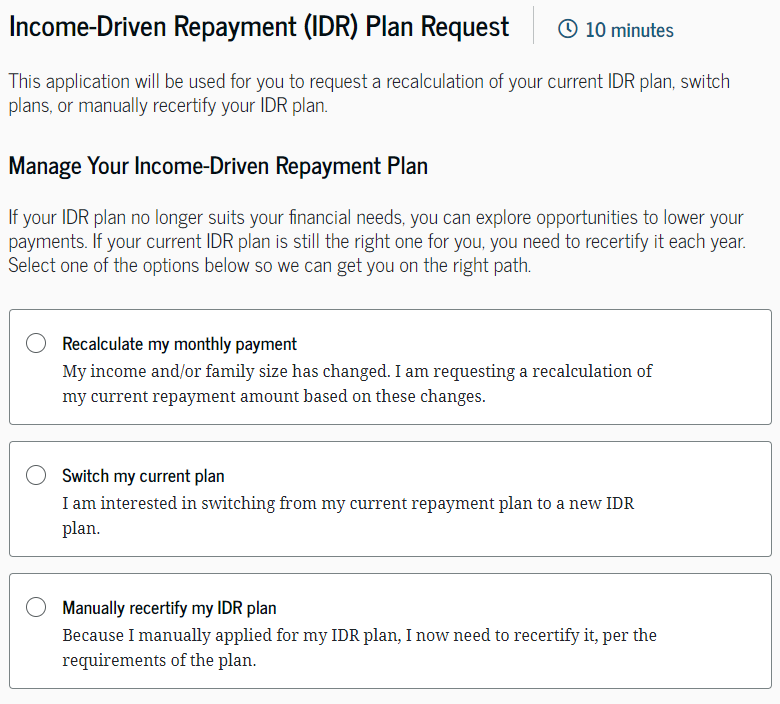

After logging in and verifying your contact information (very important to make sure all of that information is up to date), you’ll reach a page with three options:

- Recalculate

- Switch

- Recertify

When you’re providing your required renewal information, you should select the “Manually recertify my IDR Plan” option.

Choose the “Recalculate” option if your income has decreased for any reason or your minimum monthly payment would be lower than it currently is in the same plan if you provide more current income or family information. This is useful if you or your spouse increase your family size, take family or medical leave, change jobs, or your production pay schedule is lower now than in previous years, to name a few.

The “Switch” option would be for those who are interested in switching repayment plans, like in the example of switching from PAYE to SAVE or IBR to SAVE.

How do I know if I should switch my repayment plan?

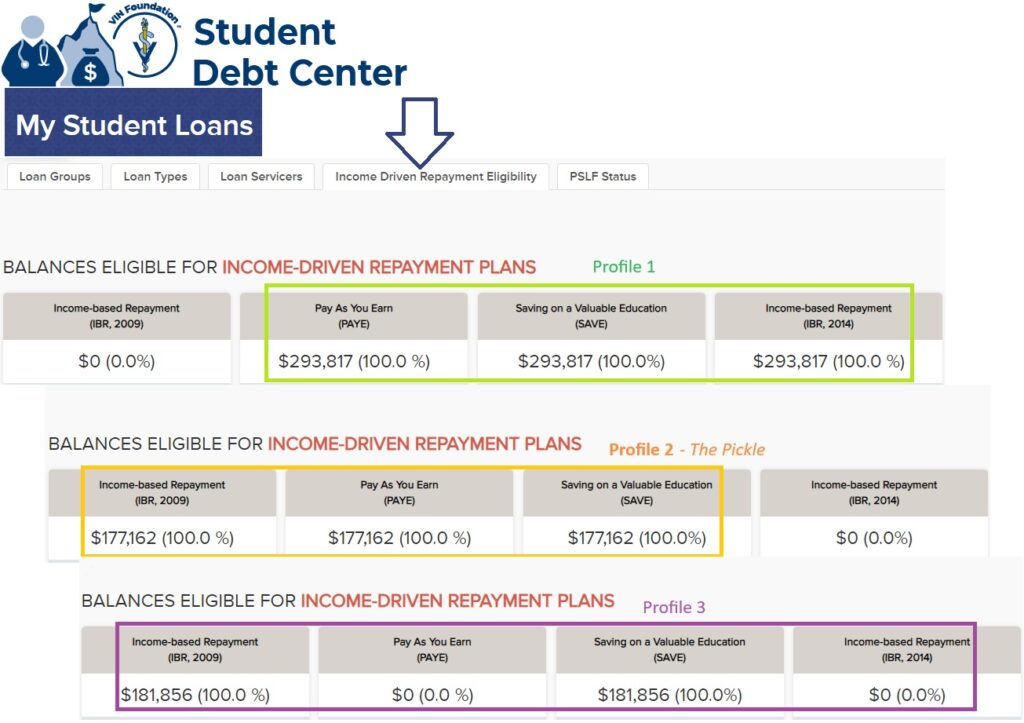

Switching student loan repayment plans depends on the plan you’re using now and the income-driven plans you’re eligible to use. In the 2024 Graduating Veterinarian repayment plan Pickle blog post, we discuss three exclusive income-driven plan profiles you can fall into:

- Eligible for PAYE, SAVE, and IBR 2014.

- Eligible for IBR 2009 (the older version of IBR), PAYE, and SAVE.

- Eligible for IBR 2009 and SAVE.

There is also a 4th profile for not-so-new graduates. Anyone who graduated veterinary school in 2010 or earlier could fall into Profile 4:

- Eligible for IBR 2009 only.

Find out which income-driven plan profile you’re in by uploading your federal student aid file into the VIN Foundation My Student Loans tool. You can watch a video tutorial on how to find your student aid file on the My Student Loans page. Once your file is uploaded, review the Income-Driven Repayment Eligibility tab.

IDR Profiles guide your next steps on switching vs. renewing:

If you’re in Profile 1, then you should be using SAVE. The question is when should you switch if you’re not already in SAVE? If you can get a lower payment than you have now by switching to SAVE, then switch now (use the “Switch my current plan” option). If you have a lower payment using a plan like PAYE or IBR compared to what you can get now while using SAVE, then wait until 35 days before your Anniversary Date to switch to SAVE.

Expert Tip

If you’re married, run at least 2 simulations regardless of your IDR profile: one with your tax filing status set to jointly, and another set as separately. All income-driven plans now allow you to exclude your spouse’s income from the payment calculation if your most recent tax return is filed separately. Depending on your circumstances, you can see hundreds of thousands of dollar differences between those two options. Folks living in community property states can benefit even more. If you can save more in student loan repayment costs filing separately than you gain in tax benefits filing jointly, do so. Each year, you should evaluate your tax filing options and costs and how that will impact your next income-driven plan renewal.

Why should I use SAVE when I’m eligible for IBR 2014?

Being eligible for IBR 2014 gives you additional flexibility. You can use SAVE for up to 5 years and still be eligible to switch from SAVE to IBR 2014. Why would you want to do that? SAVE will nearly always have the lowest monthly payment of any of the income-driven plans and provides a 100% unpaid interest subsidy if your minimum payment is less than the monthly interest accrual. However, SAVE has a time to forgiveness of 25 years and IBR 2014 is 20 years. In many cases, the best strategy will be to use SAVE for 5 years, and then switch to IBR 2014 before reaching 60 monthly SAVE payments to reach forgiveness at 20 years in IBR 2014.

Having access to IBR 2014 essentially buys you 5 years to let your career, income, and family situation unfold. Near that 5-year mark, run updated simulations to see if switching to IBR 2014 will help you finish student loan repayment cheaper and sooner. If so, then switch before you reach 5 years in SAVE. If not, stick with SAVE.

If you’re not eligible for IBR 2014, then you’re either in Profile 2, Profile 3, or Profile 4. If you’re in Profile 4, run to https://studentaid.gov/loan-consolidation/ and start a federal Direct Consolidation Loan. Submit your application before April June 30, 2024, to receive the one-time forgiveness count adjustment benefit.

If you’re in Profile 3. Your loans should be in SAVE, either now (if you can get a lower payment using SAVE), or when you’re due to renew your IBR 2009 income information (switch to SAVE).

Similarly, if you have recently consolidated or have been using a standard, extended, or graduated plan because the payment is lower than a SAVE or ICR payment and you’re hoping to reach forgiveness, then switch to either SAVE or ICR after the one-time forgiveness count adjustment is applied, by July 1, 2024. You can also make a fixed 10-year plan payment if it is the lowest available forgiveness-eligible monthly payment after you receive your count adjustment.

Profile 2 is The Pickle, the trickiest and most time-sensitive profile to navigate. The recent changes that created SAVE will also phase out PAYE on July 1, 2024. Anyone who is not using PAYE on that date will no longer be able to choose it. But anyone who is using it can continue using it until you are done repaying your student loans. Profile 2 folks need to decide before July 1, 2024, if PAYE will be better than SAVE. This is a tough one. Those in The Pickle have PAYE as their only 20-year path to forgiveness, but will lose access to that if they go for the lower payment and unpaid interest subsidy SAVE provides. Review The Pickle blog post, run simulations, and post your questions to the Student Debt Message board area to see if there is a clear winner for your situation.

Expert Tip

After any major change to your student loans: consolidation, IDR renewal, repayment plan switch, make sure to do an updated student loan physical exam. Grab a new student aid data file and confirm that the changes you anticipated were made. The studentaid.gov portal and your VIN Foundation My Student Loans summary are your best defense against loan servicer mistakes. Log your communications, keep your correspondence, and follow through with your applications to reduce the likelihood of costly errors.

What if I want to switch my repayment plan during my renewal period?

Think of switching plans and recertifying your income as two separate events. It might make sense for you to switch plans and you might be waiting to switch until you’re due to renew. Let’s say a recent graduate veterinarian has a very low payment using PAYE but has decided SAVE will be a better plan for them. They want to keep the favorable PAYE payment for as long as possible, then switch to SAVE as their favorable PAYE payment expires.

Switching repayment plans during your renewal period can be helpful. However, leave yourself enough time for your switch to process. If your application to switch is not processed before your Anniversary Date, you could end up in forbearance with interest accruing or seeing a significant increase to your regular monthly payment before your new plan payment begins.

Unlike renewing or recertifying your existing income-driven plan, your new payment schedule will start as soon as your application to switch is processed. Unfortunately, it’s impossible to say how long your application to switch will take given poor loan servicer performance, especially as repayment has restarted. If you’re going to switch, do so at least 35 days before your Anniversary Date to avoid any complications to be safe.

Follow through to see that the application is processed before your Anniversary Date. Save copies of your submitted applications with dates of submissions clearly visible. You can use this information later (if necessary) to help correct any loan servicer mistakes or delays in processing your applications.

If you need student debt help, reach out to VIN and VIN Foundation. We have free online tools like the VIN Foundation Student Debt Center and special message board areas to help you make sense of your options. If you have questions on any of the available tools and options, reach out to [email protected].

Dr. Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN) and a VIN Foundation Board member. He and his wife have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives.

9 thoughts on “Income-Driven Repayment: Recertify, Switch plans, or Wait?”

My Anniversary date was listed as the first week of May 2024. As a 2020 grad I have been enjoying my $0 payments with PAYE so was waiting until it was time to recertify to switch to SAVE. I did about a week ago to make sure I beat the deadline, but it was JUST before they announced the postponement of recertification dates until the fall. Should I try to switch back to keep my old payment of $0 until the fall or is it too late, and my new anniversary date will be based on when I switched? Such a bummer with the timing, but I guess I could not have known they’d push the dates back again.

Hi Haley,

Thanks for posting your question! I don’t think you’re going to be able to switch back. Applying to switch to a different plan is different from recertifying your income for your current plan. Chances are, they will process your switch from PAYE to SAVE and you will have a payment that is now greater than zero. What you could try to do is cancel your application to switch. If that is still processing, there could be an opportunity to cancel that. You can check the status of your application to switch in your studentaid.gov account under the “My Activity” section of your dashboard. If it still says processing, then you have a chance to cancel that. If you’re successful in canceling your application to switch, your loans should reamin in PAYE with your previous minimum payment ($0/mo) until you’re due to recertify again, which would be mid to late September 2024 based on the recent recertification extension. Clear as mud? 🙂

I had already recertified my IDR and one of my loan servicers switched the past month from Nelnet to Sloan. They were saying that I couldn’t use my 2022 tax return like I did with my other two loan servicers (who accepted the 2022 tax return) and was told I had to submit paystubs or file my taxes for 2023 to use the 1040. Additionally, when I asked about the pause, they claimed that was only for people that had an anniversary date in March 2024, since mine was in April 2024, it didn’t apply to my loan. I’m confused…

Hi Diane,

Thanks for posting a comment! I can see why you would be confused. Your loan servicer(s) are not helping you, which is unfortunately, way too common. First, if one of your loan servicers are Sloan, that means you have one/some loan(s) that would benefit from the one-time forgiveness count adjustment and consolidation before the April 30th 2024 deadline.

Second, the recent pause to the recertification extension is not only availble to those with a March 2024 Anniversary Date. You can read those details for yourself here: https://studentaid.gov/announcements-events/idr-recertification-extended. The earliest Anniversary Date is now Nov 1, 2024. Feel free to read that page to your loan servicer if you have to call them again since they seem to have not gotten the memo yet. I would ALWAYS ask for a supervisor or manager when you are hearing things that sound obviously wrong. It sucks, but that’s the only chance you might have of getting someone who has some idea of the recent changes and current rules.

Third, your loan servicer is incorrect if they say you can’t use your 2022 tax return. At this point, I don’t even think it is safe to ask your loan service what income information to use. Instead, just go to studentaid.gov and apply for or recertify your income-driven plan there. Then you don’t have to endure the nonsense most of the loan servicers are telling people lately. If you use studetaid.gov, it will pull in the most recent tax return AGI it finds that is no more than 2 years old. That would be your 2022 tax return if you have not yet filed your 2023 return. Hope that helps!

My wife and I live in California. We file our taxes jointly. She is unemployed with federal student loans she acquired BEFORE marriage. I am employed. She is doing recertification for IDR plan with advantage. How do we complete/submit the IDR recertification form to ensure my income is not used to pay off the loan? Her income is zero, so it should be zero repayment. The form is tricky for this situation and loan servicers have given mixed direction on it.

Hi Michael,

Thanks for posting! A couple of things for you to consider:

1) Check your spouse’s IDR recertification date, aka Anniversary Date. If it’s between Nov. 1, 2024, and Jan. 31, 2025, then it should be pushed out another year.

If it’s in February 2025, then her recertification wouldn’t be due just yet. If her Anniversary Date was Feb. 1, 2025, then recertification documentation isn’t due until 12/28/2024. And if she is using SAVE and her loans are in the SAVE general forbearance while the litigation is sorted out, then no recertification is due. Review this latest blog post for a summary of the latest goings on for IDR: https://vinfoundation.org/the-election-is-over-change-is-on-the-horizon-what-is-next-for-your-student-loans/;

2) If you filed your most recent tax return jointly (probaby your 2023 tax return), then you will have to provide documentation of both your incomes when you do an IDR recertification. There is an option for your spouse to say that she does not reasonable have access to your income information, but that is generally reserved for folks who are separated or going through a divorce. However, if you file your next tax return (2024) separately, then you can exclude your income from her IDR recertification calculation. Let’s say she’s using PAYE and her recertification is due before you can file your 2024 tax return. Then you could have her recertify using her zero income, provide your income and then submit for a recalcuation once you have a separate tax return filed in early 2025.

I hope that helps! Good luck 🙂

Thank you for the reply. I may have additional inquiries for you.

Does switching from the IBR plan to the standard plan and then back to IBR restart the forgiveness clock to 20/25 years? Or do I retain credit toward forgiveness for payments made under a prior IBR when I switch back from a non-income driven plan to a new IBR? I retire in 5 years but have 14 years left under IBR and my income is unexpectedly higher the next 3 years. The IBR payment will be twice the standard plan payment making it difficult to save more for retirement in these last few years. Hoping I can switch from the existing IBR to the standard repayment plan for 3-4 years and then back to an IBR without losing credit for the 131 qualifying payments. Thank you for your thoughts on this.

Hi Betty,

Thanks for posting your comment! Some of your questions are hard to answer without seeing your student loan details. Let me try clarifying several things you mentioned jump out to me:

1) I don’t recommend switching back and forth between income-driven plans and “standard” plans. For most of the IDR plans (IBRs and PAYE), your payment can never be more than the fixed 10-year plan payment. If your income increases high enough, your payment will be relatively low compared to your income, even with an income-driven plan. So once you’re in a plan like IBR, try to stay there. You’ll either pay the balance to zero or you’ll reach forgiveness. In either case, your monthly student loan payment should be reasonable for the duration of repayment. If your income decreases, your payment decreases. If you have periods of higher income, your payment will increase, but only up to that fixed 10-year payment cap set by plans like IBR or PAYE. ICR even has a cap, but it’s typically higher than those for IBR or PAYE except for those folks who have relatively small student loan balances, where ICR can be helpful.

2) The “standard” plan depends on what types of loans you have remaining. If you consolidate your loans (Direct Consolidation Loan), your “standard” plan has a timeline that corresponds to the amount you consolidated — the term ranges from 10 to 30 years. The only way that an IBR payment can be higher than a “standard” payment is if you consolidated and have a term longer than 10 years.

3) The lower your student debt to income ratio, the harder it is to get into a plan like IBR, due to the partial financial hardship requirement. That’s another reason to keep your loans in a plan like IBR once you’re in it. You can’t get kicked out of a plan like IBR or PAYE, but if you voluntarily leave, it can be hard to get back in. If you have a relatively low student debt to income ratio, then look into ICR as well. While you can’t receive forgiveness using ICR right now, you can still earn forgiveness credit using ICR.

4) “Standard” plan payments other than the fixed 10 year plan payments are not eligible for forgiveness. If possible, keep your loans in a plan that continues to provide forgiveness credit, so you reach forgiveness sooner. Forgiveness time is transferable. If you have 131 qualifying forgiveness payments now, you keep those. When you continue making payments using a qualifying plan again, your count will continue.

And if all this just looks like an acronym soup, then do a deeper dive into the various income-driven plan available and make sure you know which plans you’re eligible to use: https://www.vin.com/studentdebtcenter/default.aspx?pid=14352&catId=74141&ind=9

Hope that helps! Good luck 🙂