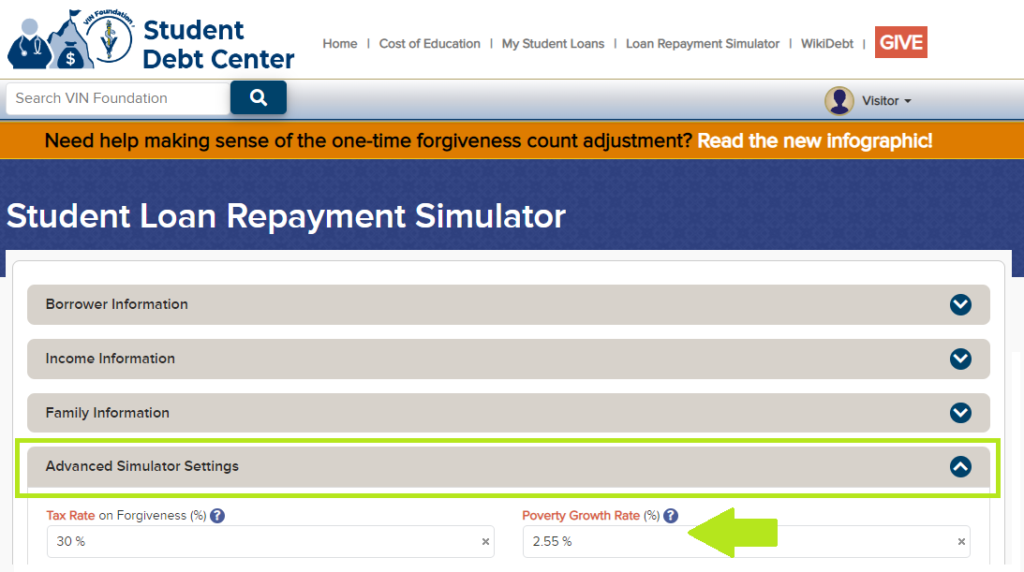

A ‘new’ income-driven repayment plan?

Federal student debt proposal would change REPAYE, phase out PAYE Buried in a sea of federal student loan announcements and changes over the last few years was the promise of a new income-driven repayment plan. Now we know how parts of that promise will be implemented when the pandemic forbearance benefits end this summer. The […]

A ‘new’ income-driven repayment plan? Read More »