2025 New Grad Student Loan Playbook: Live Session FAQ Hot Topics

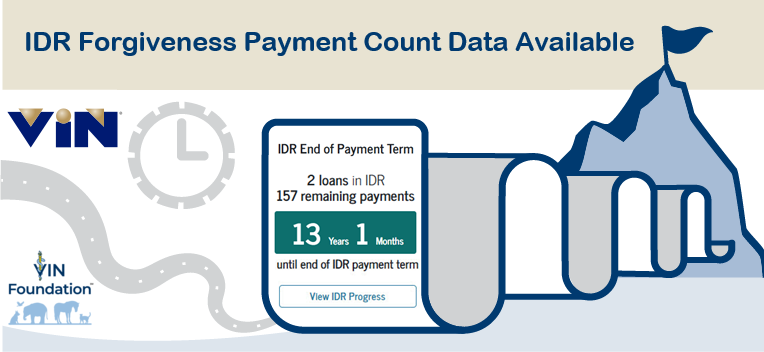

What is the “New Grad Student Loan Playbook” webinar about? The “New Grad Student Loan Playbook” is an annual webinar by VIN and VIN Foundation aimed at providing information and guidance to graduating veterinarians regarding their student loans and repayment options. With the rapidly changing student loan landscape, each graduating class faces new and different […]

2025 New Grad Student Loan Playbook: Live Session FAQ Hot Topics Read More »